The wealth of hedge fund billionaires on the Forbes 400 is the highest it has ever been, amid strong industry returns so far in 2021.

It’s a good year to be a hedge fund billionaire. Today Forbes released the 2021 edition of The Forbes 400 list of the richest people in the United States, and the 25 wealthiest hedge funders are worth a combined $220 billion, up an impressive $35 billion from last year. In the first half of 2021, hedge funds returned an average of just over 10%—the strongest industry returns in more than two decades, according to an analysis by data and analytics firm Hedge Fund Research.

The bar for entry into the top 25 richest hedge fund managers increased to nearly $3 billion this year, up from $2.1 billion in 2020. Of those who were on the 2020 list, 18 got richer, one is down (John Paulson) and four are flat.

There were two notable new faces this year. The wealthiest new hedge fund billionaire joining the ranks of The Forbes 400 is Philippe Laffont, with a net worth of $6.5 billion. Laffont is one of the so-called “Tiger Cubs,” having worked at Julian Robertson’s Tiger Management before starting his own hedge fund, Coatue Management, which has $25 billion of assets under management. Another new addition is Joseph Edelman, CEO of New York-based firm Perceptive Advisors, which returned 29% in 2020 and now manages $10 billion in assets.

The biggest gainer of the group—for the second year in a row—is the youngest hedge fund manager on The Forbes 400. Chase Coleman, the 45-year-old founder of New York-based Tiger Global Management, is worth $10.3 billion, up from $6.9 billion last year, Forbes calculates. His firm now manages $65 billion; it has averaged annualized net returns of more than 20% since inception in 2001.

Other big gainers include Millennium Management’s Israel Englander, who has a net worth of $10.5 billion, up by $3.3 billion from a year ago. Ray Dalio, the founder of Bridgewater Associates—known as the world’s largest hedge fund—saw his fortune rise by $3.1 billion, to $20 billion.

Eighty three-year old Jim Simons, founder of quantitative trading firm Renaissance Technologies, is yet again the richest hedge fund manager in America, for the 4th year in a row, according to Forbes. Though he technically retired more than a decade ago, Simons remains co-chairman at Renaissance, which manages some $50 billion in assets. Current and former executives at Renaissance agreed in September to pay as much as $7 billion to settle a long-running tax dispute with the Internal Revenue Service; Simons agreed to pay the IRS an additional settlement of $670 million.

Two billionaires dropped out of the top 25 group: TOMS Capital CEO Noam Gottesman and Wall Street legend Leon Cooperman, who fell off The Forbes 400 for the first time in years.

To determine the net worth of hedge fund managers, Forbes took into account fund returns as well as the fee and ownership structure of different money management firms to estimate earnings and cash growth. We also included the value of other assets owned by hedge fund managers, such as real estate, planes and art collections.

Here is the comprehensive list of all the hedge fund managers on the 2021 Forbes 400 list.

(Net worths are as of September 3, 2021)

1. Jim Simons

Forbes 400 Rank: #28

Net Worth: $24.4 billion

2020 Net Worth: $23.5 billion

America’s richest hedge fund manager for the fourth year running, Jim Simons founded Long Island-based Renaissance Technologies in 1982. His esteemed quantitative trading firm, which today manages some $50 billion in assets, is famous for its Medallion Fund, a $10 billion black-box strategy that is only open to Renaissance owners and employees. Though Simons officially retired in 2010, he is still involved at the firm and continues to benefit from its funds.

2. Ray Dalio

Forbes 400 Rank: #36

Net Worth: $20 billion

2020 Net Worth: $16.9 billion

Ray Dalio famously started Bridgewater Associates in 1975 out of his two-bedroom apartment in New York. By forty years later, he had turned it into the world’s largest hedge fund, which today manages some $154 billion in assets. Though Dalio stepped down as co-CEO of Bridgewater in 2017, he remains chairman and co-chief investment officer. Bridgewater returns took a hit during the pandemic market crash and subsequent economic rebound—the firm lost $12.1 billion for investors in 2020, according to LCH Investments.

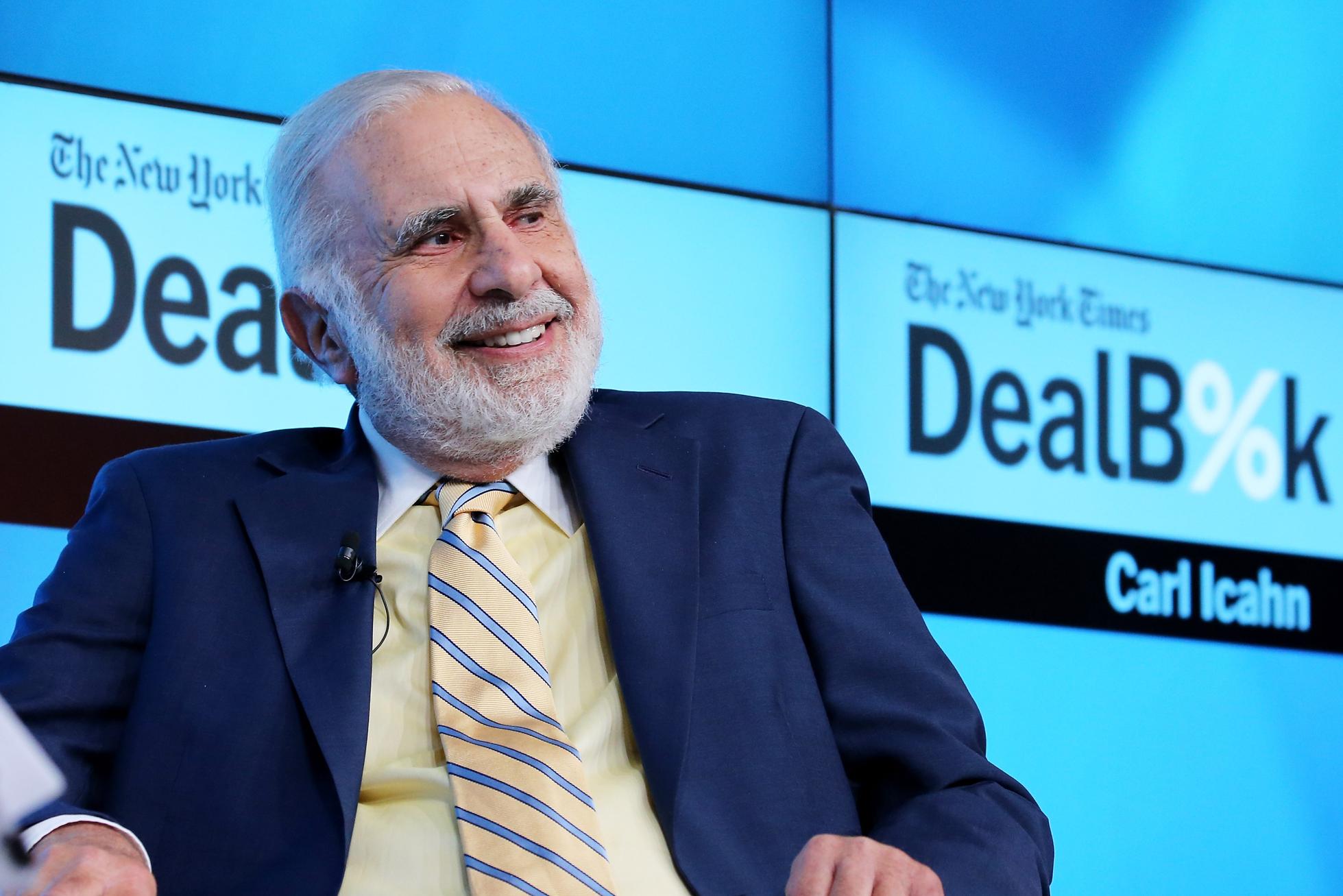

3. Carl Icahn

Forbes 400 Rank: #43

Net Worth: $16.6 billion

2020 Net Worth: $14 billion

Another Wall Street legend, activist investor Carl Icahn has been making an impact on corporate America for decades. Shares of his primary investing vehicle, Icahn Enterprises—a vast conglomerate that invests in everything from casinos and energy to real estate and food packaging—are down slightly in 2021. So far this year, Icahn has sold stakes in companies like Occidental Petroleum and Herbalife, while adding to positions in companies such as Xerox.

4. Ken Griffin

Forbes 400 Rank: #47

Net Worth: $16.1 billion

2020 Net Worth: $15 billion

Ken Griffin runs Citadel, a Chicago-based hedge fund firm he founded in 1990 that manages roughly $39 billion in assets. After returning 24% in 2020, the firm’s flagship Wellington fund was reportedly up nearly 10% for the year through August. Griffin is also the founder of Citadel Securities, one of the biggest market-making firms on Wall Street.

5. Steve Cohen

Forbes 400 Rank: #48

Net Worth: $16 billion

2020 Net Worth: $14.5 billion

Steve Cohen founded and runs hedge fund Point72 Asset Management, which has $20 billion of assets under management. The firm started managing outside capital in 2018, following a two-year supervisory ban stemming from insider-trading charges leveled at Cohen’s previous firm, SAC Capital. In October 2020, Cohen completed his purchase of the New York Mets baseball team for $2.4 billion.

6. David Tepper

Forbes 400 Rank: #49

Net Worth: $15.8 billion

2020 Net Worth: $13 billion

Arguably the greatest hedge fund manager of his generation, David Tepper runs Appaloosa Management, which boasted annualized returns of 25% in its first 25 years. Tepper has been steadily winding down and returning money to clients in recent years, however, with Appaloosa’s assets under management down to $13 billion, down from a peak of $20 billion. His fund returned over 10% in the first half of 2021.

7. Israel Englander

Forbes 400 Rank: #71

Net Worth: $10.5 billion

2020 Net Worth: $7.2 billion

Israel Englander founded Millennium Management in 1989 with $35 million from friends and family. Today, his hedge fund firm manages nearly $53 billion. After returning 26% in 2020—generating $10.2 billion in net gains for investors, according to LCH Investments—his fund was up nearly 7% through the end of July 2021.

8. Chase Coleman

Forbes 400 Rank: #73

Net Worth: $10.3 billion

2020 Net Worth: $6.9 billion

Again the youngest hedge fund manager on The Forbes 400 at 46-years-old, Chase Coleman is also this year’s biggest gainer, with his net worth rising $3.4 billion. He has had another stellar year with Tiger Global Management, boasting an annualized net return of 21% since he started the firm he started 20 years ago. Coleman has been building up Tiger’s Global venture funds in recent years, which now account for $40 billion of the firm’s total $65 billion in assets.

9. George Soros

Forbes 400 Rank: #92

Net Worth: $8.6 billion

2020 Net Worth: $8.6 billion

Another celebrated hedge fund tycoon, George Soros managed client money from 1969 to 2011. He famously became known as the man who broke the Bank of England when he shorted the British pound in 1992 for a reported $1 billion profit. He no longer manages money for clients but still invests through his family office fund. Through his Open Society Foundations, Soros has given away $16.8 billion to philanthropy in his lifetime.

10. David Shaw

Forbes 400 Rank: #117

Net Worth: $7.5 billion

2020 Net Worth: $6.5 billion

A former computer science professor at Columbia University, David Shaw founded his quantitative hedge fund, D.E. Shaw, in 1988. Known for using sophisticated mathematical modeling and algorithms, the fund now manages more than $55 billion in assets. Shaw stepped away from day-to-day operations in 2002, leaving an executive committee to oversee the firm.

11. Paul Tudor Jones II

Forbes 400 Rank: #123

Net Worth: $7.3 billion

2020 Net Worth: $5.8 billion

12. Stanley Druckenmiller

Forbes 400 Rank: #138

Net Worth: $6.8 billion

2020 Net Worth: $4.4 billion

13. John Overdeck

Forbes 400 Rank: #147

Net Worth: $6.5 billion

2020 Net Worth: $6.5 billion

13. David Siegel

Forbes 400 Rank: #147

Net Worth: $6.5 billion

2020 Net Worth: $6.5 billion

13. Philippe Laffont

Forbes 400 Rank: #147

Net Worth: $6.5 billion

2020 Net Worth: N/A (New)

16. Bruce Kovner

Forbes 400 Rank: #161

Net Worth: $6.2 billion

2020 Net Worth: $5.3 billion

17. Julian Robertson Jr.

Forbes 400 Rank: #224

Net Worth: $4.8 billion

2020 Net Worth: $4.3 billion

18. Daniel Och

Forbes 400 Rank: #261

Net Worth: $4.3 billion

2020 Net Worth: $3.2 billion

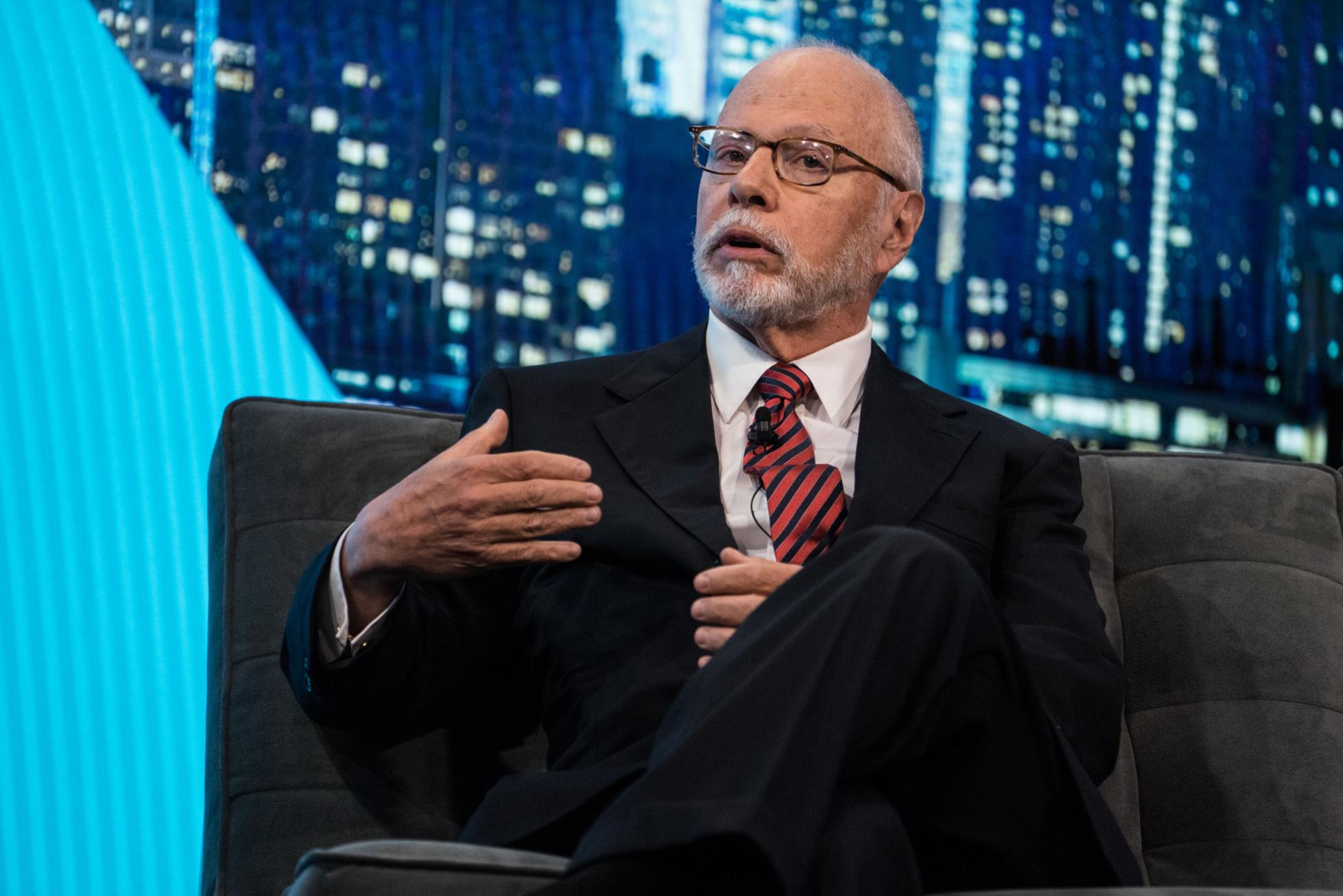

18. Paul Singer

Forbes 400 Rank: #261

Net Worth: $4.3 billion

2020 Net Worth: $3.6 billion

20. Daniel Loeb

Forbes 400 Rank: #281

Net Worth: $4 billion

2020 Net Worth: $2.9 billion

20. John Paulson

Forbes 400 Rank: #281

Net Worth: $4 billion

2020 Net Worth: $4.2 billion

22. Stephen Mandel Jr

Forbes 400 Rank: #289

Net Worth: $3.9 billion

2020 Net Worth: $2.8 billion

23. John Arnold

Forbes 400 Rank: #358

Net Worth: $3.3 billion

2020 Net Worth: $3.3 billion