Ratings for Fiserv (NYSE:FI) were provided by 24 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 14 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 1 | 0 | 0 |

| 2M Ago | 3 | 8 | 4 | 0 | 0 |

| 3M Ago | 1 | 4 | 0 | 0 | 0 |

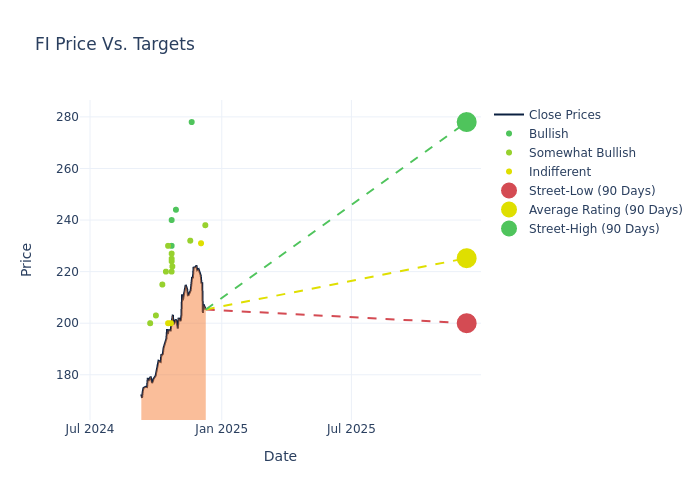

The 12-month price targets, analyzed by analysts, offer insights with an average target of $219.0, a high estimate of $278.00, and a low estimate of $183.00. Witnessing a positive shift, the current average has risen by 15.77% from the previous average price target of $189.17.

Decoding Analyst Ratings: A Detailed Look

A comprehensive examination of how financial experts perceive Fiserv is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Vasundhara Govil | Keefe, Bruyette & Woods | Raises | Outperform | $238.00 | $225.00 |

| Will Nance | Goldman Sachs | Raises | Neutral | $231.00 | $208.00 |

| Dominick Gabriele | Compass Point | Announces | Buy | $278.00 | - |

| Rufus Hone | BMO Capital | Raises | Outperform | $232.00 | $222.00 |

| Ivan Feinseth | Tigress Financial | Raises | Buy | $244.00 | $190.00 |

| Dan Dolev | Mizuho | Raises | Outperform | $222.00 | $183.00 |

| Daniel Perlin | RBC Capital | Raises | Outperform | $224.00 | $183.00 |

| Bryan Bergin | TD Cowen | Raises | Buy | $230.00 | $200.00 |

| Alex Markgraff | Keybanc | Raises | Overweight | $225.00 | $180.00 |

| Tien-Tsin Huang | JP Morgan | Raises | Overweight | $227.00 | $199.00 |

| Will Nance | Goldman Sachs | Raises | Neutral | $208.00 | $188.00 |

| Timothy Chiodo | UBS | Raises | Buy | $240.00 | $185.00 |

| Andrew Bauch | Wells Fargo | Raises | Overweight | $220.00 | $215.00 |

| Trevor Williams | Jefferies | Raises | Hold | $200.00 | $195.00 |

| Charles Nabhan | Stephens & Co. | Raises | Equal-Weight | $200.00 | $170.00 |

| James Friedman | Susquehanna | Raises | Positive | $230.00 | $190.00 |

| Brad Handler | Jefferies | Raises | Hold | $195.00 | $160.00 |

| Ole Slorer | Morgan Stanley | Raises | Overweight | $220.00 | $177.00 |

| David Anderson | Barclays | Raises | Overweight | $215.00 | $185.00 |

| Bryan Bergin | TD Cowen | Raises | Buy | $200.00 | $182.00 |

| Rufus Hone | BMO Capital | Raises | Outperform | $191.00 | $175.00 |

| Daniel Perlin | RBC Capital | Maintains | Outperform | $183.00 | $183.00 |

| Rayna Kumar | Oppenheimer | Raises | Outperform | $203.00 | $170.00 |

| David Koning | Baird | Raises | Outperform | $200.00 | $186.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Fiserv. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Fiserv compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Fiserv's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Fiserv's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Fiserv analyst ratings.

Unveiling the Story Behind Fiserv

Fiserv is a leading provider of core processing and complementary services, such as electronic funds transfer, payment processing, and loan processing, for us banks and credit unions, with a focus on small and midsize banks. Through the merger with First Data in 2019, Fiserv also provides payment processing services for merchants. About 10% of the company's revenue is generated internationally.

Fiserv's Financial Performance

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Over the 3 months period, Fiserv showcased positive performance, achieving a revenue growth rate of 7.02% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 10.81%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Fiserv's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.02%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Fiserv's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.65%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Fiserv's debt-to-equity ratio is below the industry average at 0.92, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.