Rachel Reeves appeared to win few plaudits for Wednesday’s Budget, which analysis suggests will lead to a decade of higher tax for Britons.

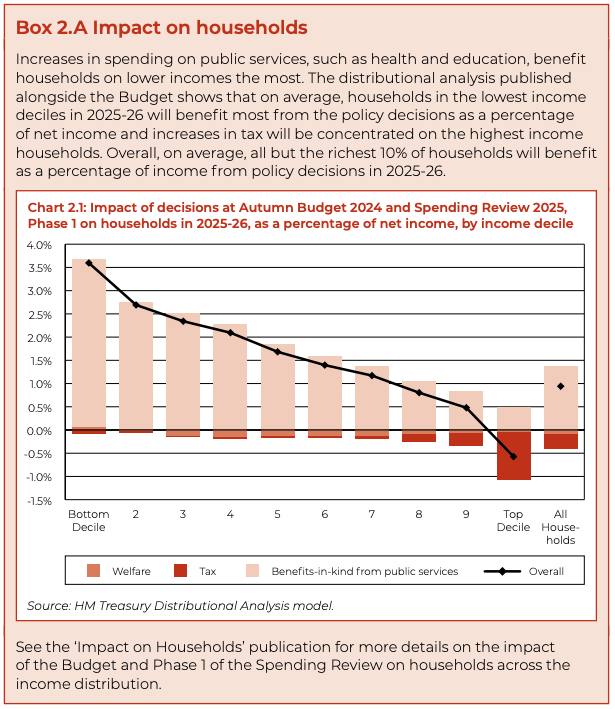

But one chart which appeared to go largely under the radar shows that most earners will be better off, with only the wealthiest 10 per cent losing out.

Nine out of 10 taxpayers will benefit as a percentage of income from the Budget, according to a Treasury analysis, as they will receive better public services from a rejuvenated NHS and growing economy, assuming Ms Reeves’ plan works.

The rosy view was criticised by Paul Johnson of the think tank the Institute for Fiscal Studies, who pointed out that the chart ignored the £25bn tax hike from increasing employers’ national insurance, a tax rise that may erode workers’ wages.

According to the Office for Budgetary Responsibility, which marks the Treasury’s homework, the Budget should deliver a boost to the economy in the next few years, peaking next year with an extra 0.6 per cent.

The poorest will get a boost of more than 3.5 per cent of their incomes as a result of more government spending, while the top tenth of earners will see their incomes shrink by just over 0.5 per cent as taxes outweigh the public service benefits, said the Treasury.

Mitigating the benefit is the fact that earnings are now likely to grow at a slower rate.

IFS director Mr Johnson said the chancellor was faced with “a genuinely difficult inheritance” and responded by hiking taxes, spending and borrowing, taking the former to record levels.

But, in a warning to Rachel Reeves ahead of future Budgets and spending reviews, he added: “Worryingly for the government, and indeed all of us, the OBR has reduced its forecast of household income growth, and expects income growth over this parliament to be lower than over any other parliament in modern times – except the last parliament.

“Not a recipe for a happy public come the next election.”

He also said that yesterday made the state bigger and that Britons would need to accept a “decade of higher taxes”.

Mr Johnson said that Ms Reeves’ current plans mean a 4.3 per cent jump in spending next year, 2.6 per cent the year after and then 1.3 per cent in each of the following years.

Mr Johnson said: “I’m afraid this looks like the same silly games playing as we got used to with the last lot. Pencil in implausibly low spending increases for the future in order to make the fiscal arithmetic balance.”

It comes as Ms Reeves has admitted that her £40bn tax-raising Budget could impact wage growth for workers.

Asked about the consequences of increasing national insurance contributions for employers she told BBC Breakfast: “It will mean that businesses will have to absorb some of this through profits and it is likely to mean that wage increases might be slightly less than they otherwise would have been.”