SLM (NASDAQ:SLM) underwent analysis by 8 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 5 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 3 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 1 | 0 | 0 |

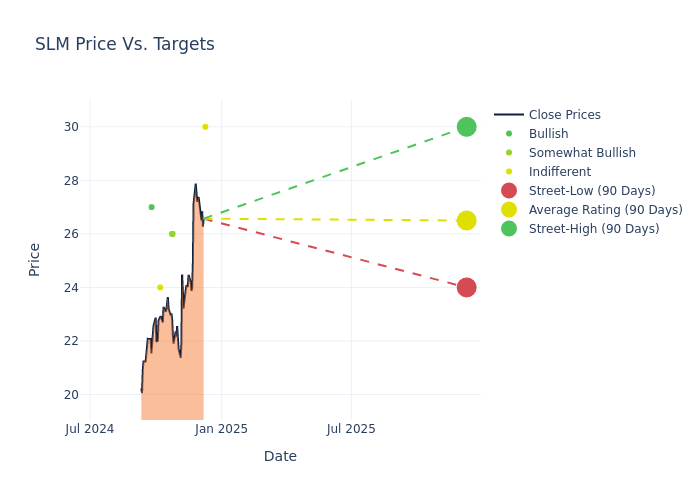

In the assessment of 12-month price targets, analysts unveil insights for SLM, presenting an average target of $26.5, a high estimate of $30.00, and a low estimate of $24.00. Surpassing the previous average price target of $26.14, the current average has increased by 1.38%.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of SLM's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Sanjay Sakhrani | Keefe, Bruyette & Woods | Raises | Market Perform | $30.00 | $27.00 |

| Jon Arfstrom | RBC Capital | Maintains | Outperform | $26.00 | $26.00 |

| David Chiaverini | Wedbush | Maintains | Outperform | $26.00 | $26.00 |

| Mark Devries | Barclays | Lowers | Overweight | $26.00 | $27.00 |

| Mark Devries | Barclays | Raises | Overweight | $27.00 | $23.00 |

| Richard Shane | JP Morgan | Lowers | Neutral | $24.00 | $25.00 |

| Nathaniel Richam-Odoi | B of A Securities | Announces | Buy | $27.00 | - |

| David Chiaverini | Wedbush | Lowers | Outperform | $26.00 | $29.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to SLM. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of SLM compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of SLM's stock. This examination reveals shifts in analysts' expectations over time.

For valuable insights into SLM's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on SLM analyst ratings.

About SLM

SLM Corp is the largest student lender in the country. It makes and holds student loans through the guaranteed Federal Family Education Loan Program as well as through private channels. It also engages in debt-management operations, including accounts receivable and collections services, and runs college savings programs.

Financial Insights: SLM

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Negative Revenue Trend: Examining SLM's financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -6.1% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: SLM's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -12.97%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): SLM's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -2.54%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): SLM's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -0.17%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a high debt-to-equity ratio of 3.21, SLM faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.