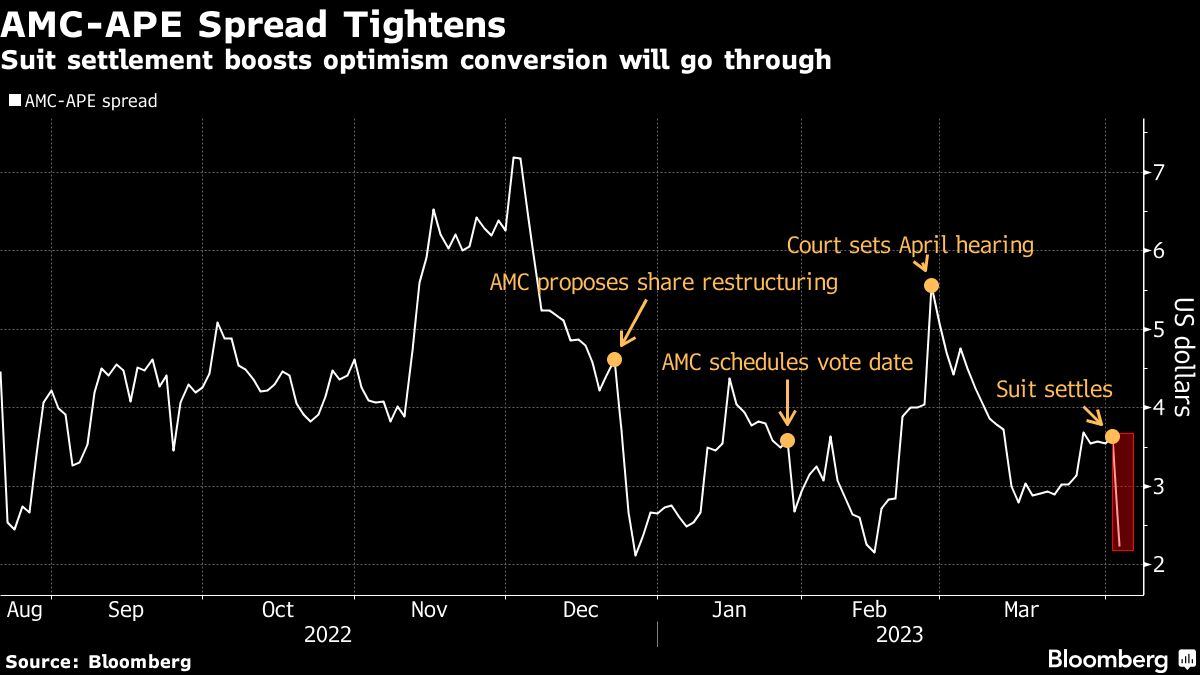

The gap between AMC Entertainment Holdings Inc.’s common-stock price and its preferred shares is narrowing significantly, as a lawsuit settlement boosted expectations that the conversion between the two units will go through.

The movie theater operator’s common AMC stock slumped 23% to $3.91 on Tuesday, while the preferred shares — ticker APE — jumped 14% to $1.68. That put the spread at $2.23, shrinking from $3.63 at Monday’s close and at its tightest level since February. The company announced the one-for-one exchange proposal last year as part of AMC’s broader strategy to raise cash and keep the lights on.

“The settlement clears the path for APE’s conversion into AMC shares,” said Nick Pappas, Churchill Capital’s risk arbitrage analyst. “Pending court approval, AMC will effect the increase in its share authorization and reverse stock split, permitting the conversion of APE units into AMC shares.”

Risk arbitrage traders have been looking to capitalize on the spread, betting that the price gap would vanish once the conversion goes through. While the proposed plan received investor approval, the court case had created uncertainty. The meme-stock posterchild also rallied last week on a report that Amazon.com Inc. was weighing an offer.

“For arbitrageurs, this investment was a battle given the extremely high borrow cost to short AMC, along with the significant volatility of the spread,” said Julian Klymochko, the chief executive officer of Accelerate Financial Technologies.

For AMC, this settlement also “clears the deck” for a potentially massive equity raise, according to B Riley analyst Eric Wold. After the conversion and a reverse split, the company could issue around 394 million shares to raise cash, the analyst said in a Tuesday note.

--With assistance from Subrat Patnaik, Bailey Lipschultz and Philip Sanders.

©2023 Bloomberg L.P.