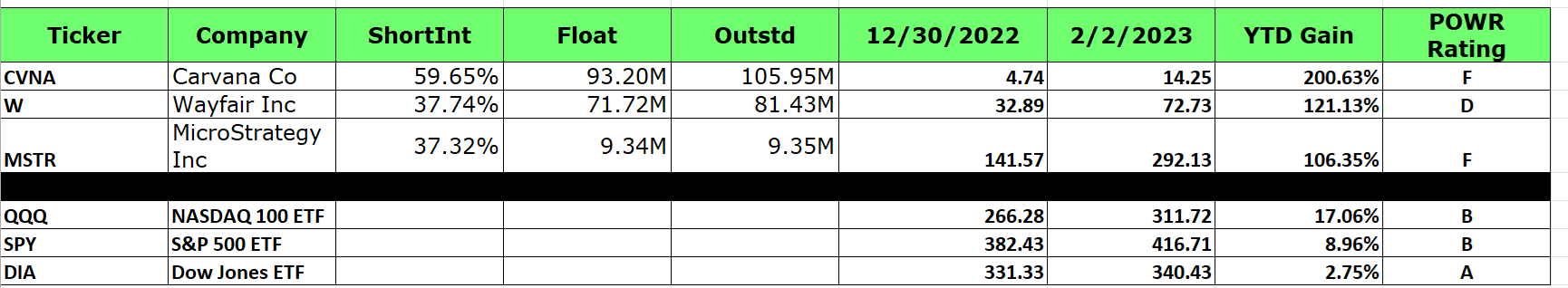

It has definitely been a rip-roaring start to 2023 for stocks. As of the close on February 2, the NASDAQ 100 (QQQ) was up an astounding 17.06%. The S&P 500 (SPY) tacked on nearly 9%. The lower beta Dow Jones Industrials (DIA) gained only 2.75%.

Spectacular gains to say the least. Indeed, it was the best start to a year since 2001 for QQQ. Yet the crazy gains to start the year in the most shorted stocks makes the outsized gains in the QQQ seem tame in comparison.

The top 10 most heavily shorted stocks by short interest had a truly mind-boggling average gain of 75.28% from January 1 to February 2. The top 3 most shorted stocks by short interest (Carvana, Wayfair, and MicroStrategy) all had gains of well over 100% in that same time frame. Carvana rose over 200%.

The table below shows that performance, along with the comparative performance of the major stock ETFs.

Interesting to note that all three of these massive outperformers were not only heavily shorted, but also carried extremely low ratings from a POWR ratings perspective. CVNA and MSTR were Strong Sell (F rated) stocks, while W was a Sell (D rated) stock. Even more reason to be wary of the red-hot rally.

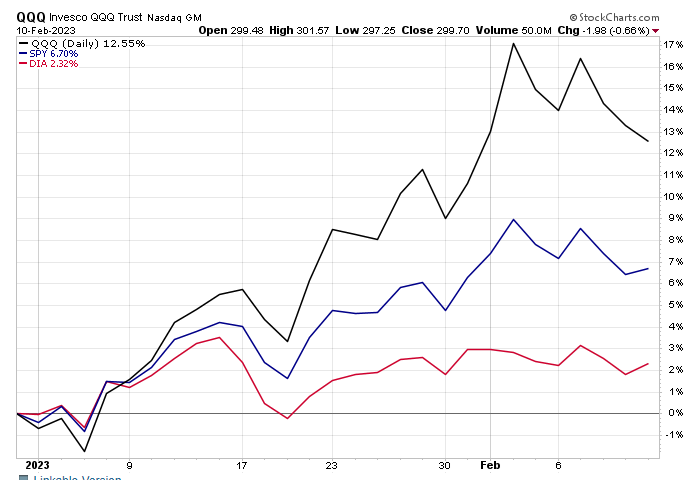

Fast forward to the latest close on Friday and you can see that the biggest outperformer (QQQ) to start 2023 has become the biggest underperformer over the past week. NASDAQ 100 dropped 4.5%, S&P 500 gave up just over 3% while the Dow Jones Industrial have pretty much traded sideways with a loss well under 1%. Mean reversion is beginning. The relative performance gap is starting to narrow.

The ridiculous red-hot rally in the high beta Nasdaq names in reminiscent of 2001 in performance. As mentioned earlier, 2023 was the best start to the year since 2001. There’s a caveat, though. In 2001, the Nasdaq (QQQ) fell 20% in the remaining 11 months. A great start to a year does not at all guarantee smooth sailing.

This is readily evident in the recent performance of the top short squeeze stocks. All reached extremely overbought levels on a technical basis before starting to crater.

The 3 most heavily shorted names that previously led the insane short squeeze rally higher have finally fallen back to earth in a big way. Below is a quick synopsis of each.

Carvana (CVNA)

Carvana has dropped 24% since making the February 2 close of $14.25. Shares actually traded all the way up $19.87 on that day only to reverse course and finish near the lows. This type of price action is called a key reversal day and is many times a reliable indication of a top in the stock. The buyers have gotten exhausted, and the sellers are back in charge.

Wayfair (W)

Similar price pattern for Wayfair. Stock has fallen over 28% in the past week. Made an intra-day high at $74.25 on February 2 only to close much lower on the day. Another key reversal day.

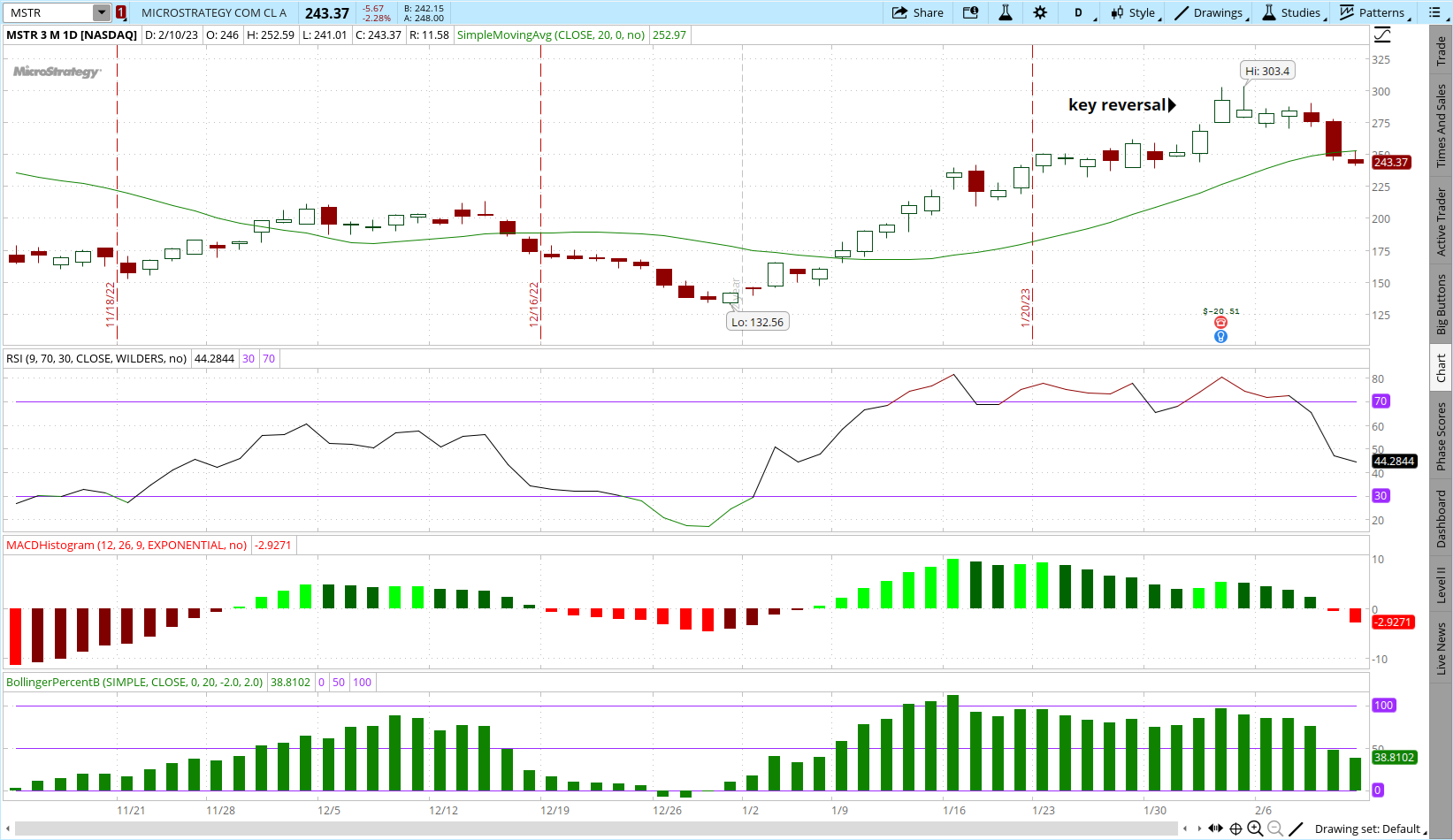

MicroStrategy (MSTR)

Once again, chasing manic momentum on low rated names never seems to pay. MSTR has dropped 16.69% since the highs on February 2. Yet another poster child for a key reversal technical pattern.

Now that the rally is being to stall, I expect the higher quality, lower beta names to outperform the lower quality, higher beta (and speculative names) over the coming months.

It will likely be a market to pick the best stocks, not just pick any stocks. Don’t fight the Fed has become more of a liability than an asset for the bulls.

That is where the POWR Ratings provide a big edge. Since inception, the highest A rated Strong Buy stocks have beaten the S&P 500 by more than 4x since 1999.

Of course, shorting stocks to take advantage of situations like we have just seen can be expensive-and risky.

Luckily, POWR Options provides a straightforward and simple solution. Buying puts on the low rated and over-extended stocks like CVNA, W and MSTR provides a defined risk way to magnify your returns at a low cost-just $500 or so per trade. Plus we wait for the market to tell you when the rally has run out before initiating a short position.

The POWR Options portfolio did such a trade on one of these short squeeze names just recently with good success so far.

POWR Options

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

MSTR shares closed at $243.37 on Friday, down $-5.67 (-2.28%). Year-to-date, MSTR has gained 71.91%, versus a 6.70% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

The Best Way To Short The Most Shorted Stocks StockNews.com