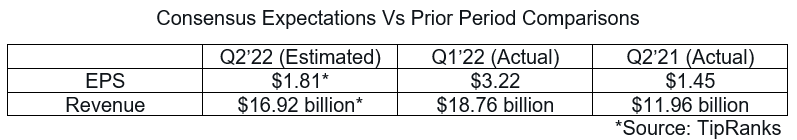

Electric vehicle maker Tesla, Inc. (NASDAQ:TSLA) has had a tough quarter to contend with, given the inclement macro situation and the COVID-19 lockdowns in China. The good news is that the stock has already discounted a not-so-buoyant quarterly performance.

The Key Numbers:

Tesla confirmed earlier this month that it delivered 254,695 vehicles in the second quarter, down from 310,048 units in the first quarter. This was higher than the 201,304 cars the EV giant sold in the year-ago quarter.

The average selling price of a Tesla vehicle was around $54,382 in the first quarter, considering the quarter's total vehicle revenue, excluding regulatory credit, and the units sold. Applying the same ASP to second-quarter deliveries, automotive revenue could come in at least $13.85 billion.

Since the beginning of the quarter, the company has raised prices, which leaves scope for upside from this base-case scenario.

Regulatory credit for the first quarter was up 31% year-over-year to $679 million.

External Factors Weigh Down: Entering the quarter, Tesla was already grappling with input cost inflation, precipitated by the Ukraine war. Battery raw materials such as lithium shot up, forcing Tesla to raise vehicle prices multiple times. Higher prices didn't prove demand destructive, as evident from the strong first-quarter deliveries.

Come second-quarter, Tesla had to contend with a complete lockdown in China that forced shuttering of its Giga Shanghai factory. The EV maker's Chinese factory serves as its main export base and produced over half of the total vehicles in 2021.

The factory closure lasted for about 22 days, and even after its restart on April 19, it took until late-May for a full ramp up. The total production at Giga Shanghai picked up pace thereafter. In June, the company clocked record deliveries of 78,906 cars.

The second quarter will also include output from the company's two newest Gigas, Berlin and Austin. Tesla CEO Elon Musk said in late June that these two factories were losing billions of dollars, as they struggled to ramp up production amid the scarcity of battery materials and port issues in China that constrained component exports.

Read Benzinga's preview of the week's key earnings releases

Forward Outlook: Tesla's second half could benefit from pent-up demand, coming off a quarter hit by the COVID-19 resurgence in China.

The demand side of the equation still remains in question amid an inflationary and higher-interest-rate environment. Talk of a recession is growing louder, and if a recession does set in, consumers will likely first reduce their spending on discretionary items such as cars.

Musk said in a recent tweet that Tesla might roll back price hikes if inflation cools off.

On the earnings call, investors are likely to pay close attention to comments on supply chain and demand. Musk and his executive team may also shed some light on the product roadmap.

Tesla's long-term delivery growth target is 50%. If the company has to hit this target this year, it has to sell at least 839,257 cars for the remainder of the year. This appears to be a tall order.

The consensus estimate, according to Wedbush analyst Daniel Ives, is currently factoring in 1.4 million deliveries for 2022, which suggest a slight miss versus Tesla's target.

This is already baked into the stock at current levels, the analyst said. Tesla stock is down about 32% for the year-to-date period. Some of the weaknesses may also have to do with Musk's pursuit of Twitter Inc(NYSE:TWTR), which has become murkier with the billionaire's backtracking and the subsequent lawsuit filed by the social media platform.

Source: TradingView

Based on reservations and wait times, Ives estimates that demand for Model Y is outstripping supply by 15%-20%.

"The Street is now focused on 2H (likely up 40%-50% from 1H barring no more major China zero-COVID issues) deliveries and 2023 numbers as a more normalized environment to gauge the overall health of Tesla's delivery trajectory and top-line/EPS," the analyst said.

At last check Tuesday afternoon, Tesla stock was trading at $739.33, up 2.45%, according to Benzinga Pro data.

Photo: Courtesy Tesla Inc.