6 analysts have shared their evaluations of Fifth Third Bancorp (NASDAQ:FITB) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

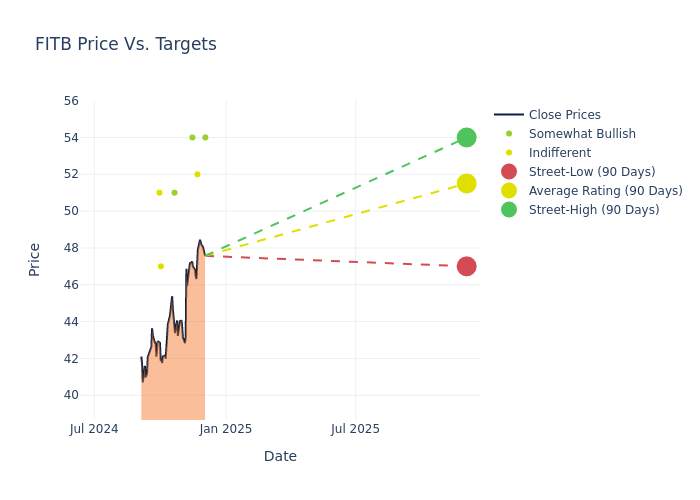

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $51.5, with a high estimate of $54.00 and a low estimate of $47.00. Marking an increase of 10.35%, the current average surpasses the previous average price target of $46.67.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of Fifth Third Bancorp by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Siefers | Piper Sandler | Raises | Overweight | $54.00 | $49.00 |

| Keith Horowitz | Citigroup | Raises | Neutral | $52.00 | $43.00 |

| Whit Mayo | Wells Fargo | Raises | Overweight | $54.00 | $52.00 |

| Jason Goldberg | Barclays | Raises | Overweight | $51.00 | $43.00 |

| John Pancari | Evercore ISI Group | Raises | In-Line | $47.00 | $46.00 |

| Manan Gosalia | Morgan Stanley | Raises | Equal-Weight | $51.00 | $47.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Fifth Third Bancorp. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Fifth Third Bancorp compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Fifth Third Bancorp's stock. This analysis reveals shifts in analysts' expectations over time.

To gain a panoramic view of Fifth Third Bancorp's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Fifth Third Bancorp analyst ratings.

Unveiling the Story Behind Fifth Third Bancorp

Fifth Third Bancorp is a diversified financial-services company headquartered in Cincinnati. The company has over $200 billion in assets and operates numerous full-service banking branches and ATMs throughout Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia, and North Carolina.

Unraveling the Financial Story of Fifth Third Bancorp

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Fifth Third Bancorp's revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -0.96%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Fifth Third Bancorp's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 25.79%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Fifth Third Bancorp's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.97%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Fifth Third Bancorp's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.25%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.97, Fifth Third Bancorp adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.