Lili was celebrating her birthday when she realised she had been scammed. The 52-year-old Londoner was enjoying high tea with her daughter, who works at a hedge fund, when talk turned to a vexing financial problem. Lili, not her real name, had started trading cryptocurrencies in March 2021, under the guidance of friends she had met online.

At one point, she had been up $1.4mn. But a bad trade later that year had obliterated most of her gains. Still, she had about $300,000 in one of her crypto trading accounts, close to the total amount she had invested. Put off by the losses, Lili was ready to quit. To liquidate her remaining tokens and cash in, Lili was told she needed to pay some tax. But when she tried to wire the money to the trading platform, it bounced back.

Lili’s daughter had heard enough to be alarmed. And, with a sinking feeling, Lili realised her newfound friendships and foray into crypto had been an elaborate scam. This moment of clarity was the start of a gruelling fight for justice.

Lili is one of thousands of victims swept up in a tidal wave of fraud that accompanied the crypto boom during the Covid-19 pandemic as more people became interested in investing in cryptocurrency.

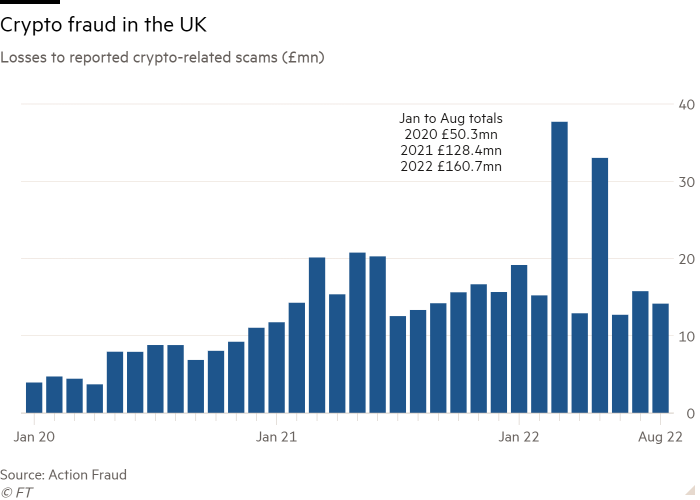

Scammers stole $6.2bn from victims worldwide in 2021, according to the blockchain research group Chainalysis, an annual increase of about 80 per cent. Losses from crypto-related scams reported to Action Fraud, the UK’s national reporting centre for fraud, more than doubled to £190mn last year compared with 2020. And, by the end of August, losses are 25 per cent higher than the same period last year.

Yet investigators lack the resources to investigate the accompanying rise in fraud cases — especially when the sums involved in individual scams are seen as relatively small. And, with the cost of living crisis set to worsen, UK regulators warn another fertile environment for scammers may be on the horizon. “We are concerned that, in current economic circumstances, people could be tempted to invest in fake investments,” says Nausicaa Delfas, interim chief executive of the Financial Ombudsman Service.

Lili’s battle to recover her losses and get justice reflects a gaping divide in consumer protections between people who use regulated financial institutions and those who embrace digital currencies.

Crypto scams occur outside the system of regulated financial institutions and legal protection that safeguards consumers. And tracing the international networks of faceless criminals behind this fraud presents huge challenges for law enforcement and other investigators.

“Inevitably, due to the nature of cryptocurrency — that it’s irreversible, anonymous and global — it’s obviously attractive to fraudsters,” says Rich Drury, ombudsman manager at the FOS, which handles complaints against financial companies.

The two “friends” who introduced Lili to crypto, having earned her trust over months of chatting online during the loneliness of lockdowns, did not exist. It is possible both aliases belonged to one scammer.

They shared pictures that testified to their wealth; posing in front of a Bugatti Veyron supercar, showing off a fluffy white dog wearing a Burberry scarf. All the while, they encouraged Lili to plough more money into her, apparently successful, crypto trades. She sold one of her two flats in London to raise cash for investment. Lili later discovered the trading site her so-called friends had recommended, and the apps she had downloaded, were spoofs.

Even though she has lost a significant amount of her life savings, Lili and her fellow victims are unlikely to receive much help. Their losses are not considered significant enough to justify hiring armies of lawyers and consultants for criminal or civil cases — or to rise up the priority list of overstretched police crypto experts.

Crypto criminals exploit the fact that smaller frauds involving multiple victims in different countries can escape the attention of national authorities. “There’s an economy of scale that fraudsters can work on,” says Carmel King, a director at Grant Thornton, who specialises in asset recovery. “Around the world, you are under the radar for all authorities because it doesn’t reach that level where it’s worth significant resources to investigate.”

That often means victims who suffer life-changing financial loss have nowhere to turn. “On an individual basis, if your loss is relatively low, there are very few options,” adds King. “There’s no point spending £300,000 to recover £100,000.”

‘I can’t help everyone’

Despite the challenges they face, lawyers and police have racked up a handful of high-profile wins against crypto criminals. British courts, in particular, have begun to establish a playbook for recovering stolen crypto following a series of rulings since 2019.

Courts are now willing to grant global orders to crypto exchanges to freeze and eventually return ill-gotten cash, and to disclose the identity of suspected scammers. If blockchain forensics can rapidly trace stolen funds to an exchange, barristers can be in court the next morning to secure freezing orders.

“England and Wales is the best jurisdiction in the world if you are a victim of crypto asset fraud,” says Racheal Muldoon, a barrister who has worked on these cases.

The progress in the UK gave hope to Phoebe, a healthcare professional based in New York, who was defrauded by scammers posing as fellow Christians facing legal difficulties in the Middle East. She sent hundreds of thousands dollars in crypto to support their cause.

“I was one of those people who thought this could never happen to me. I thought: ‘How stupid can these people be?’ But the scammers are so good,” says Phoebe, who also asked that her real name be withheld. “They would use biblical references to build up your trust and then steal from you.”

As some transactions went through UK banks, Phoebe contacted a British lawyer hoping to benefit from their experience in recouping stolen crypto. Even with losses of $800,000, Phoebe eventually concluded private legal action would not be worthwhile.

Muldoon and other lawyers who specialise in cryptocurrency are inundated with pleas for help, but say the tactics that have led to a handful of successful legal actions in England are out of reach for most victims. “I can’t help everyone,” Muldoon says. “Often, the amount of crypto is so small that I can’t advise that they spend the court fees.”

Lawyers say cases where the loss is less than £1mn are usually not economically viable.

Lili also reported her crime to the authorities, including London’s Metropolitan Police. But almost eight months after the scam ended, the detective emailed to say the Facebook profiles used by the scammers had been deleted and the social media trail had gone cold.

The UK police have built up expertise in crypto, according to lawyers and experts in the field, leading to a few multimillion-pound busts. But they do not have the capacity to cope with the vast number of smaller cases.

“There’s no confidence at all in the market that the police can help. I think that’s a resource problem, not a skills problem,” says Sam Goodman, a barrister who brought some of the first crypto recovery cases in UK courts.

Action Fraud declined a request for an interview.

Exchange of power

The crypto sector was built on the idea that traditional financial institutions rip off the little guy, so there is some irony that Lili’s best chance of getting some money back has come through appealing to banks.

In 2019, the UK financial services sector introduced measures to tackle “authorised push payment” frauds, where customers are tricked into sending money to a scammer. Ten of the largest UK banks and payment providers have agreed to compensate fraud victims out of their own pockets, except under certain circumstances, such as if the customer ignored a warning. Companies can also be forced to refund victims if they failed to spot suspicious transactions and intervene to warn the customer.

The system has been criticised for inconsistency and honouring only a small percentage of claims, leading to calls for the rules to be tightened. Nonetheless, it has provided a substantial safety net for victims of smaller scams, whose cases are unlikely to be investigated by police. Banks paid £238mn to victims in 2021, about half of the total losses to APP fraud, according to the latest data from the banking trade association UK Finance.

As some of the money Lili lost to the fraudsters was sent via bank transfer, the two banks involved in her case have offered to refund about 30 per cent of her total losses. She has complained to the Financial Ombudsman Service and is arguing for more.

Drury at the ombudsman service explains that crypto cases often fall outside the scope of these protections, because the first transaction leaving the victim’s bank account does not go directly to the fraudsters. Instead, they guide victims to buy crypto on a legitimate exchange and then send the tokens to their wallet.

“One of the issues with many complaints is that the code excludes payments that don’t go to another person in the first instance,” says Drury. “It’s always difficult, but with crypto it’s very difficult to get your money back. You’re almost always relying on redress from your payment provider.”

That banks provide a line of defence against losses to scammers underlines how heavily the present approach to tackling scams relies on regulated financial institutions.

“You regulate the intermediaries as a form of protection. And if they are not there, it’s a real problem . . . It’s the essence of the entire [crypto] project to disintermediate finance,” says Marc Jones, a partner at the law firm Stewarts who specialises in fraud cases.

Crypto exchanges — the companies that provide user-friendly services to buy, store and trade digital assets — come closest to replacing the role of banks. “The exchanges are the only thing right now that fills the gap,” Jones adds.

But lawyers and fraud investigators say co-operation from exchanges on tackling fraud is patchy, and that companies sometimes fail to collect proper identification data on their customers. Identifying the fraudster via a court order to an exchange is a key step in most anti-scam cases.

“Sometimes, it’s great. You get a linked bank account or a real passport,” says Goodman. “Very often it’s complete garbage information. It’s a fake passport or a fake utility bill and that’s it.”

Know-your-customer, or KYC, checks are a regulatory requirement for most financial groups, and are increasingly required of crypto companies in many jurisdictions, including for those based in the UK. Many of the largest crypto exchanges aren’t subject to these requirements as they are based offshore. OKX, for example, lets users make daily withdrawals of up to 10 bitcoin with no KYC, equivalent to almost $200,000.

“Unlike banks, cryptocurrency exchanges that locate themselves in exotic places aren’t subject to the same rigorous standards. So even when you can get KYC information, often the quality is very poor,” says Goodman.

In August, a US congressional committee wrote to five of the largest exchanges to express concern over “the apparent lack of action by cryptocurrency exchanges to protect consumers conducting transactions through their platforms”.

Exchanges insist their KYC systems are robust, and that their collaboration with law enforcement and ability to detect and trace fraud is better than that of many traditional financial institutions.

“The quality of information and the assistance that we provide is so much better than I was ever able to get from a bank,” says Tigran Gambaryan, global head of intelligence and investigations at Binance, a former special agent at the US Internal Revenue Service.

“I think some of the criticism that cryptocurrency exchanges face are outdated and not based on facts,” he adds.

Blockchain busting

Fraud investigators see the potential afforded by more transactions being recorded on transparent and unalterable blockchain ledgers to make fraud easier to fight.

“With blockchain-based scams, you have a unique toolset available to you,” says Danielle Haston, a former asset recovery lawyer who now works for Chainalsyis, a company that builds blockchain tracing tools.

Tracking money through the banking system can be a painstaking process, whereas digital assets can be traced in a few days or even hours. If blockchain sleuths can link one victim to a network involving other crimes responsible for a significant collective loss, it increases the case’s chance of becoming an investigative priority or viable grounds for a joint legal action.

Phoebe says her stolen funds are linked to a network of wallets handling millions in illicit transactions. She believes this is why detectives are pursuing her case. “I am now about a year away from the start of this,” she says. “It’s painful, but I feel that I’ve actually made progress.”

The challenge for investigators is to link crypto wallets dealing in stolen funds to real identities. This, investigators argue, is what makes tighter regulation on KYC checks so crucial.

“There’s this big battle going on at the moment. The philosophical underpinning of crypto begins with crypto anarchists and the idea that you keep things hidden from the state,” says Goodman. “If there was a regime that was as strict as banks, that would be immensely helpful.”

Europe’s sweeping Markets in Crypto-Assets regulation, expected to come into force from next year, includes tougher standards for “virtual asset service providers”, including exchanges. Companies will also be required to have a presence in an EU country to serve clients in the bloc, preventing offshore crypto giants from skirting jurisdiction.

Progress has been slower in the UK. The Treasury started work on comprehensive crypto regulation, spearheaded by Rishi Sunak as chancellor and John Glen as City minister when Boris Johnson was prime minister.

Lisa Cameron, the MP who chairs the UK parliamentary group on crypto, is pushing for a redress scheme to be part of any future regulatory framework.

Although the courts have made progress applying the law to crypto cases, barristers such as Muldoon say regulators are not keeping up. “Seemingly old dusty judges — all due respect to them — are getting their heads around it far quicker than young bright things at the FCA, Revenue and in government,” she says. “It needs to change.”

She believes public and regulatory pressure will eventually force exchanges, like banks, to do more to tackle fraud. “They will have to spend more money and time,” she says. “It can’t carry on as it is.”

For Lili, the battle for restitution has dragged on for as long as the fraud itself, with little prospect of resolution. For months, she was unable to talk about the losses without bursting into tears. That her case is unresolved makes it difficult to move on.

“I feel horrible. Really, really horrible. I can’t believe I’ve been fooled at my age,” she says. “I need justice.”