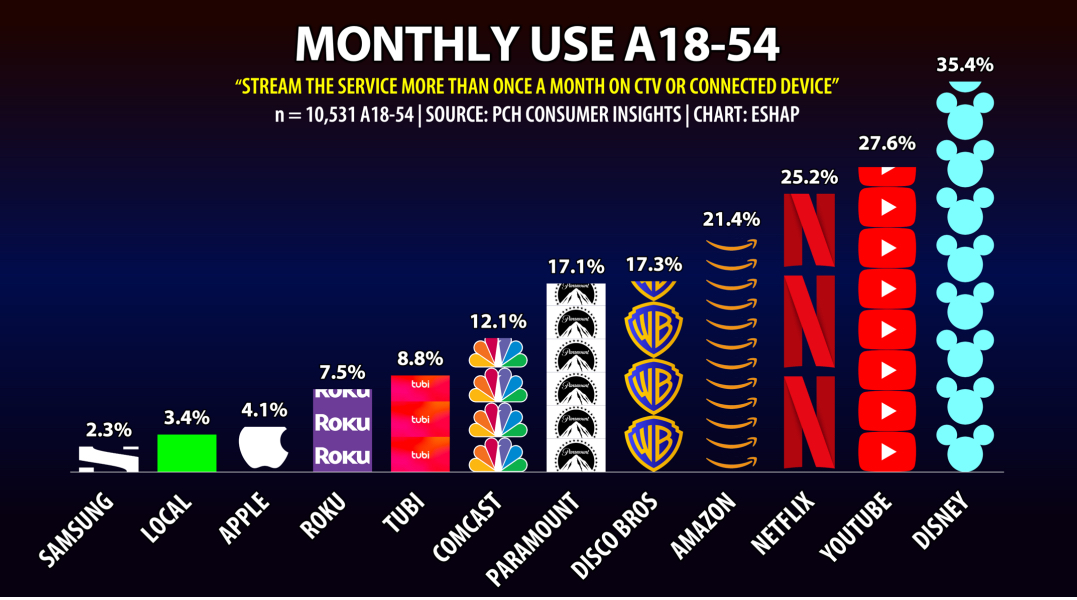

More than 35% of adults ages 18-54 say they stream one or more of Disney's major subscription services, Disney Plus, Hulu or ESPN Plus, more than once a a month on a connected-TV device, according to a new study conducted by Publishers Clearing House’s recently launched market research division, PCH Consumer Insights.

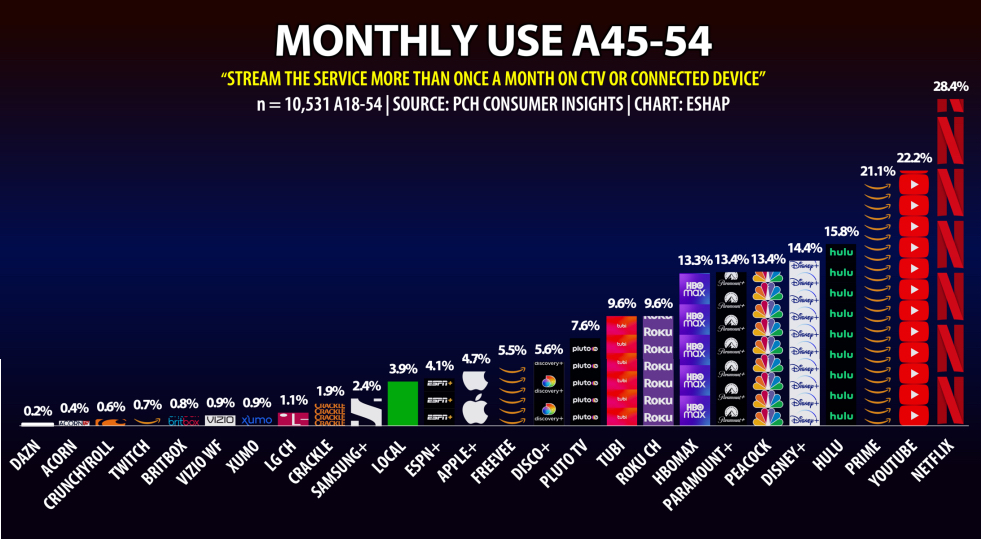

Notably, when streaming services are not combined by operator and arbitrated individually, Google/Alphabet's YouTube is the streaming platform with the most U.S. engagement, with 27.6% of of the survey panel reporting frequent monthly usage, followed by Netflix (25.2%).

The findings come from PCH's latest report, “Streaming In Flux,” which was culled from online surveys of 16,650 “media consumers’ in February and can be downloaded here.

And yes, we're talking about that Publishers Clearing House, the 70-year-old direct marketing company perhaps best known for the sweepstakes ostensibly pitched by Johnny Carson sidekick Ed McMahon, who notably carried around life-sized prize checks in TV commercials for decades. (Actually, as PCH was quick to remind us, McMahon actually flew the flag for rival American Family Publishers. Our confusion.)

Following scandals and lawsuits litigated through and settled decades ago, PCH evolved into a largely online company, collecting gobs of qualifying data, by permission, on its customers for what became a tightly regulated sweepstakes business, as well as an internet commerce operation.

With tens of thousands of consumers in its database, the company made a savvy pivot last year into market research, putting veteran PCH executive Smriti Sharma in charge of the new division.

To serve as a kind of liaison to the TMT community, PCH partnered with high-profile digital media influencer Evan Shapiro, an NYU media biz professor perhaps best known for creating NBCUniversal's pioneering Seeso platform six years ago. Shapiro and Sharma both hopped on a zoom earlier this week to explain PCH's new offering to Next TV.

Ahead of the upcoming “NewFronts” and “upfront” advertiser pitches to Madison Avenue, PCH Consumer Insights is trying to position itself as a robustly-backed alternative for advertisers vs. research incumbents like Nielsen.

Also read: Who's No. 1 in Subscription Streaming? Muddled Metrics Methodologies Make Matters Murky

We’d already leveraged an earlier PCH report about dwindling theatrical engagement for one of our Friday rambles earlier this month ... and we don't trust Nielsen as far as we can throw them, so we were all ears.

Gauge This ...

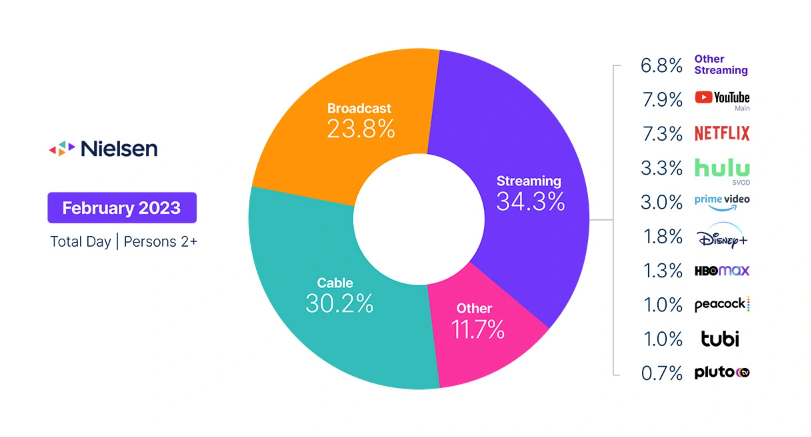

A key point of our discussion was Nielsen's monthly U.S. TV viewership share graphic “The Gauge,” which has quickly become an influential measuring stick in the tech-media business as to how much streaming usage has expanded and which platforms have truly “arrived” as relevant industry forces.

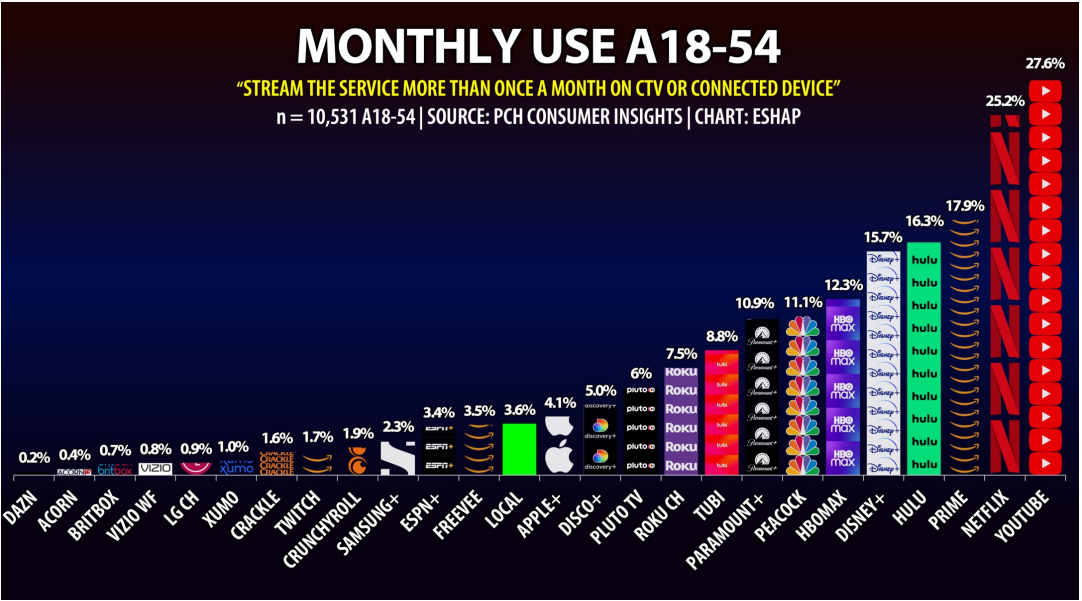

Both Shapiro and “Streaming In Flux” take direct aim at The Gauge, noting the conspicuous absences of streaming platforms including Paramount Plus and The Roku Channel. These would seem to command enough usage to rank on Nielsen's pie chart.

Also missing from Nielsen's graphic are transparent markers — the methodology and sample size, for example.

And then there’s The Gauge’s impossibly broad demographic focus — “persons 2-plus,” which Shapiro finds confounding.

“What’s the point of doing this kind of research other than to determine how we’re going to divide the ad dollars at the end of the day?” he noted.

Indeed, viewer age can’t be understated when your business is delivering actionable consumer insights on the streaming video business. For example, limit the cohort to adults 45-54, and the platform market share picture changes dramatically, with usage of premium subscription platforms far outpacing ad-supported services.

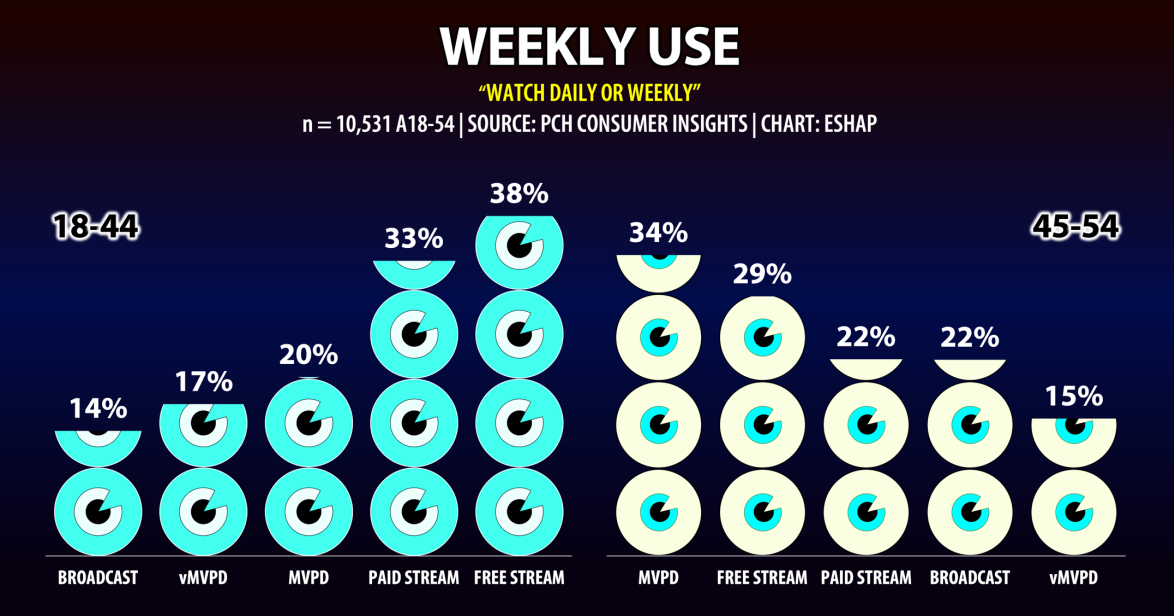

Perhaps even more illustrative is PCH’s demo comparison based on viewing platform category. Adults 18-44 favor ad-supported streaming by a significant margin vs. adults 45-54, who tend to favor traditional pay TV.

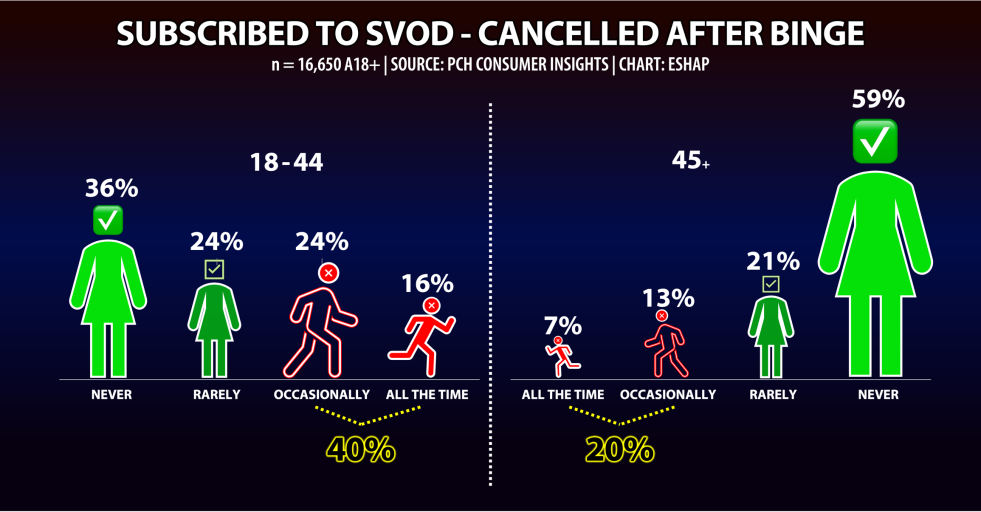

Looking at one more PCH chart from the study before we get out of here for the weekend, notable is the tendency for younger subscription streaming users to sign up for a service so that they can binge on a specific show or movie, then ditch the platform when they’re done.