The latest TrendForce report suggests a 6.2% decline in NAND flash revenue across Q4 last year, primarily driven by weak consumer demand. Leading NAND flash manufacturers have faced a consistent revenue drop, with most focusing on enterprise to recoup losses. Considering the shifting market trends, ASPs (Average Selling Prices) and overall NAND flash shipments also took a minor hit.

TrendForce cites weakening consumer demand as the driving force behind this downturn. By the end of 2024, PC and smartphone manufacturers are reportedly being pushed to clear excess inventory, driving down NAND flash prices as a knock-on effect. ASPs (Average Selling Prices) for NAND flash dropped by 4% QoQ with a 2% decline in overall shipments. This trend is expected to persist for the first fiscal quarter this year, with TrendForce projecting a massive 20% industry-wide drop in revenue.

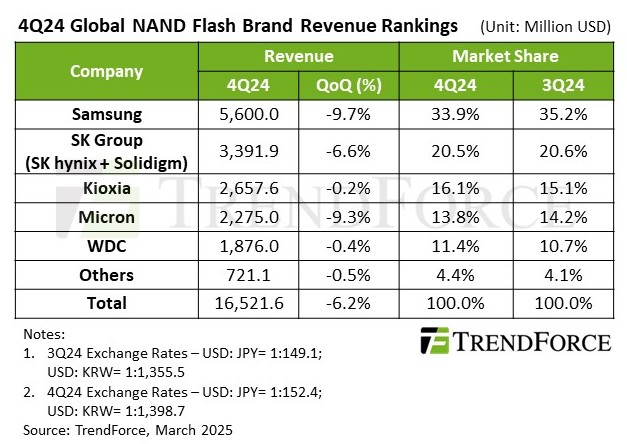

The global NAND flash revenue for Q4 2024 has been quoted at $16.52 billion, 6.2% lower than the previous quarter. A report that surfaced last October already foreshadowed this downturn. Memory producers were reportedly mulling over converting their existing NAND production facilities to focus on DRAM or HBM, which might've improved profits. All said and done, we should see an improvement by Q2 this year as production aligns with demand.

The report provided a chart comparing the industry-leading NAND flash providers. It seems that all manufacturers took marginal hits. That's quite telling, given how the same giants have been posting record profits in the HBM landscape. Samsung still holds 35.2% of the market, though it suffered a near 10% drop in revenue versus Q3 last year. The SK Group is in second place, with a 6.6% hit, followed by Kioxia at 0.2%, Micron at 9.3%, and WDC at 0.4%.

Most manufacturers are shifting gears to enterprise SSDs, per the report. Both Samsung and SK hynix suffered from production imbalances relative to market demand. Kioxia is taking a more technological stance with faster data transfer speeds and improving 3D NAND layer counts, as was reflected with its 10th-gen 332-layer V-NAND flash recently. Micron reportedly plans to cut back on costs in NAND flash operations but will continue offering high-capacity enterprise SSDs to boost earnings.