9 analysts have shared their evaluations of Haemonetics (NYSE:HAE) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 3 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 3 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 1 | 1 | 0 | 0 |

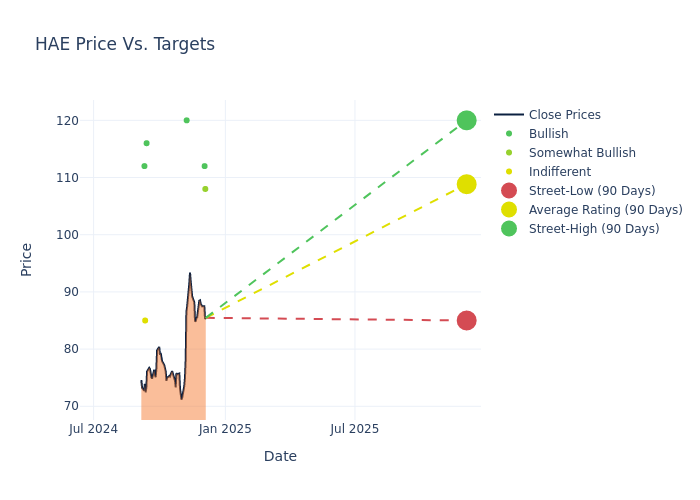

In the assessment of 12-month price targets, analysts unveil insights for Haemonetics, presenting an average target of $109.0, a high estimate of $120.00, and a low estimate of $85.00. This current average has decreased by 2.09% from the previous average price target of $111.33.

Decoding Analyst Ratings: A Detailed Look

In examining recent analyst actions, we gain insights into how financial experts perceive Haemonetics. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Petusky | Barrington Research | Maintains | Outperform | $108.00 | $108.00 |

| Mike Matson | Needham | Maintains | Buy | $112.00 | $112.00 |

| Mike Matson | Needham | Maintains | Buy | $112.00 | $112.00 |

| Michael Petusky | Barrington Research | Maintains | Outperform | $108.00 | $108.00 |

| Andrew Cooper | Raymond James | Maintains | Strong Buy | $120.00 | $120.00 |

| Michael Petusky | Barrington Research | Maintains | Outperform | $108.00 | $108.00 |

| Kristen Stewart | CL King | Announces | Buy | $116.00 | - |

| Craig Bijou | B of A Securities | Announces | Neutral | $85.00 | - |

| Marie Thibault | BTIG | Announces | Buy | $112.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Haemonetics. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Haemonetics compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Haemonetics's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

For valuable insights into Haemonetics's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Haemonetics analyst ratings.

Unveiling the Story Behind Haemonetics

Haemonetics Corp aims to improve patient care and reduce the cost of healthcare by providing medical products and solutions in the blood and plasma component collection, surgical suite, and hospital transfusion service spaces. As such, the company operates under three segments: plasma, blood center, and hospital. The company places primary emphasis on its plasma and hospital segments due to their robust growth potential, whereas the blood center segment tends to be constrained by higher competition. Product revenue is driven by demand for disposable blood component collection and processing sets and the related equipment needed for proper functionality.

Financial Insights: Haemonetics

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Haemonetics's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 8.59%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Haemonetics's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 9.79% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.79%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Haemonetics's ROA excels beyond industry benchmarks, reaching 1.34%. This signifies efficient management of assets and strong financial health.

Debt Management: Haemonetics's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.39, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.