Make a plan and stick with it. That's one piece of investing advice that gurus of all sorts – no matter how they approach the market – agree on.

What they're talking about is having an asset allocation plan, which divvies up your money into stocks, bonds, cash and other assets in appropriate proportions according to your goals, how long you plan to invest and your tolerance for risk.

The advice is sound. By spreading your money among different kinds of assets – diversifying your investments, essentially – you lower the chance that you'll lose money because, theoretically, they won't move in lockstep.

But asset allocation strategies were seriously tested in 2022, when stocks and bonds fell in tandem. Diversification goes out the window during such market crashes, "just when investors need it the most," says Sebastien Page, chief investment officer at T. Rowe Price and author of "Beyond Diversification: What Every Investor Needs to Know About Asset Allocation."

Even so, asset allocation matters. One old Wall Street saw says it drives 90% of portfolio returns. But in fact, asset allocation affects portfolio volatility more than returns. "You engage in asset allocation because, like ballast in a boat, you want to minimize the sway of the portfolio," says Sam Stovall, chief investment strategist at investment research firm CFRA Research. More important, "because you're smoothing out the fluctuations, your emotions are less likely to become your portfolio's worst enemy," he says.

Smart investors will view the turmoil of 2022 as a sign that some tweaks to their portfolio may be required. After all, the market has changed. Bond yields are higher and cash, at long last, can earn a decent interest rate. Inflation, despite recent declines, remains high.

Meanwhile, U.S. stocks, down from their peak in late 2021 even after a rebound, are still expensive relative to shares in other countries' markets. Foreign stocks have been outperforming their U.S. counterparts in recent months.

To help you decide how to apportion your portfolio, we went to the experts. We polled some of the best asset allocators in the business for their thoughts on how to construct a portfolio. The process is part art and part science. We'll walk you through the steps the pros take to help clients build their portfolios so you can benefit, too.

Know your investing goals and risk tolerance

Asset allocation is basically about "getting the right mix of assets given your risk tolerance and risk capacity, or time horizon," says Robert Williams, managing director of financial planning at Charles Schwab. "Balancing those risks is the key to investment planning."

Before professional advisers get into that, however, they get a full picture of your finances and square away important questions first.

"What are we trying to accomplish?" asks Ryan Viktorin, a certified financial planner at Fidelity Investments. Are you saving for retirement, college, a down payment on a house? "When is that happening? Five years away, or 25 years away?" Viktorin continues. "Once you have that framework, you can start to know how to invest given what you hope to accomplish," she says.

Risk capacity. Your time horizon is easy to nail down. Your child's first college tuition bill will land in two years, for example, or you plan to retire in 10.

"Time horizon is a big driver of the amount of risk you can take on in the portfolio," says T. Rowe Price's Page. Money needed for a down payment on a house in three years, for instance, should be invested in cash or short-term bonds, not stocks, because you may not have enough time to make up any potential losses.

Risk tolerance. Figuring out how much volatility you can stomach – your tolerance for risk – is tougher. "Risk tolerance is a fuzzy concept," says Page. It's emotional. It also varies from person to person, and it may be colored by market conditions.

"People say they want to take lots of risk when markets are rising and no risk when markets are falling," says David Born, a certified financial planner in Orinda, Calif. Likewise, major life events can have an effect, too. If you're going through a divorce, for example, "no matter who you are, you're going to have a low tolerance for risk," says Blaine Thiederman, a certified financial planner in Arvada, Colo.

Most money managers, from digital robos to high-net-worth advisers, pose questions to gauge how aggressive or conservative you are as an investor. Much of it boils down to assessing how you will react during a market crash. If your portfolio declines by 20% in one year, are you likely to stay the course or change the portfolio?

Even better is a real-life example. "What investment changes did you make in 2022? Did you sell? Did you buy? Do nothing?" asks Sabino Vargas, a senior financial adviser and certified financial planner at Vanguard. "We tend to remember what happened most recently, so these are good questions to ask now."

If you sold investments in 2022, you are less risk tolerant (or more conservative) than someone who did nothing (moderate) or the investor who bought during a downdraft (aggressive).

Of course, we're paring down a complex task that advisers say requires time and effort. Getting a handle on your risk tolerance "is not a precise or scientific approach. It's by feel," says David Kressner, a managing adviser at Altfest Personal Wealth Management. But it is critical to building the right asset allocation strategy because the best portfolios are the ones you can stick with over time, even through big market drawdowns.

"Making imprudent decisions at the wrong time can have a meaningful impact on your outcome," says Kressner. "Avoid those mistakes by having the right allocation in place."

How much should investors put in stocks, bonds and cash?

Both risk capacity and risk tolerance play a role in how much you put in the basic building blocks of every portfolio: stocks, bonds and cash. Although most model portfolios are tagged with names that point to risk tolerance – conservative, moderate and aggressive, mostly – they also point to time frame. In his book, for instance, T. Rowe Price's Page refers to what he calls life-cycle-based model portfolios in terms of years to retirement – 20 years before retirement, 15 years, 10, 5 and zero.

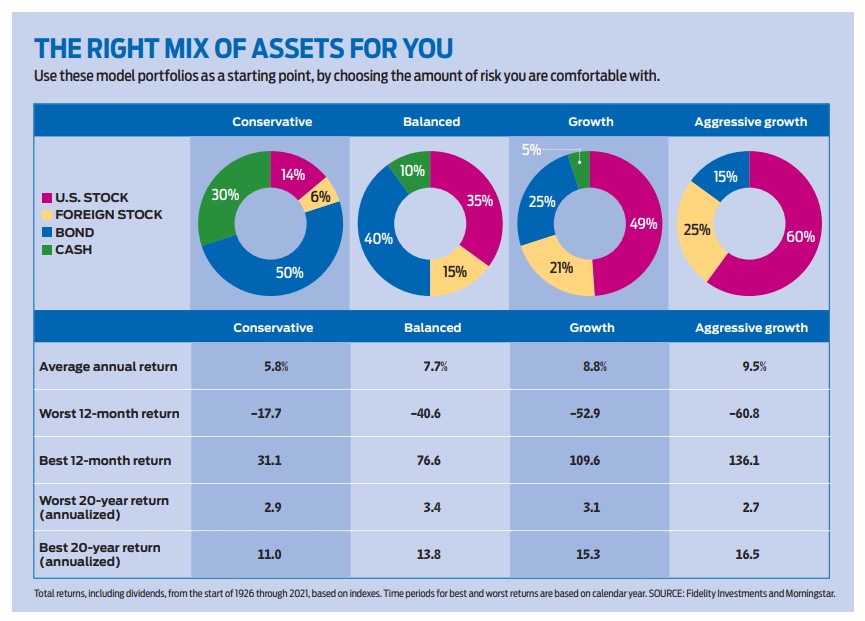

In the end, the most important decision you'll make is how much you put in stocks, says Page, "because it is the most effective way to calibrate your risk level in the portfolio." Use the model portfolios below as a broad-brushstroke guide to constructing a portfolio that's right for you. Read on for ideas on how to fill in the picture.

Stocks. Stocks offer the biggest reward over the long term, but the trade-off is high volatility. Over the past 20 years, stocks have returned an annualized 10.0%, but they suffered four bear markets – technically defined as a decline of 20% or more from the most recent peak. What's more, in any given calendar year – and in some years more than once – the S&P 500 Index tends to dip 5% to 10%.

There are dozens of ways to slice your stock portfolio. The division of assets between U.S. and foreign shares is just the start. Within the international portion, you can choose among developed markets and emerging markets. And for both U.S. and foreign stocks, you can home in on company size (small, medium or large) or tilt toward investment style (growth or value). Or you can focus on certain sectors – technology, energy, materials or industrial stocks, for example.

You can keep it simple by investing in index funds that cover the whole swath of stocks, such as a total stock market mutual fund or exchange-traded fund, for instance, which holds a stake in nearly every publicly traded stock in the U.S.

Our favorites include the Vanguard Total Stock Market ETF (VTI, $207, expense ratio 0.03%), which also trades in a mutual fund share class (VTSAX, 0.04%), and its international stock counterpart, the Vanguard Total International Stock Index (VXUS, $54, 0.07%), or its mutual fund version (VTIAX, 0.11%). The Fidelity Zero Total Market Index (FZROX) and the Fidelity Zero International Index (FZILX) are both broad index funds that charge no annual expenses.

Or leverage index funds to access slices of the stock market. That makes it easy to tilt your portfolio tactically, says Thiederman, the CFP in Arvada, Colo. "We piece out each part of the allocation with its own ETF to give us control to make adjustments to the portfolio," he says. His holdings include Vanguard ETFs that focus on U.S. small-company value stocks, U.S. small-company growth stocks and the like, as well as individual funds that focus on large-company and small-company stocks in foreign developed countries and in emerging markets.

But don't worry about getting so narrowly focused if that isn't your thing. "Granularity adds value, but it's not a requirement," says Schwab's Williams. Choosing an asset allocation and saving and investing, Williams says, can be like constructing a rocket ship: "You shoot it in the air and head toward a destination. You may change the steering here and there," tweaking your stock portfolio with more foreign shares, say, or small-cap stocks, "but generally you're all moving in the right direction."

Bonds. Bonds provide ballast against stock volatility – 2022 notwithstanding – but the trade-off is lower returns. Over the past 20 years, the Bloomberg U.S. Aggregate Bond Index returned 3.2% annualized. In that period, it had just three years of negative returns, in 2022 (–13.0%), in 2021 (–1.5%) and in 2013 (–2.0%).

But bonds can do more than just play the foil to stocks. They can also generate income, preserve capital and hedge against inflation. A core bond fund can go a long way toward meeting those objectives: Our favorite actively managed fund is the Baird Aggregate Bond (BAGSX, 0.55%). The fund, yielding 3.8%, is a member of the Kiplinger 25, the list of our favorite actively managed, no-load funds.

Or consider the iShares Core US Aggregate Bond ETF (AGG, $99, 0.03%), yielding 4.0%. You can fine-tune your portfolio to specific objectives with the right mix of bonds. Determine what you need most from your bond portfolio – income, preservation and/or diversification from stocks – then match the objective with the right kind of bonds.

To diversify from stocks, stick with high-grade bonds, such as Treasuries or government-guaranteed mortgage-backed securities. Buy Treasuries directly from the government at TreasuryDirect.gov and hold to maturity. ETFs are another option. The iShares US Treasury Bond ETF (GOVT, $23, 0.05%) holds debt with short-, medium- and long-term maturities and yields 4.0%. Our favorite mortgage-bond funds include the Vanguard Mortgage-Backed Securities ETF (VMBS, $46, 0.04%), which yields 3.2%, and the Vanguard GNMA (VFIIX, 0.21%), which yields 3.1%.

To generate income – an easier task these days thanks to higher rates – focus on high-quality, investment-grade corporate bonds (debt rated between triple-A and triple-B). The Vanguard Intermediate-Term Investment-Grade (VFICX, 0.20%) yields 4.9%. Add some oomph, if your risk tolerance allows, with small doses of high-yield bonds (debt rated double-B to triple-C) or emerging-markets bonds. The Osterweis Strategic Income (OSTIX, 0.84%) tilts toward debt with maturities of five years or less and recently yielded more than 7%. The Vanguard Emerging Markets Bond (VEMBX, 0.55%), another Kip 25 fund, yields 7.3%.

For capital preservation, focus on high-quality, short-term bond funds, which yield roughly 4% these days. The Baird Short-Term Bond (BSBSX, 0.55%) holds a mix of government and corporate debt – triple-A-rated debt makes up nearly half of the portfolio – and currently yields 4.3%.

Finally, to hedge against inflation, invest in Treasury inflation-protected securities (TIPS), which pay a fixed rate on principal that adjusts with inflation. Buy directly from Uncle Sam at TreasuryDirect.gov. Or consider a fund. The Vanguard Short-Term Inflation-Protected Securities ETF (VTIP, $48, 0.04%) yields 1.8%; the SPDR Bloomberg 1-10 Year TIPS ETF (TIPX, $19, 0.15%) covers both short- and medium-term securities and yields 1.5%.

Cash. Gone are the days when sitting in cash was a liability. Cash accounts pay nearly 4% or more now. Most high-yield savings accounts yield 4.0% or nearly, including Capital One's 360 Performance Savings account. Six-month Treasuries recently yielded 5.5%. Buy individual short-term Treasuries and Series I savings bonds (which yield 4.3%) at TreasuryDirect.gov. Or invest in the iShares 1-3 Year Treasury Bond ETF (SHY, $82, 0.15%) or the Goldman Sachs Access Treasury 0-1 Yr ETF (GBIL, $100, 0.12%). Both funds yield more than 4.0%.

Money market mutual funds recently yielded more than 5.0%. Vanguard beats everyone on expense ratio and yield in this category – specifically, the Vanguard Federal Money Market (VMFXX, 0.11%) and the Vanguard Cash Reserve Federal Money Market (VMRXX, 0.10%), both yielding just over 5.0%.

Consider alternative investment strategies

Stick with your plan, but understand it's okay to make incremental shifts in response to market conditions. Bond yields are higher, and so are stock valuations, says T. Rowe Price's Page. So he's slightly underweight in stocks relative to bonds, he says. By underweight, he means below the target stock allocation in any given portfolio. But, he adds, "we limit our tactical adjustments to plus or minus 10 percentage points" around the target allocation. "These aren't big adjustments."

Similarly, the advisers at Altfest Personal Wealth Management have shifted their focus since late 2021 from short-term inflation-protected bonds to intermediate and longer-term Treasury debt to lock in higher yields.

Asset classes can morph over time, too. Today, more than half the high-yield bond market is made up of double-B-rated debt, the highest-quality junk bonds, says Page. That's up considerably from 2008, when double-B bonds accounted for roughly one-third of the junk-bond market. That means the asset class is slightly higher in quality than in years past – so it is lower in risk – but investors should expect to earn lower yields on junk bonds relative to Treasuries than in the past. Emerging-market countries, too, are less tied to volatile commodity prices, Page adds. "That will affect how the asset class behaves" relative to its historical performance, he says.

Perhaps the biggest lesson investors learned in 2022 is that portfolios could use a dose of alternative strategies, which tend to move independently from stock and bond markets. Some of these strategies posted double-digit-percentage returns in 2022.

"It's a catch-all category," says Altfest's Kressner, that can include long-short funds, market-neutral funds and managed-futures strategies. Today, a growing number of these approaches are available in mutual funds for mom-and-pop investors. Among them, we like the Pimco Trends Managed Futures Strategy Fund (PQTAX, 1.87%) and the Boston Partners Global Long/Short Fund (BGRSX, 2.81%). We also like the Vanguard Market Neutral Fund (VMNFX, 1.83%). Note that a $50,000 minimum investment is required.

Some advisers make a case for putting up to 20% of your portfolio in alternative-strategy funds, depending on your age, circumstances and risk tolerance – "especially today," says Dan Villalon, global cohead of AQR's portfolio solutions group, who cites expectations for low returns from stocks and bonds in the coming years and the greater level of uncertainty in the world.

Ideally, you would trim from both your stock and bond allocations to add alternatives to your portfolio. But Villalon says many investors, especially those who want to maintain a certain level of risk in their portfolio, simply take from the bond side. Either way, Villalon recommends considering a fund that employs multiple alternative strategies. Check out the AQR Diversifying Strategies (QDSNX, 1.72%). The fund proved to be a good diversifier in 2022, when it returned 14.5%.

At Altfest, alternative asset strategies include a hodgepodge of approaches, including hedged-equity ETFs that offer some protection against stock downturns in exchange for a cap on potential gains. These so-called buffered or defined-outcome ETFs take some explaining. To limit losses and gains, the ETFs invest in options linked to, say, the S&P 500. Fund firms Innovator, Allianz and Trueshares have the longest track record with these strategies. We'll be watching them closely.

Hire a professional adviser

Enlisting an expert to manage your portfolio is a good idea for many investors, especially those with complex financial situations. For others, a sit-down with an adviser – to assess whether you're on track with your investment goals – can offer peace of mind, which will help you stick with the plan. A robo adviser is a good option for many, too. You can also access professional expertise without hiring an adviser by buying shares in a fund that holds stocks and bonds, such as a balanced fund, or invest in a target-date fund.

Balanced funds typically hold 60% of assets in stocks and 40% in bonds, a common allocation for an investor with a medium- to long-term time horizon and a moderate amount of risk tolerance. Actively managed funds tend to outshine ETFs in this category. Our favorite is the Vanguard Wellington (VWELX, 0.25%) because it has delivered solid, consistent returns and boasts a low annual expense ratio. The Fidelity Puritan (FPURX, 0.50%), American Funds American Balanced (BALFX, 0.62%) and Dodge & Cox Balanced (DODBX, 0.52%) are worth a look, too.

Target-date funds grow old with you. Experts decide how to allocate your assets over your working life (and often well into your retired life, too) by gradually shifting the mix of stocks and bonds as you grow older. These funds are standard offerings in 401(k)s, but you can invest in one outside of your plan.

Choose a target-date series that matches your tolerance for risk. Some are more aggressive than others. The funds in the T. Rowe Price Retirement and Fidelity Freedom target-date series consistently hold more stocks along their glide path (the shift in the stock-bond allocation over time) than peer funds do. The American Funds Target Date Retirement series follows a glide path that starts conservatively relative to peers but ends moderately aggressive. The T. Rowe Price Target series – which is more conservatively positioned than the firm's Retirement series – have lower exposure to stocks compared with peers.

Index-based target-date funds get the job done, too. The Vanguard Target Retirement series shines here for its simplicity—the target funds hold a handful of broad-market index funds—and a low expense ratio of 0.08%. No other series comes close.

Use online tools to identify identify risk tolerance

Online tools can help you identify – roughly – your tolerance for risk. Bear in mind that your mood and/or market conditions may affect how you answer certain questions.

Charles Schwab's questionnaire is open to all; you don't have to be a Schwab client to access it. Your answers will inform a time-horizon score and a risk-tolerance score that together slot you into one of five profiles: conservative; moderately conservative; moderate; moderately aggressive; or aggressive.

Vanguard has a free tool, too. It will suggest a stock/bond/cash mix.

Robo advisers can be good sources for model portfolios, even if you don't have an account. Check out Schwab Intelligent Portfolios; E*Trade's Core Portfolios and Fidelity Go. You fill out a questionnaire about your age, time horizon and risk tolerance, among other things, and are shown a breakdown of how much to hold in stocks, bonds and other assets. Schwab and Fidelity even show what funds you'd hold if you opened an advisory account with them.

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.