We live on a planet where people still die of starvation, and yet we still waste so much food — it’s a problem, and not just for sustenance but the environment. You may not be aware of it, but a huge amount of that waste comes from the grocery stores and supermarkets we shop at every week. Part of it is just a category problem: Americans are used to seeing a wide and alluring variety of foods on shelves, and a lot of it, especially for produce and meats.

So what do the stores do? They overpurchase, “knowing that some food waste must be built into their bottom line,” says Jennifer Molidor, senior food campaigner at the Center for Biological Diversity. We also have high standards for freshness, especially with unregulated best-by dates that make it hard to determine whether food is actually safe to eat, so retailers throw out edible food that might be perceived as undesirable. Profit margins on perishable foods are so high that stores would rather overstock so as not to miss even one sale.

The end result of these problems is tons of food going uneaten before it spoils and perfectly good food thrown out. In 2022, grocery retailers in the United States generated about 5 million tons of surplus food, over a third of which went to landfills or was incinerated.

Profit margins on perishable foods are so high that stores would rather overstock so as not to miss even one sale.

There are a number of things that could reduce grocery store waste, and the good news is that the appetite among retailers to change their practices appears to exist. “There’s a really broad spectrum of high-tech, high-cost solutions and low-tech, low-cost solutions,” says Jackie Suggitt, capital, innovation, and engagement director at ReFED, a nonprofit dedicated to fighting food waste.

On the high-tech side, retailers are starting to use artificial intelligence to better determine how much and when to order food items. Afresh, a grocery store data consultant, uses machine learning to examine supermarket data and pinpoint mismatches between what stores stock and what people actually buy. New Seasons Market, a supermarket chain in Portland, Oregon, recently implemented a sophisticated tracking system to determine where food waste was happening at each store. It found that one of the items being thrown away the most was rotisserie chickens, so the store started repurposing unsold ones into hot bars before composting the rest. This initiative was part of the Pacific Coast Food Waste Commitment — a public-private partnership that includes smaller outlets like New Seasons and mega-chains such as Walmart and Kroger that just announced a reduction in unsold food waste of 28 percent between 2019 and 2022.

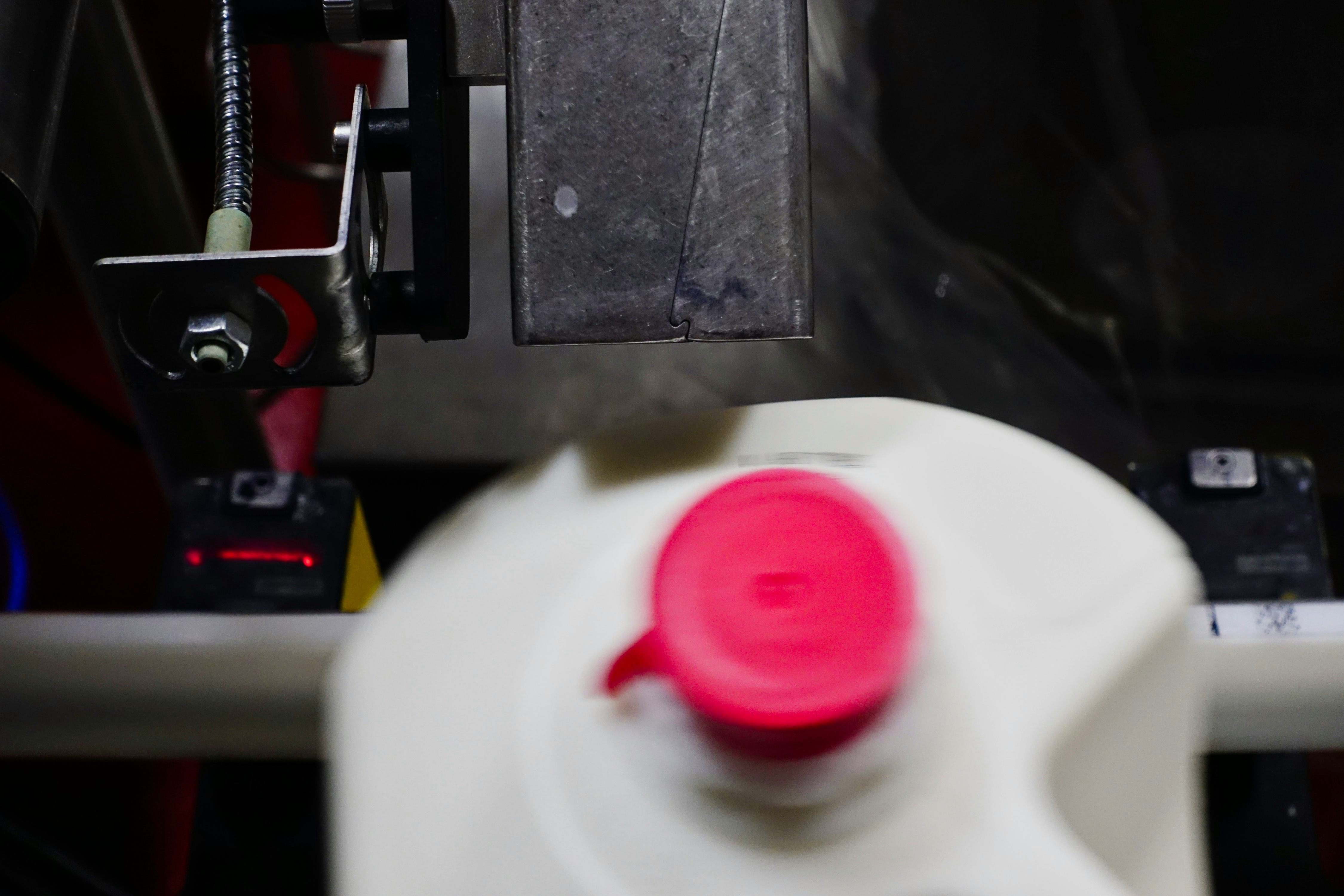

Another high-tech solution is “dynamic pricing,” or flexible price points that can shift depending on real-world market factors, in this case allowing stores to discount items that are getting close to the end of their shelf life. “We’ve lost sight of how weird it is that milk that’s going to expire tomorrow is priced the same as milk that’s going to expire two weeks from now,” points out Robert Evan Sanders, assistant marketing professor at the University of California, San Diego.

Dynamic pricing would take this into account, lowering the prices for products that are closer to expiration and that stores are less likely to sell — we’ve all rooted around for the milk with the furthest sell-by date — and are more likely to have to toss. It’s a “triple win,” Evans says: Not only is food waste reduced but stores sell more of their products and consumers get a discount. It could also be very effective — Sanders has found that it would reduce food waste by 21 percent and “could be considerably higher than that,” he says, depending on which categories of food it is applied to.

The Environmental Protection Agency (EPA) prioritizes preventing food waste above all other efforts such as donation, upcycling, using food for animal feed, composting, or anaerobic digestion. Still, when food does go unsold, it can go somewhere more productive than a landfill, and there, too, ReFED has seen progress. In the Pacific Coast Food Waste Commitment, signatories increased the percentage of unsold food that was composted by 28 percent and donated by 20 percent. “That is wonderful because total food has gone down; there is less food to donate, but they’re also donating more,” Suggitt says. “Hopefully it’s getting into the hands of people that need it most.”

“You can’t manage what you don’t measure.”

But some methods to discourage landfilling have spotty track records. A handful of states have started requiring stores to compost instead of landfill any food waste. But when Sanders looked at the impact the bans have had on landfill volumes, his preliminary results found virtually no effects in nearly all of them. The outlier was Massachusetts, which eventually reduced landfill by 11.2 percent. A big reason, Sanders found, is that Massachusetts has actually enforced its law by cracking down on businesses; the others had done barely anything. Los Angeles County enacted its law in 2014 and still hasn’t issued any citations. “Why would the business take costly action if there’s no consequence to not doing that and no one else is doing it?” he says.

Even just taking food waste more seriously, and not treating it like a pet project, is a solution that can go a long way. Suggitt has seen a lot of companies move the issue out of the sustainability team into the operations, purchasing, and procurement teams. They are “viewing food waste as a financial and operational problem, not just an environmental problem,” she says.

Then there’s simply collecting data. “You can’t manage what you don’t measure,” Suggitt pointed out. In 2018, 9 out of the 10 largest grocery companies weren’t publicly reporting their total food waste. That made it hard to determine whether things were getting better or worse, Molidor points out, but also allowed companies to “make large but vague claims about sustainability.”

Suggitt argues that measurement and data reporting has increased since Molidor’s reports. Some of that comes from consumer demand that brands be more transparent; some of that comes from regulatory pressure, such as the Securities and Exchange Commission’s proposal to increase what companies have to disclose when it comes to climate change impacts. The Pacific Coast Food Waste Commitment was based on data the signatories tracked and reported, not estimates, for example.

But even this solid data is not broken down by brand, and of course, it is only for one particular geographic region. So why isn’t there more robust transparency? Companies are often afraid “to be the first one in the room” to report their data, Molidor says, because “the fear is that the data is so colossal the public would be shocked.” So there has to be coordination; the government could require companies to create data-tracking infrastructure and report the numbers. Suggitt notes that internationally, reporting is mandated. “There’s some anticipation that will make its way here eventually,” she says.

Even with data in hand, it can be hard to figure out exactly which tactics work and which ones don’t. Retailers are typically taking on a number of strategies at once, making it difficult to tell which ones are responsible for any reductions. Sanders agreed. “I don’t think we generally have an answer to ‘What is the single best way grocery stores can reduce waste?’” he says.

There are also a number of barriers to widely implementing what works. One challenge for dynamic pricing is how to reduce prices without a ton of extra labor. Some startups are experimenting with digital labels that could be easily changed. More difficult to overcome is that grocery stores “do not have high-quality inventory data,” Sanders says. The barcodes on each product don’t include information about expiration dates, so stores don’t know how much milk they have that’s close to expiration; it has to be figured out manually by a stock employee. And because the information isn’t in the barcode, a cashier would have to manually input the marked down price rather than just swipe it through. There are barcodes that contain this information, but using them would require the entire manufacturing and grocery industries to switch over.

“Landfilling in the United States is dirt cheap.”

Meanwhile, date labeling isn’t standardized or regulated on the federal level except for infant formula. Instead, each manufacturer puts its own dates on its products, and the date is almost always about quality — when a product will taste best — and not about when something is dangerous to eat. There is now a push to require a two-date system: one date for quality, or a best-if-used-by date, and one for safety, or a use-by date. The Food Date Labeling Act, which would do just that, was introduced in the Senate last year, and both lawmakers and advocates are pushing for it to be included in this year’s farm bill. Even with these challenges, dynamic pricing is actively being deployed by “big companies you have heard of,” Sanders says.

There are also plenty of hurdles for finding useful places for food waste to go. For one thing, “landfilling in the United States is dirt cheap,” Sanders says, so doing just about anything else with unsold food costs more. Composting is also limited by how much infrastructure an area actually has to process food waste and what it costs a retailer to get it there. Massachusetts was able to achieve such a high reduction in landfill waste in part because it increased its composting capacity from 100,000 tons per year to 617,000 between 2011 and 2017, accounting for 12 percent of its total disposal in 2013; by contrast, other states’ composting share was in the single digits. “I do believe [bans] can work, but it takes investment,” Sanders says.

Donating food, meanwhile, not only comes with liability risk to keep the food well preserved, but it also requires new processes and labor for store employees to collect the food and new partnerships for how it gets picked up and where it goes.

There is also the fact that food waste is such a fundamental part of the grocery store business model. At some point, change will require mandatory measures, not just voluntary ones, to disrupt that dynamic. “We need laws and regulations from the government to hold industry accountable and make food waste prevention a requirement,” Molidor says.