The trade in Tesla (TSLA) has been decisively bullish.

From the April 27 low to the recent high, Tesla stock rallied more than 80%. From the January low, the electric-vehicle leader's shares have more than doubled (up 150%).

Investors have been busy putting their money to work in megacap tech stocks. That’s been fueling the year-to-date gains in the indexes, but also in single stocks like Tesla, Nvidia (NVDA), Meta (META) and others.

More specific to Tesla has been the recent supercharger deals the company inked with Ford (F), General Motors (GM) and Rivian. (RIVN)

Don't Miss: Micron Stock Dangles Above Key Support as Earnings Loom. Buy?

It’s been a runaway trade for the bulls, although Tesla’s five-week winning streak could come to an end today. (At last check the stock was off 2%.) On the plus side, a pullback in this stock would be helpful for the bulls’ cause.

Let’s look at two key dip-buying spots now.

Trading Tesla Stock

Chart courtesy of TrendSpider.com

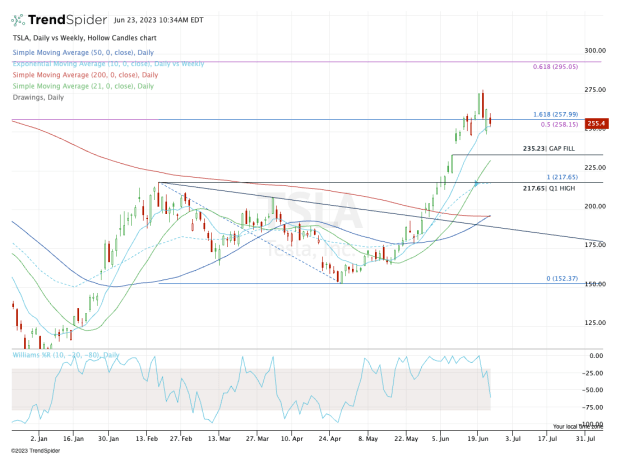

Previously, we had been looking for a rally to the $258 area. That marked the 161.8% upside extension of the prior range, as well as the 50% retracement of the bear-market decline.

Tesla shares edged above this key area but faded hard from $275. They now wobble around the $258 area and are searching for direction.

If it can hold the 10-day moving average and regain $260, then the $275 level is back in play.

Otherwise, the bulls need to turn their attention to potentially lower levels and possible buy zones.

Don't Miss: Buy the Dip in Intel as Shares Try to Ride AMD, Nvidia Momentum?

The first level to watch is around $235. That marks the gap-fill from June 8 and comes into play near the 21-day moving average.

The second level is around $217.50. That area marks the first-quarter high and the rising 10-week moving average. It’s also near where the 50% retracement of the current rally comes into play, around $214.50.

If Tesla stock were to get to this level, the 10-week may be a bit higher if the pullback takes some time. Still, this combo — the Q1 high and 10-week moving average — is an area investors will want to keep a close eye on.

Failure to hold these two levels could open up the $200 level, where the stock will likely find its 50-day and 200-day moving averages.