If we look at 2024’s biggest loser on the Nasdaq 100, it becomes clear that even the mightiest can stumble.

The name is Intel — a once-shining giant in the semiconductor industry that is now grappling with the harsh reality of declining market share, delayed innovations and intensifying competition.

The Nasdaq 100 rose 25% in 2024, and the list of the year’s underperformers tells a story of shifting investor priorities and challenges for non-AI sectors, like biotech.

The bottom five stocks in the Nasdaq 100 index in 2024 are Intel, MongoDB, Biogen, Dexcom and Microchip Technology.

What happened to Intel? (Down 60%)

Intel's decline didn’t begin in 2024 — it’s the result of many strategic missteps.

In the mid-2000s, the company (INTC) famously passed on the chance to develop the chip for Apple’s iPhone, paving the way for rivals like Qualcomm to dominate the mobile market.

In the following years, Intel fell behind Taiwan Semiconductor in manufacturing. By the 2010s, TSMC had overtaken Intel in producing faster, smaller chips.

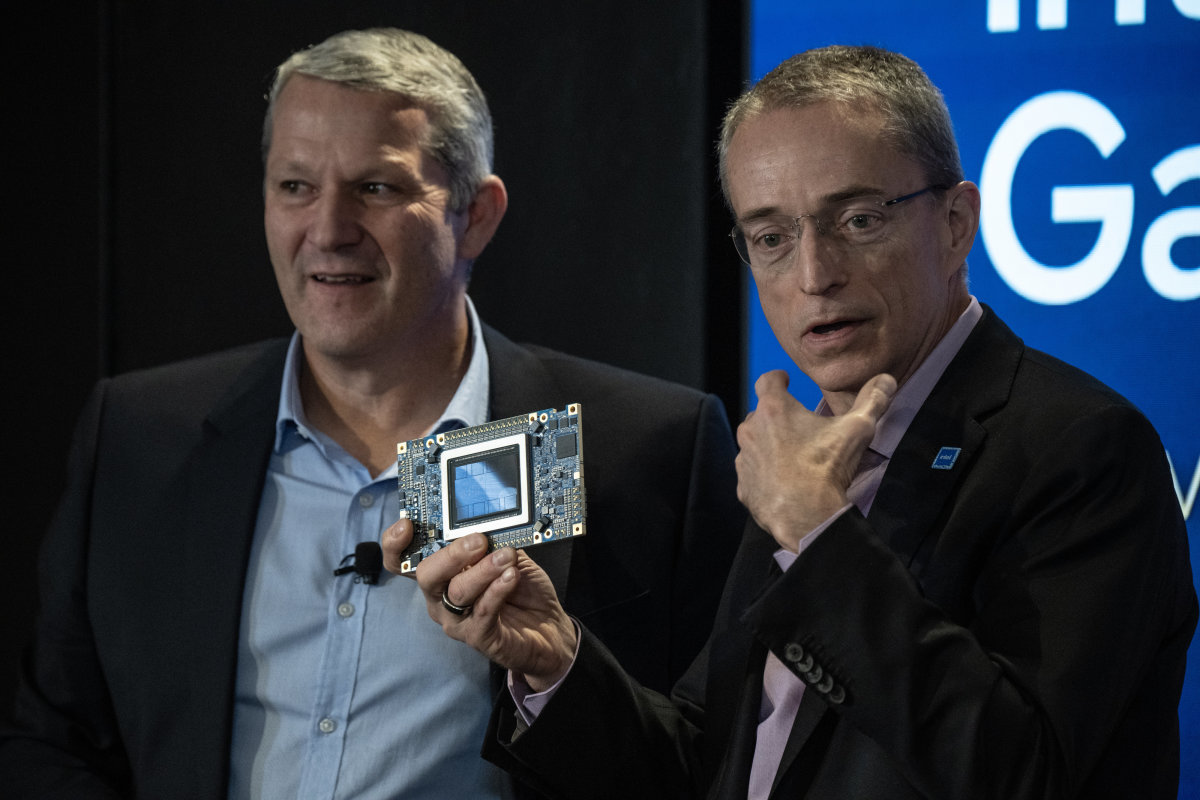

Related: Analysts reset Intel stock forecasts after CEO exits

Now, Intel is lagging behind in the AI wave, where companies like Nvidia have emerged as leaders in advanced GPUs and AI hardware.

Intel’s June quarter was brutal: Earnings per share missed expectations by 80%, landing at just 2 cents, while revenue fell 1% to $12.83 billion. Though the September quarter beat forecasts, revenue dropped 6%, and Intel posted a nearly $17 billion net loss.

The company has taken turnaround steps, including a cost-reduction plan that involved laying off 16,500 employees and reducing its real estate footprint.

But analysts remain cautious about the stock, especially after Pat Gelsinger stepped down as CEO.

According to Stifel, Intel might further modify its strategy, further delaying its ability to right the direction of its technology roadmap toward the rapidly evolving total addressable market for AI, thefly.com reported.

Truist analyst William Stein recently lowered its Intel price target to $22 from $26 and affirmed a hold rating, reiterating a cautious view of the semiconductor and artificial-intelligence sector.

MongoDB: Growth questions (Down 43%)

While AI software might thrive in 2025, analysts have mixed views on whether MongoDB can share in that growth.

Related: Analyst says big shift in AI coming in 2025 is huge tailwind for two stocks

MongoDB (MDB) develops commercial support for open-source databases, enabling businesses to manage data across the cloud, on-premises, and in hybrid environments.

The company had a better Q3 earnings report, but "conservative" Q4 guidance and CFO Michael Gordon's departure "are further discussion points" for investors, Barclays said. The investment firm raised its MongoDB price target to $400 from $375 with an overweight rating on the shares.

Scotiabank raised its price target on MongoDB to $350 from $295 while maintaining a sector-perform (effectively neutral) rating. The firm advises investors to take a wait-and-see approach, citing uncertainty from chief information officer checks on AI benefits and competition trends in the database market.

Research firm Monness Crespi downgraded MongoDB to sell from neutral with a $220 price target, thefly.com reported.

MongoDB's Atlas is "mired in a protracted growth slump and void of the powerful tailwind implicit in the industry's gen AI propaganda," the analyst said.

Biogen (Down 41%), Dexcom (Down 37%): Biotech optimism at Canaccord

The healthcare sector didn't do well in 2024. The Health Care Select Sector SPDR ETF (XLV) was only up 3%, and the iShares Nasdaq Biotechnology ETF (IBB) fell 2% in 2024.

Two healthcare companies — Biogen and Dexcom —are among the Nasdaq 100 bottom five returners.

More stocks’ performance in 2024

- The 5 best performing stocks on the Dow Jones Industrial Average in 2024

- The 5 worst-performing stocks on the Dow Jones Industrial Average in 2024

- The 5 best performing stocks on the Nasdaq 100 in 2024

- The 5 best performing stocks on the S&P 500 in 2024

- The 5 worst performing stocks on the S&P 500 in 2024

Biogen, (BIIB) developer of therapies for neurological illnesses, faced setbacks with Alzheimer’s drug Leqembi, declining sales of key multiple sclerosis treatments, and reduced contract manufacturing and royalty revenue.

BMO Capital recently downgraded Biogen to market perform from outperform with a price target of $164, down from $230, thefly.com reported on Dec. 20.

The investment firm said the downgrade reflected slower Leqembi growth, shrinking revenue from MS treatments, weak rare-disease performance, and fewer near-term catalysts.

"Efforts to change the course of the company will take time to materialize," the analyst said.

Dexcom (DXCM) , a maker of insulin monitoring devices, faced an uphill climb in 2024, partly because of the growing use of weight-loss drugs.

Dexcom's CEO Kevin Sayer said in July that the company was “short a large number of new patients,” CNBC reported. The stock tumbled 40% in July after it cut full fiscal-year guidance.

In December, Canaccord analyst William Plovanic raised DexCom's price target on DexCom to $99 from $89 and affirmed a buy rating on the shares.

Canaccord remains optimistic about the medtech sector heading into 2025. The firm expects growing investor interest as small-to-mid-capitalization valuations stay low, M&A activity increases, and the IPO market gains momentum.

The firm also highlights the impact of AI on the industry.

Microchip Technology: Sales drop (Down 36%)

While Microchip Technology (MCHP) and Intel focus on different segments— Intel primarily in central processing units and data centers and Microchip in microcontrollers and analog devices — their declines share common problems like slowing demand and competition within the semiconductor industry.

Microchip sales have slumped. In the quarter ended Sept. 30, the company reported a decline of nearly 50% in net sales.

"We continued to navigate through an inventory correction that’s occurring in the midst of macro weakness for many manufacturing businesses," said CEO Ganesh Moorthy.

Related: Veteran fund manager issues dire S&P 500 warning for 2025