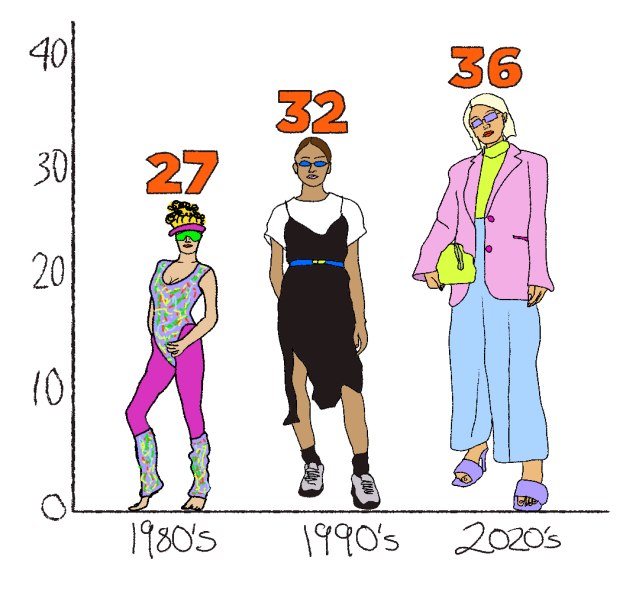

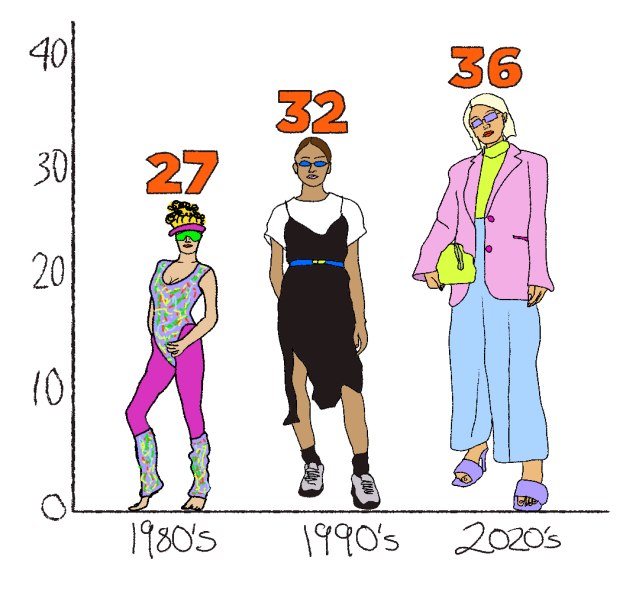

The average age

first-home buyers

global study

Looking back, the median age of was 27 in the early 80s and 32 in the mid-90s. Basically, children playing Monopoly.

These days, it’s higher. A done in 2020 showed that the average age of first-home buyers in Australia is 36.

Given the study covered 25 countries, we can have a geeze at where we stand in the world. I expected Aussies to be the oldest first-time buyers because of how heinous our housing market is but turns out, we’re on par with Canadians and five other countries (Switzerland, Spain, Japan, Czech Republic and Nigeria) even averaged older than 36.

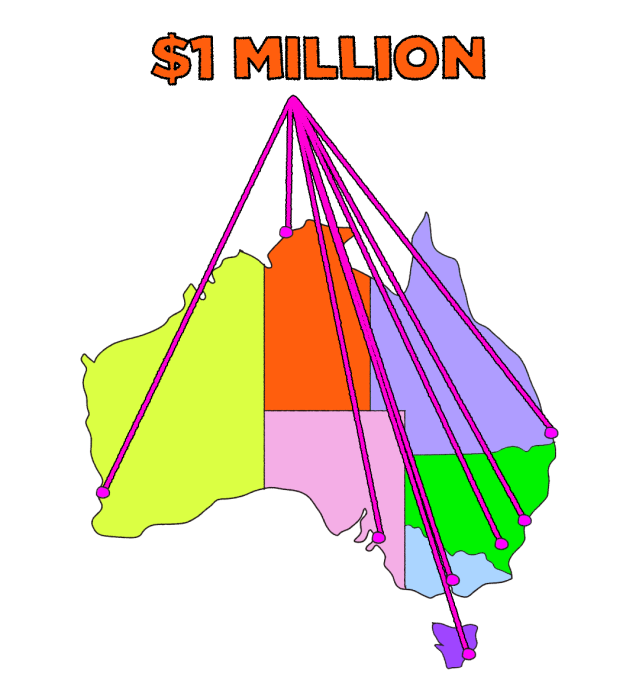

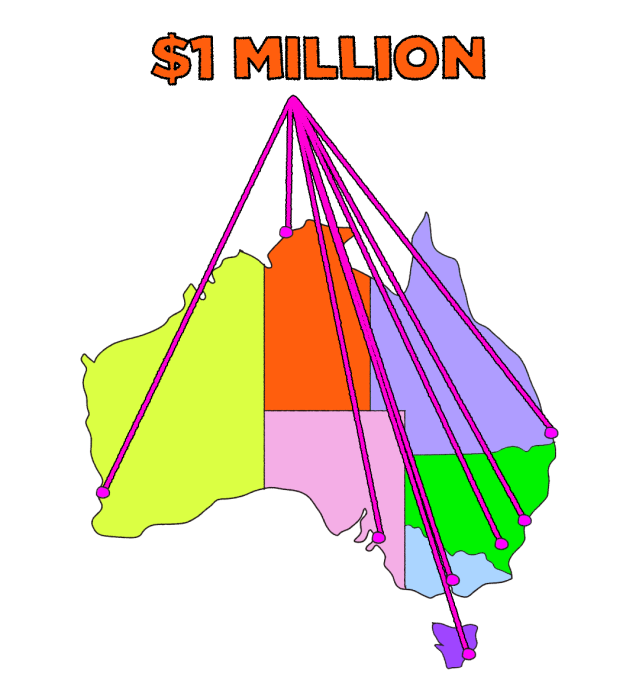

The national , for all capital cities combined, hit over $1 million at the end of last year — a record high. Obviously, it depends where you live. For schmucks like me who live in Sydney, we’re looking at a median house value of $1.6 million.

Cool. Cool. Cool.

And just as a refresher, deposits for a home loan are ideally 20%, so for , that’d mean you have to scrape together $200,000. Yeah, easy…

So, how the flaming heck do young Aussies afford such an astronomical thing? And at such a young age? Our poll respondents shared their secrets.

Sadly (and unsurprisingly), many referenced being in a privileged position where parents could lend a hand. That being said, there were other paths taken.

Here’s what they said:

“Had a partner, didn’t buy too expensive. Couldn’t have done it single which is fucked.” –

“I had an inheritance that helped with my deposit. And the bank of Mum and Dad.” –

“Saved up and purchased regionally.” –

“Being a couple, pandemic savings and a boost from a redundancy.” –

“In-laws went guarantor, bought a cheap, run-down house and slowly did it up ourselves.” –

“Working overseas in a low-tax country while saving” –

“Sacrifice everything. Really not worth it, have fun instead.” –

“Bought in outer suburbs of Perth (40-minute drive into the city), prices are cheaper.” –

“Right place, right time, since building value has more than doubled.” –

“Six-figure salary and inheritance, AKA privilege.” –

“Didn’t drink for seven years. Bought it at 25 and started drinking again at 27.” –

Whether you’re currently saving hard for a deposit or reckon it’ll be 15 years down the track, it’s worth putting some good habits in place now. An app like can give you personalised insights to get a better idea of your incoming and outgoing expenses.

Anyway, godspeed. I’ll probs see you at auction in 20 years when we’re late-in-life buyers.

The average price

median house price one million dollars

The average Joe’s way in

Danny Sarah Maddie Jen Rory Chris Alana Navid Elise James Hannah Money by Afterpay Please note that this information is general in nature and shouldn’t be construed as financial advice. Money by Afterpay is a product from Afterpay Australia Pty Ltd (ABN 15 169 342 947, AFSL 527911) with accounts and debit cards issued by Westpac Banking Corporation (ABN 33 007 457 141, AFSL 233714). T&Cs apply. *Names have been changed for privacy.The post The Average Age Of First-Time Home Buyers Actually Gives Me A Wafer-Thin Feeling Of Hope appeared first on PEDESTRIAN.TV .