While Chinese chipmakers, such as SMIC, cannot procure advanced deep ultraviolet (DUV) lithography systems from ASML due to restrictions from the U.S. and Dutch governments, they can still use their existing DUV tools to produce rather advanced chips. This is not exactly appreciated by the U.S. government, so next week, it will try to urge the Dutch government to prohibit ASML from servicing already-installed tools at facilities in China, according to Reuters.

Alan Estevez, a top U.S. official for export policy, will meet with Dutch officials and ASML representatives to discuss the matter next week. The report says the discussion may also include the possibility of expanding the list of Chinese chip factories that are barred from receiving Dutch equipment. If the U.S. and the Netherlands agree to limit the servicing of ASML's machines in China, this could hurt or even disrupt China's abilities to produce advanced chips using lithography equipment that its chipmakers already have.

If ASML is restricted from servicing its installed tools at certain China fabs, this could impact its financial results (ASML's service revenue totaled $6.07 billion last year), and it could also face lawsuits from clients.

Last year, SMIC and Huawei produced a sophisticated processor — the HiSilicon Kirin 9000S — for smartphones using SMIC's Second Generation 7nm-class fabrication process. This technology relies on multi-patterning using advanced DUV tools that SMIC procured years ago. It turned out that the companies planned to use the same production node to make processors for AI and other sensitive applications, which raised the concerns of the U.S. government.

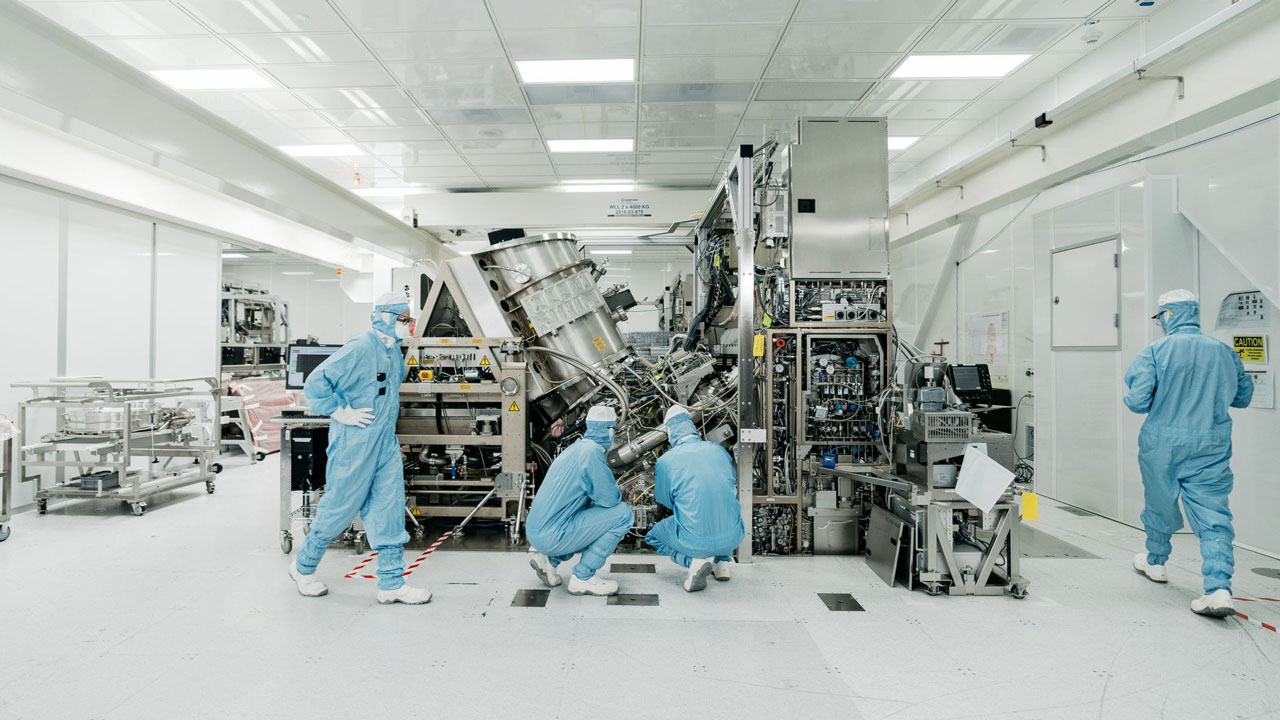

ASML's litho machines need regular service from qualified professionals, and any restrictions will make it harder (or perhaps impossible) for SMIC to produce advanced chips using its second-gen 7nm-class technology.

In 2022, the United States introduced export regulations requiring U.S. companies and individuals to get export licenses to sell equipment, technologies, and services used in making non-planar transistor logic chips on 14nm/16nm nodes and smaller, 3D NAND with 128 layers or more, and DRAM memory chips with a half-pitch of 18nm or less. The rules also restrict U.S. citizens and green card holders from supporting the development or production of ICs at certain China-located semiconductor fabrication facilities without a license.

In 2023, the U.S. urged Japan, the Netherlands, and Taiwan to follow its export control rules and restrict sales of advanced fab tools for 14nm logic, 18nm DRAM, and 128-layer 3D NAND. However, specialists from these countries can still service tools already installed at advanced fabs in China, enabling companies like SMIC to produce sophisticated chips.