In 2025, the camera market will continue to grow, but at a slowed pace compared to the previous year, the latest forecast from the Camera and Imaging Products Association (CIPA) suggests. During the CP+ photography show, CIPA shared its predictions for 2025, offering a conservative one percent uptick in the number of digital cameras shipped worldwide. But, at the same time, CIPA shared an in-depth look at the 2024 data, including a chart that shows the average cost of compact cameras surprisingly surpassing the price of interchangeable lens cameras.

The presentation by CIPA group chair Sato Kazu first analyzed the latest available data, then shared the predicted numbers for the 2025 market during the CP+ show in Japan last week. While camera shipments as a whole are expected to remain about the same with a predicted one percent growth for 2025, cameras with built-in lenses are predicted to sit at 101.9% of the previous year’s numbers. Interchangeable lens cameras have a more conservative 100.9% prediction, while the lenses used with those cameras are also expected to grow, at around 102.4%.

While CIPA predicts minor growth for 2025, the group predicted a decrease for 2024, estimating camera sales to be at 96% of the 2023 numbers. But, now that the actual numbers are in, CIPA noted how far off those 2024 predictions were, with a 110% growth overall rather than the predicted decline.

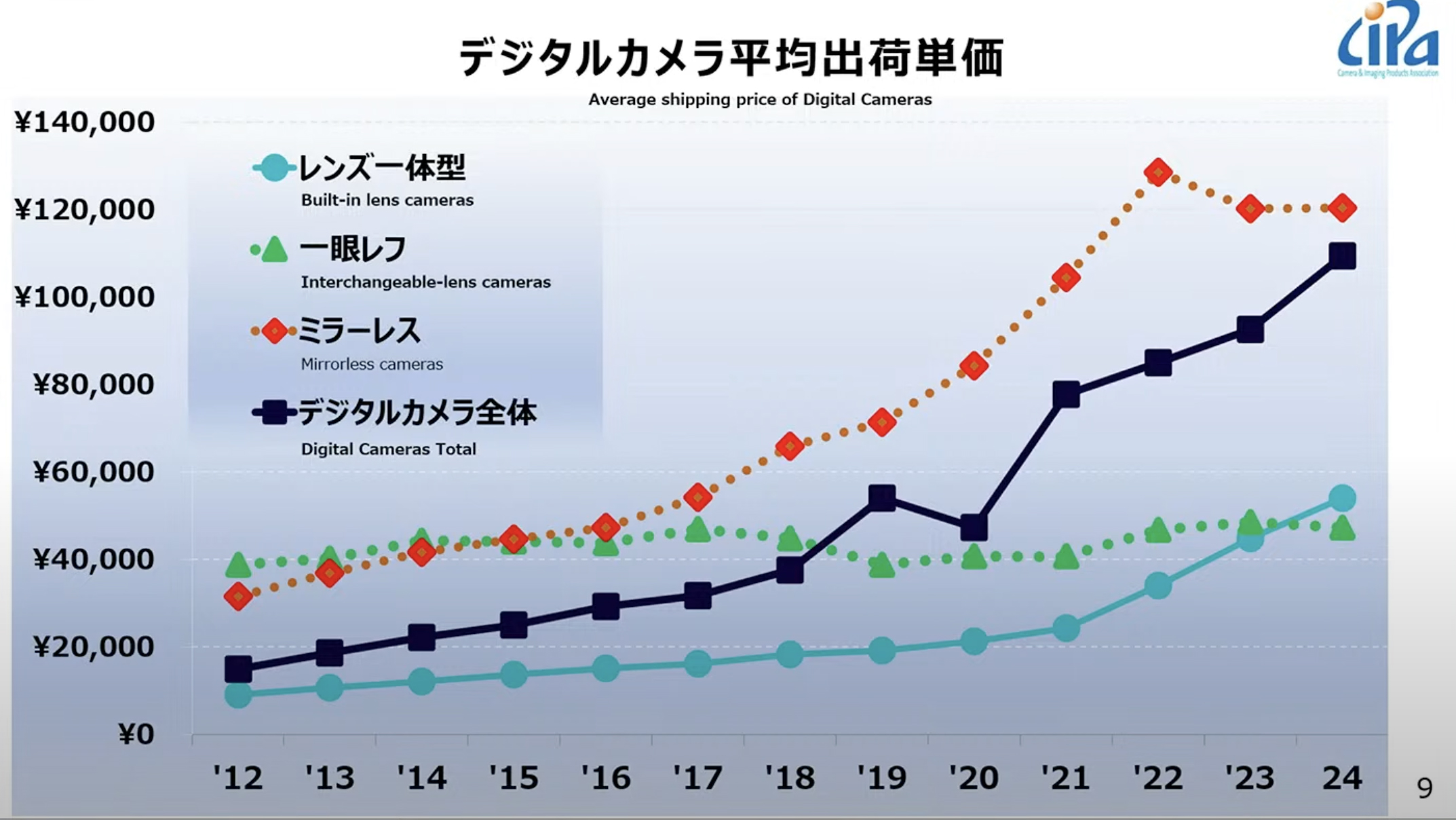

The average shipping cost of cameras has also been on a steady uptick over the last 12 years, CIPA shared, excluding a drop in 2020. Kazu noted that this increasing cost is largely due to higher-end cameras making up more of the market share, as consumers look for cameras that offer features that smartphones do not.

While the cost of cameras overall has steadily increased, the cost of mirrorless cameras seemed to peak in 2022, declining slightly in 2023 and remaining fairly stable in 2024. Instead, the cost of cameras with built in lenses started increasing at a bunch faster rate beginning in 2021.

In 2024, the average cost of a camera with a built-in lens actually surpassed the cost of interchangeable lens cameras. That average cost still sits far below the average cost of a mirrorless camera, however, which means the cost of those fixed lens cameras only outpaces the cost of interchangeable lenses when taking the lowering cost of DSLRs into account.

I suspect the jump is due to the popularity of high-end compact cameras like the Fujifilm X100VI, Leica D-Lux-8, and aging Canon G7X series driving up compact prices. But, Kazu notes that there’s also an increasing trend for video features, which means popular compact vlogging cameras like the Sony ZV series or the DJI Pocket series could also be contributing to the trend.

The camera industry has been on the upswing since a dip in 2020 as the market recovered from the impact of the COVID-19 pandemic. But, CIPA data shows that the role of DSLRs and mirrorless cameras flip-flopped around 2019, with the graph for mirrorless sales continuing to pull away from DSLR sales since. It’s only when averaging the cost of all types of interchangeable lens cameras together that the cost of compact cameras surpasses the category, with the average cost of a mirrorless camera still more than twice as high as the compact camera.

While mirrorless cameras remain the highest cost, interchangeable lens cameras made up about 39 percent of the cameras shipped worldwide in 2024. Kazu noted that mirrorless cameras are a pillar for the industry supporting the market.

The presentation during CP+ also highlighted some demographics not typically part of the monthly CIPA reports. Kazu broke down the demographics by age and gender for camera buyers in Japan, numbers which suggest those under 40 could be a driving factor in the unexpected 2024 growth.

While Gen Z’s move to bring back compact cameras made headlines, the younger generation makes up more of the mirrorless sales than the fixed lens cameras, at least in Japan. The number of people under age 30 buying interchangeable lens cameras jumped from 7% of the total sales to 18%, while those aged 30 to 39 also jumped significantly from 18% to 29%. That puts those under the age of 40 as responsible for 47% of the interchangeable lens camera sales in Japan last year.

The younger demographic also jumped when looking at fixed lens cameras, with those under 30 jumping from 4% to 15% in 2024, and ages 30-39 moving from 14% to 21%.

You may also like

Browse additional reports on the latest CIPA numbers, or dig into the best compact cameras or the best cheap cameras.