The UK’s supply of carbon dioxide (CO₂), which is essential for everything from critical NHS operations to keeping food fresh while being transported, remains in jeopardy. It was recently ensured for the second time in a few months thanks to a short-term deal between leading supplier CF Industries and the UK government, which keeps CF’s two English plants up and running until the end of April. After that, however, it is not yet clear what will happen, and fixing this problem is not going to be easy.

CO₂ shortages have been a recurring issue for some time. Since as far back as the FIFA World Cup 2018, the UK seems to have been facing an impending crisis every few months. The worst so far came in 2021 when CF Industries, which supplies 60% of the UK’s requirement as a byproduct of making fertilisers, announced it would be shutting its plants in Teesside and Cheshire because the global surge in natural gas prices had made them commercially unviable.

In October 2021, the UK government had no choice but to give the American firm a cash injection reportedly worth “tens of millions” of pounds. When that expired at the end of January, the second three-month deal was done. It is not clear what will happen after April. So what does a long-term solution look like?

Supply chain risks

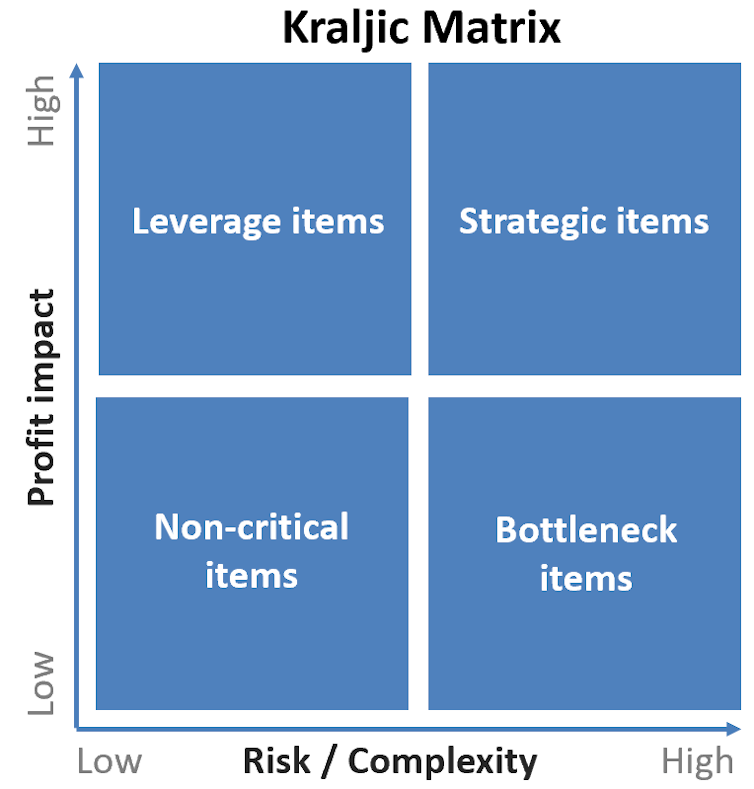

When it comes to understanding supply chain risks, many companies use the Kraljic matrix. Created in 1983 by Peter Kraljic, the economist and former director of management consultancy McKinsey, it can equally be used to analyse a nation’s supply requirements. It breaks products into four categories by weighing supply-chain risks and the effect on profits if the product is not available.

The products that need to be taken most seriously are the “strategic items” on the top right-hand side of the matrix (pictured above). These face severe supply chain risks and a big threat to profitability if they are not available.

The supply of CO₂ clearly falls into this category. Yet by focusing on short-term deals instead of long-term agreements, from sources with limited production capabilities, the government is treating this commodity more like one in the Kraljic’s bottleneck category (high supply risk but low impact). Typical of an item in the bottleneck category, this has put the government into a passive position in which it is entirely dependent on limited sources of CO₂ supply and is having to pay (very) high costs.

Bridging and buffering

To address this problem, academic research recommends a combination of what are referred to as buffering and bridging approaches. A bridging approach focuses on working with your existing suppliers to ensure you are informed in advance about possible disruptions and their consequences. The government was in fact given this information about CF Industries, but appears not to have heeded it. Clearly there are lessons there for the future.

A buffering approach is about strengthening your supply of the product by building up larger inventories, forging relationships with alternative suppliers, and investing in infrastructure like storage facilities to cope with disruptions to supply and demand.

In particular, developing alternative suppliers would help move the nation’s CO₂ supply into Kraljic’s leverage items quadrant – high impact in the event of a shortage but with low supply risk. To this end, the government should establish a centralised procurement body with responsibility for CO₂ supply. It would be tasked with signing long-term framework agreements with suppliers, with clauses incentivising continuity of supply, early warnings, regular and detailed risk assessments, and possible risk/reward sharing.

Having said that, it’s probably not an option to import CO₂. As a relatively cheap commodity, the specialist equipment required to move it from another part of the world has been considered (so far at least) to be too expensive to justify the outlay. We know from the theory of transaction cost economics that where a product is highly uncertain, in high demand and can’t be substituted, it is more economical in the long-term to vertically integrate the supply chain – in other words, do everything yourself. This points to a long-term investment to increase the UK’s national CO₂ capacity.

This probably entails looking beyond the fertiliser industry. For example, making bioethanol creates CO₂ a by-product. The UK already produces some 260 million litres of bioethanol a year, and the government could invest in more. Since bioethanol is a sustainable fuel for road vehicles, so this would be two wins for the price of one. Another solution would be to buy CO₂ from anaerobic digestion sites. These use bacteria to extract gases from organic waste, and some are already up and running in the UK.

One long-term answer might be carbon capture technology, which aims to trap the CO₂ released from burning natural gas to make electricity. The UK already has plans for building and scaling this technology in the 2030s, though this is subject to costs come down “sufficiently”. To ensure that carbon capture becomes viable, the UK needs to invest heavily, including in the infrastructure to convert the CO₂ into a suitable source for commercial customers.

A parallel approach would be to rethink UK procurement of natural gas. The UK currently stores less than 6% of its annual demand, compared to about 20% stored by Italy, France, and Germany. Greater storage capacity in the UK would have reduced its exposure to changes in the price, which might have prevented CF Industries from halting production in 2021.

The authors do not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.