During the last three months, 4 analysts shared their evaluations of American Woodmark (NASDAQ:AMWD), revealing diverse outlooks from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 0 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

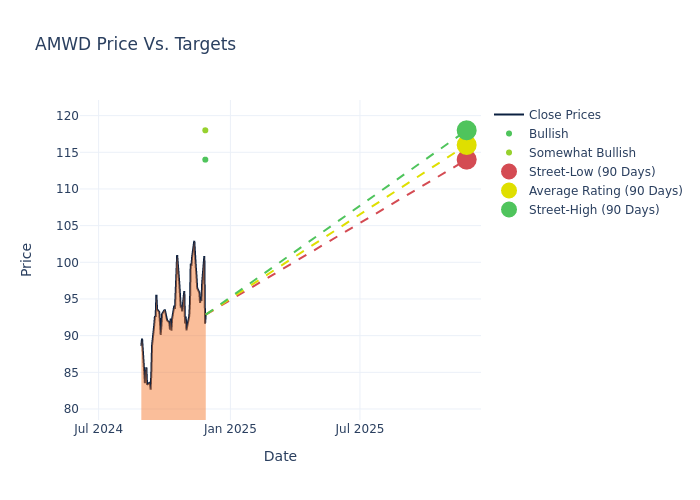

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $116.5, with a high estimate of $119.00 and a low estimate of $114.00. This upward trend is apparent, with the current average reflecting a 4.95% increase from the previous average price target of $111.00.

Exploring Analyst Ratings: An In-Depth Overview

A comprehensive examination of how financial experts perceive American Woodmark is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Garik Shmois | Loop Capital | Lowers | Buy | $114.00 | $119.00 |

| Timothy Wojs | Baird | Raises | Outperform | $118.00 | $115.00 |

| Timothy Wojs | Baird | Raises | Outperform | $115.00 | $112.00 |

| Garik Shmois | Loop Capital | Raises | Buy | $119.00 | $98.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to American Woodmark. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of American Woodmark compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of American Woodmark's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of American Woodmark's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on American Woodmark analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into American Woodmark's Background

American Woodmark Corp manufactures and distributes cabinets and vanities for the remodeling and new home construction markets. It offers several products that fall into product lines including kitchen cabinetry, bath cabinetry, office cabinetry, home organization, and hardware. The products are sold under the brand names American Woodmark, Timberlake, Shenandoah Cabinetry, and Waypoint Living Spaces among others.

American Woodmark's Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Negative Revenue Trend: Examining American Woodmark's financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -7.85% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: American Woodmark's net margin excels beyond industry benchmarks, reaching 6.45%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 3.25%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): American Woodmark's ROA stands out, surpassing industry averages. With an impressive ROA of 1.84%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: American Woodmark's debt-to-equity ratio is below the industry average. With a ratio of 0.57, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.