What a disaster it’s been with Tesla (TSLA) lately. The electric-vehicle leader's shares are currently down for five straight months and for eight of the past nine weeks.

The stock made 52-week lows on Tuesday and did so again on Wednesday morning.

Shares of Tesla are now down 55% in 2022 and have fallen more than 61% from their all-time high in November 2021.

The stock is now trading at its cheapest forward price-to-earnings multiple since the company went public, but that doesn’t seem to be providing meaningful support.

Tesla stock at last check was off about 1%. A price-target cut from Goldman Sachs is not helping matters. The analysts reduced their target to $235 from $305 and assigned a bear-case price target of $135.

Outside Goldman Sachs investors remain concerned about the company following Elon Musk’s takeover of Twitter and amid reports of lower production and worries about demand.

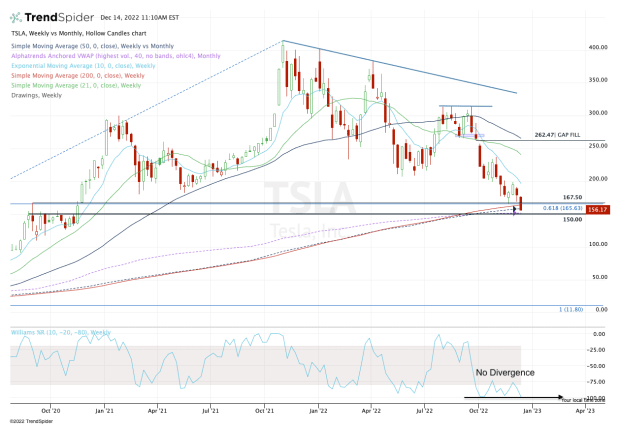

With all this said, the chart indicates quite a bit of potential support near current levels.

Trading Tesla Stock

Chart courtesy of TrendSpider.com

The relative weakness in Tesla stock is concerning. Even as the market tries to push higher, Tesla continues to roll over.

But the risk is starting to skew to the upside, given the big decline we’ve seen into a key area.

In the $150 to $165 area, the stock faces its 200-week and 50-month moving averages, the monthly VWAP measure, the 61.8% retracement and a major breakout level from 2020.

Consider this:

Bullish traders buying in around $150 know the risk. If Tesla breaks below or closes below $150, they can get out with minimal losses.

Conversely, they can look for a break of this area and a rebound back up through it — a bullish reversal — giving them a specific must-hold level going forward (that being the new low).

For a trader, it’s vital to be positioned at a good risk/reward balance.

Contrast that with a trader who may have bought in the $190s, knowing there’s support at $150 and simply hoping that it holds. Even if it does, they have to stomach about $40 a share in losses and risk even more than that if support fails.

There’s more than one way to do things, but as it pertains to this specific setup in Tesla stock, I see a very vital zone of support in the $150 to $155 area. If this area fails, it could ultimately open the door to the $120 to $125 zone.

On the upside, a move back up through $167.50 could put the $200 level and declining 10-week moving average in play.

Real Money: Expert Investing Insights Are Just a Click Away.

For a limited time, save $200 on actionable market insights from your own team of money managers, traders and experts. Hurry — this offer won't last!