The government is scrambling to put together a plan to rescue Thames Water over increasing fears the company is set to go bust.

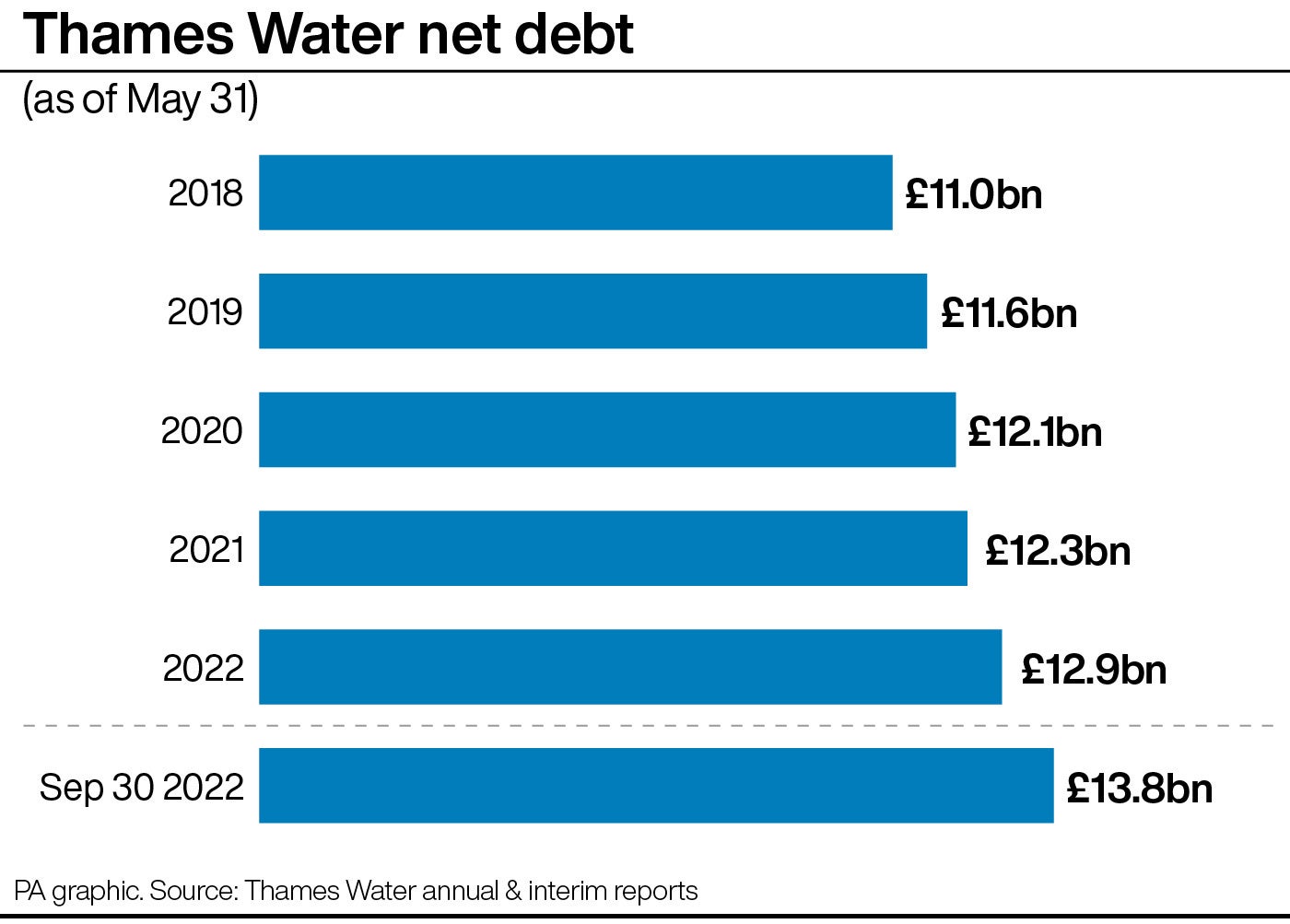

The utility giant is struggling under a £14 billion debt pile it has accrued since it was privatised in 1989 and could now potentially be taken into public ownership if further investment is not found.

It follows the shock resignation of the chief executive Sarah Bentley who stepped down with immediate effect on Tuesday after two years in the job.

The crisis engulfing Thames Water, which serves 15 million customers in London and the south-east, comes amid renewed focus on the industry which over the last year has been condemned for sewage spills, a lack of infrastructure investment and rising bills.

The Independent has put together everything you need to know about the ongoing crisis.

Who owns the company?

The company is co-owned by a series of pension funds and sovereign wealth funds.

The biggest single shareholder is the Ontario Municipal Employees Retirement System, which holds around 32 per cent of the shares. Another pension fund, the UK-based Universities Superannuation Scheme, holds another 20 per cent.

Around 10 per cent of the shares are owned by a subsidiary of the Abu Dhabi sovereign wealth fund, which is owned by the Abu Dhabi Government, and China’s sovereign wealth fund owns a little under 9 per cent.

Other investors include the British Columbia Investment Management Corporation (8.7%), Hermes GPE (8.7%), Queensland Investment Corporation (5.4%), Aquila GP Inc (5%), and Stichting Pensioenfonds Zorg en Welzijn (2.2%).

What could the government do?

Work and pensions secretary Mel Stride has said that there are “contingency plans in place for any eventuality”, an attempt to allay fears about the company’s imminent collapse.

If the worst does happen, the government will be forced to step in as water and energy companies are considered too important to let them go bankrupt, as they provide vital resources.

Either the government or water regulator Ofwat can apply to a court to appoint a special administrator for Thames Water, which would run the company, and ensure that water keeps coming out of the taps.

The administrator would also try to find another investor or private company to buy Thames Water and bring it out of administration.

The special administration regime (SAR) has only been used once before, when Bulb Energy collapsed in late 2021. Bulb was later bought by its former rival Octopus.

What will happen to water bills?

Health minister Neil O’Brien has assured British consumers that their water supply will continue and bills will not increase.

He told Sky News: “Absolutely nothing is going to happen in terms of either their (customers’) bills or their access to water, we have contingency plans - like we do in all of these network utilities - to manage any difficult situations.”

Despite this pledge, Alex Jay, Partner and Head of Insolvency and Asset Recovery at law firm Stewarts, explained that there was “significant risk in the medium or long term” that bills would increase for consumers.

He said: “Fundamentally Thames Water is a loss making business that is struggling to survive on its current business model.

“It is reasonable to assume therefore that, at some point, it will need to cut costs (if it can, in significant enough volume) or increase prices - or indeed do both.”

In addition, water companies are set to push for bills to rise by at least 40 per cent to deal with escalated costs related to climate change and sewage disposal. Thames Water is reportedly proposing rises of 20 per cent, according to the report in The Times.

Could pensions be impacted?

Pension funds invested with Thames Water could potentially face “significant impairment to their investments”, an expert has said.

Alex Jay, Partner and Head of Insolvency and Asset Recovery at law firm Stewarts, said: “Thames Water has not just declared a loss in the latest financial year; it is reported to be verging on insolvency and the need for a government bailout.

“If that is correct then it seems obvious that the value of the pension funds’ investments will also be at risk.”

This could have a knock-on impact for consumers as if the investments in your pension fund drop, the overall value of your pension pot could be lowered.

This could pile further misery on those looking to retire this year as they have been hit by tough economic circumstances and the blowback from Liz Truss’s disastrous mini-budget in September 2022.

Joanna Ford, restructuring & insolvency partner at Cripps, added that if Thames Water was made insolvent “it is mainly the shareholders that lose out, as they sit at the bottom of the pile when it comes to repayment.”

She added: “Secured bank lending would be repaid first, before other creditors such as HMRC, employees, and trade creditors. Insolvent means that a company does not have enough money to repay all its creditors, and so if Thames Water was to go into administration then not all creditors would be repaid in full, and so they would also lose out to some extent - how much will depend on what there is left in the pot to go round.”

What has the water regulator Ofwat said?

In a statement on Thursday, the regulator said: “Over the last day or so, there has been a lot of commentary about financial resilience in the water sector with considerable focus on Thames Water in particular.

“We have been clear that Thames Water has significant issues to address – their environmental record and leakage performance, for example, are poor. Alongside the turnaround of their operational performance, they need to improve their financial resilience too.

“But that is all in the context of a company that has strong liquidity – it recently received an additional £500 million from shareholders and has £4.4bn of cash and committed funding.

“Overall, the sector is continuing to attract international capital and is especially attractive to long term investors such as pension funds. Indeed, there has been an additional equity injection of around £2bn since 2020, with companies acting to strengthen their financial position.

“Ofwat will continue to keep companies’ financial resilience under close scrutiny and work with companies to ensure they take action to ensure that they have the financial backing to deliver for customers and the environment.”

The water regulator has said it has been clear about Thames Water’s ‘significant issues’ (Andrew Matthews/PA)— (PA Archive)

Are any other water companies in trouble?

In short, yes. In December Ofwat highlighted five water suppliers whose financial resilience it was most worried about.

As well as Thames Water, it highlighted Portsmouth Water, Yorkshire Water, Southern Water and SES Water as its “highest priority for engagement”.

Susannah Streeter, head of money and markets for Hargreaves Lansdown, said: “Big questions are now being raised about the potential precariousness of other water firms.

“Ofwat had been monitoring Southern Water and Yorkshire Water, as well as Thames Water, given its concerns over their financial resilience.

“In its 2022 annual report, it also flagged worries about Northumbrian Water and Portsmouth Water for having fallen far short of expectations when it came to the level of dividends paid given their relative financial resilience.

“It’s no wonder waves of worry are now surrounding more firms who have been caught uptide, as the era of cheap money has been dammed and their debt payments have hurtled upwards.”

Additional reporting by agencies