For me, one of the neatest things about being involved in the futures industry is the study of futures markets trading history. The longer I am in this business (now in my 41st year), the more I look to history for clues that will help me gain that all-important trading edge.

Some in the futures industry are busy cramming raw data into big spreadsheets on high-powered computers to find mathematical correlations or produce some other type of statistical analysis, in hopes of finding the “Holy Grail” of trading.

Not me. I recharge my trading and analytical batteries by reading old and tattered and often hard-to-find books on markets and trading. Usually, the older and more tattered the book, the more interest I have in reading it.

Early in my career, I spent time working on the trading floors of the Chicago Board of Trade and Chicago Mercantile Exchange, as well as the New York futures exchanges. I always enjoyed listening to the veteran floor traders share with me some of the lore of the trading pits. The old sayings and superstitions of the trading pits – especially for grains markets – are indeed fascinating.

When I was on the trading floors in Chicago and New York in the 1980s, legendary traders and analysts like Conrad Leslie, Larry Williams, John Henry, Richard Dennis, Jack Schwager, Phil Stanley, Tom Baldwin, and Paul Tudor Jones were a presence on the floors, and I was very fortunate to meet a few of them.

Below are a couple of trading lore tidbits I will share with you — and they involve potential opportunities that can be employed now and in the next few weeks.

‘Oats Knows’

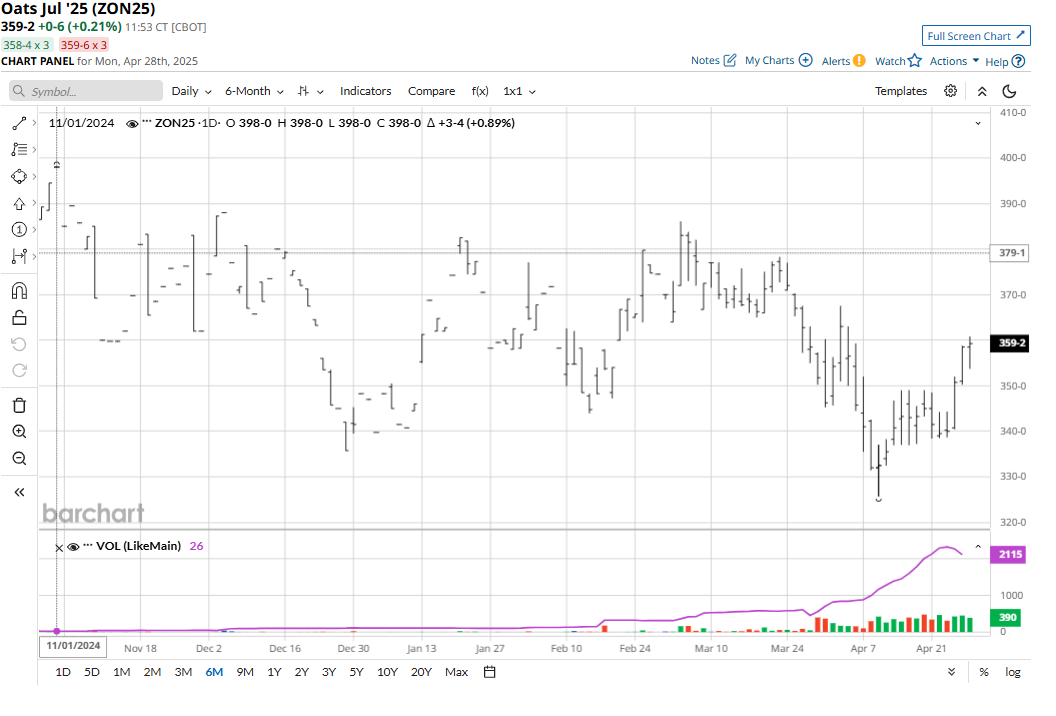

While working at the Chicago Board of Trade and covering the grain futures markets as a floor reporter, veteran grain traders told me to keep an extra close eye on the diminutive oats futures (ZON25) market. They said trending oats market price action has a history of forecasting soon-to-come bigger trending moves in the larger grain futures markets — corn (ZCN25), soybeans (ZSN25), and wheat (ZWN25). “Oats knows,” the grain traders would quip.

July oats futures hit a four-week high on Monday, April 28 and prices are trending up on the daily bar chart. The oats market as an early predictor may be signaling the grain markets have either put in, or are close to putting in, near-term price bottoms (wheat) or that fledgling price uptrends will remain in place (corn and soybeans).

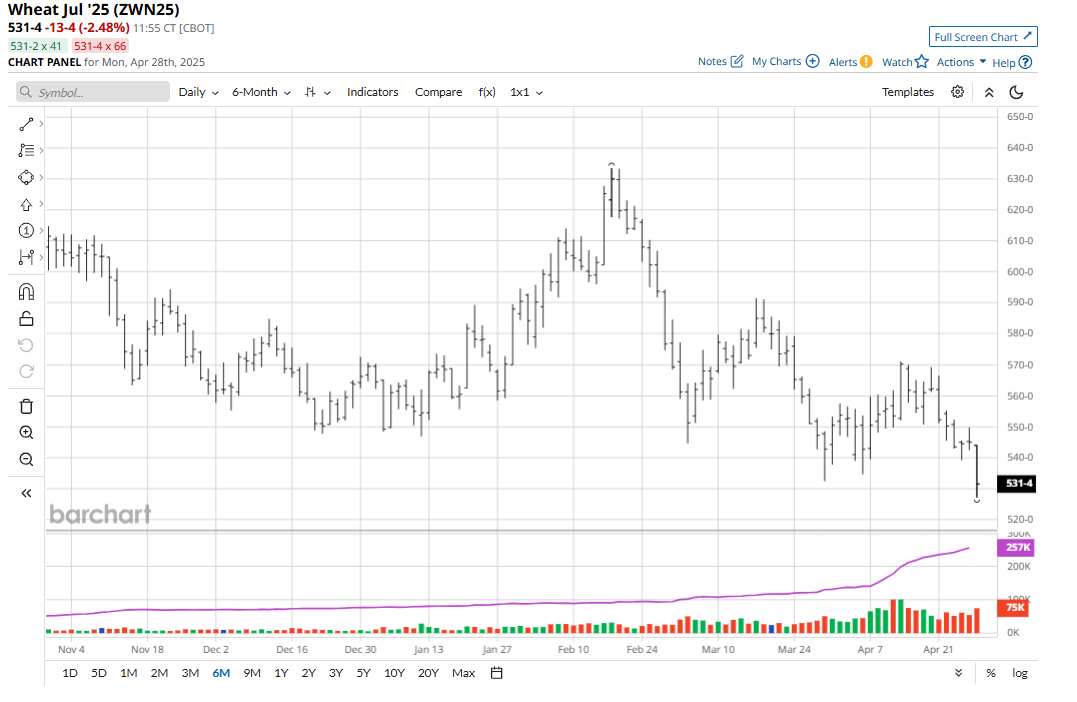

‘The Voice from the Tomb’ Suggests Selling Wheat and Corn in May

Here’s another tale from the floor of the Chicago Board of Trade.

An old and very successful grain trader lay on his deathbed. As he neared the end, he called his family members into the room. He told them they would find their most valuable inheritance in an old strongbox. Hoping to find cash, gold, or precious jewelry, the family members instead discovered an old scrap of paper, on which the trader had written:

Buy Wheat:

February 22

July 1

November 28

Buy Corn:

March 1

June 25

Sell Wheat:

January 10

May 10

September 10

Sell Corn:

May 20

August 10

The old scrap of paper did not provide any further details. And it’s not known whether family members ever made a fortune from following the trading advice written on the scrap of paper in the dead trader’s strongbox.

However, there are many present-day grain traders who do pay close attention to those dates written down, as they do correlate with historical seasonal price movements in corn and wheat futures.

The Voice from the Tomb note suggests that selling wheat and corn in May could be a profitable venture.

Tell me what you think. Email me at jim@jimwyckoff.com.