5 analysts have shared their evaluations of Roper Techs (NASDAQ:ROP) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 1 | 1 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 2 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

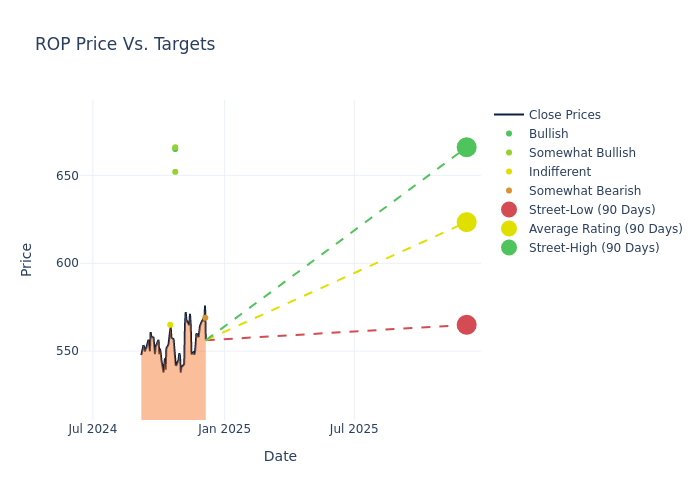

In the assessment of 12-month price targets, analysts unveil insights for Roper Techs, presenting an average target of $623.4, a high estimate of $666.00, and a low estimate of $565.00. A decline of 0.26% from the prior average price target is evident in the current average.

Interpreting Analyst Ratings: A Closer Look

The perception of Roper Techs by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Julian Mitchell | Barclays | Lowers | Underweight | $569.00 | $625.00 |

| Deane Dray | RBC Capital | Lowers | Outperform | $666.00 | $675.00 |

| Terry Tillman | Truist Securities | Raises | Buy | $665.00 | $660.00 |

| Joe Vruwink | Baird | Raises | Outperform | $652.00 | $635.00 |

| Brett Linzey | Mizuho | Raises | Neutral | $565.00 | $530.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Roper Techs. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Roper Techs compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Roper Techs's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Roper Techs's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Roper Techs analyst ratings.

Get to Know Roper Techs Better

Roper Technologies is a diversified technology company that operates three segments: application software, network software, and technology enabled products. Roper acquires asset light, cash generative businesses and deploys excess cash to acquire further portfolio companies. The firm operates a highly decentralized model with portfolio company management holding autonomy and accountability for key operational decisions, and a small, centralized team overseeing capital deployment and providing executive coaching and reviewing strategic goals.

Roper Techs: Delving into Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Roper Techs's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 12.87%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 20.85%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Roper Techs's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.01%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Roper Techs's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.2%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Roper Techs's debt-to-equity ratio is below the industry average. With a ratio of 0.45, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.