Shares of Tesla (TSLA) continue to struggle with the $300 level, even after the stock recently split 3 for 1.

On Thursday, Tesla stock began trading for the first time since its split. That follows stock splits from other Big Tech names, like Alphabet (GOOG) (GOOGL) and Amazon (AMZN).

Unlike Alphabet and Amazon, however, Tesla had already split its stock this decade: 5 for 1 in August 2020.

Alongside Ford (F), Tesla has been a strong performer lately. At the recent high, Tesla stock was up more than 50% from its low in May.

That’s even as the Musk-Twitter (TWTR) saga continues to press on and as drama around the potential sale builds.

Now that the stock has undergone the split, what do the charts look like from here?

Trading the Tesla Stock Split

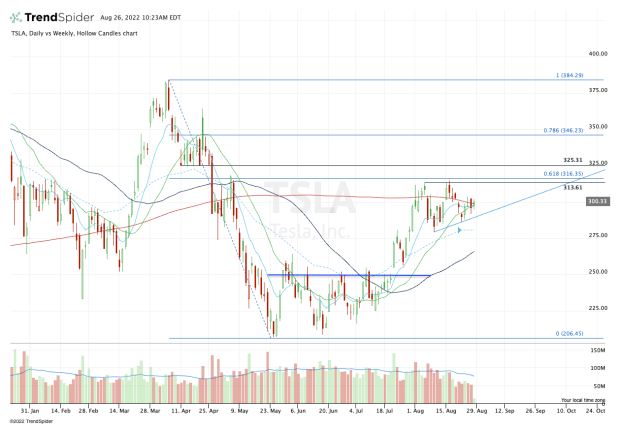

Chart courtesy of TrendSpider.com

In July, Tesla stock underwent an impressive breakout over $250. The move helped kickstart an impressive rally to north of $300.

So far, Tesla shares have found resistance near the $315 area, just shy of the 61.8% retracement. That zone actually marks a short-term double top, while support is marked by rising uptrend support (blue line).

Essentially, Tesla stock has been consolidating its recent gains by trading in the $285 to $315 zone with rising support. From here, the key will be a break of the range — either losing support or breaking out over $315.

More specifically, the shares are still struggling with the $300 level and the 200-day moving average. If Tesla trades below these measures, it will put uptrend support back to the test.

A break of this measure puts the August low in play near $279. Around that mark, the stock's 10-week moving average also comes into play. It’s a break of this zone that becomes concerning for the bulls.

Specifically, it opens the door down to the 50-day moving average. Below that puts the $250 breakout zone back in play, along with the 61.8% retracement of the current rally (near $248).

On the upside, a move over $300 puts $315 resistance back in play. If Tesla stock breaks out over this area, it opens the door to the 78.6% retracement up near $346, then $350-plus.

Tesla plays a big role in the market. That's partly from its size, with a $910 billion market cap, and partly from a sentiment standpoint. Keep that in mind when trading this name.