Tesla (TSLA) -) shares slipped lower Thursday after the carmaker unveiled pricing for its Cybertruck, which will cost around $100,000 for the high-end version of the long-delayed vehicle.

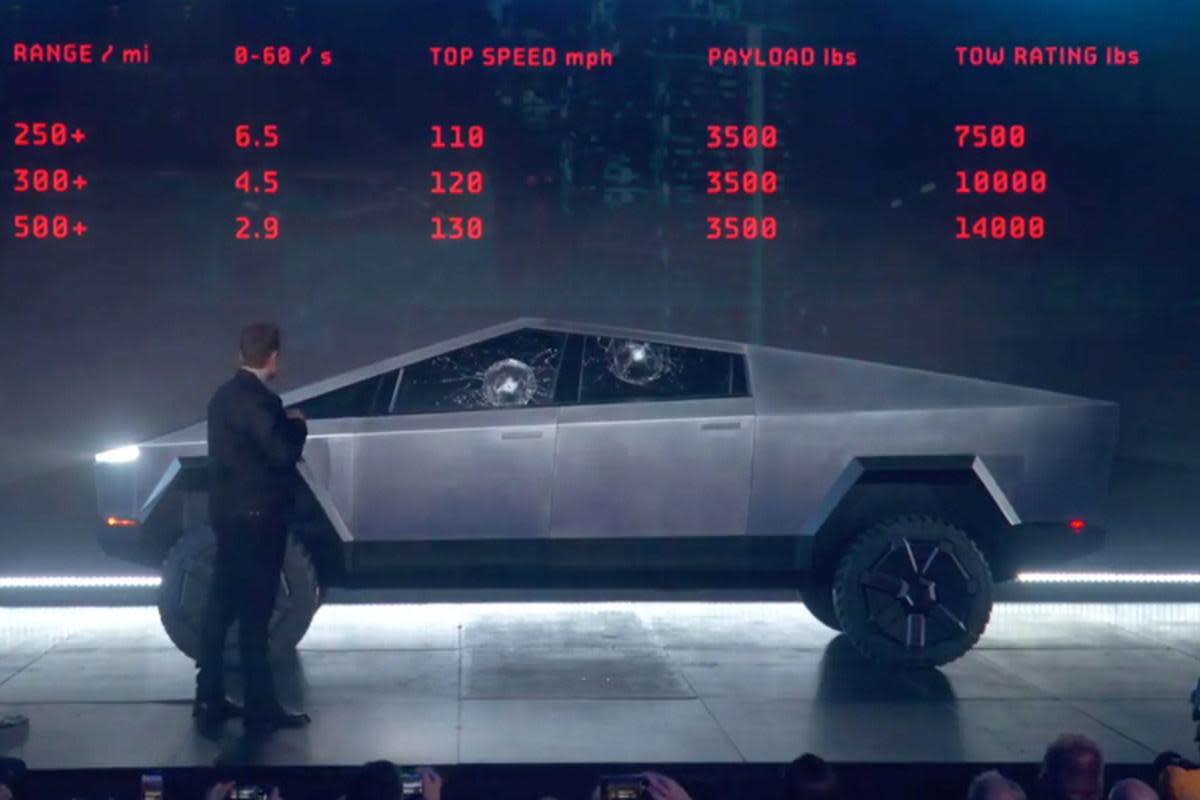

Tesla said the price of its cheapest Cybertruck will be $49,890 each, around $10,000 more than CEO Elon Musk had initially indicated when he introduce the truck to investors in 2018. The rear-wheel drive version will become available in 2025 and have an estimated driving range of around 250 miles, according to the Tesla website.

Taking out the $7,500 tax credit linked to the Inflation Reduction Act (IRA) as well as an estimated gas savings of $3,600, the base model Cybertruck will cost $60,990 each.

The all-wheel drive variant, meanwhile, will be priced at $68,890 and available in 2024 while the higher-end Cyberbeast will cost around $99,990 and have a range of 320 miles, according to details posted on the carmaker's website. Removing IRA and gas savings pegs the two models at $79,990 each and $99,990 each, respectively.

Musk delivered the first 10 Cybertrucks at a live-streamed event held at the group's headquarters in Austin, Texas, having tamed estimates for 2024 deliveries last month when he warned that ramping the new vehicle "is going to be extremely difficult."

"This is simply normal for – when you've got a product with a lot of new technology or any new – brand-new vehicle program, but especially one that is as different and advanced as the Cybertruck, you will have problems proportionate to how many new things you're trying to solve at scale," Musk told investors on Oct. 19.

"So, I just want to emphasize that one. I think this is potentially our best product ever," he added. "And I think it is our best product ever. It is going to require immense work to reach volume production and be cash flow positive at a price that people can afford."

Tesla shares closed 1.78% lower on the session at $239.79 each, pegging their six-month gain at around 15.55%.

Tesla has been aggressively cutting the price of its flagship Model 3 sedan and Model Y midsize SUV in key markets worldwide including the U.S. and China as part of that aim, in its effort to entice new buyers and fend off increasing competition in the EV space.

Tesla's third quarter deliveries, while the highest on record, missed Wall Street forecasts when they were published in early October, suggesting at least some demand headwinds linked to China's post-Covid sluggishness and looming recession risks in Europe.

The slowing sales will test Tesla's 2023 strategy, outlined earlier this year by Musk, of focusing on market-share growth at the expense of profit.

Tesla will need to deliver around 477,000 new vehicles over the final three months of the year to meet its stated goal of 1.8 million, but CFRA analyst Garrett Nelson suggests the Cybertruck's installed production capacity should "reassure investors concerned about the ramp-up of the highly-anticipated new model."

"We also view investor concerns regarding recent gross margin pressures as somewhat overblown, as comps should improve in the next couple of quarters," said Nelson, who carries a 'buy' rating with a $300 price target on the stock. "Tesla should emerge from the UAW strike with an even wider competitive moat and as the industry's biggest winner."

- Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.