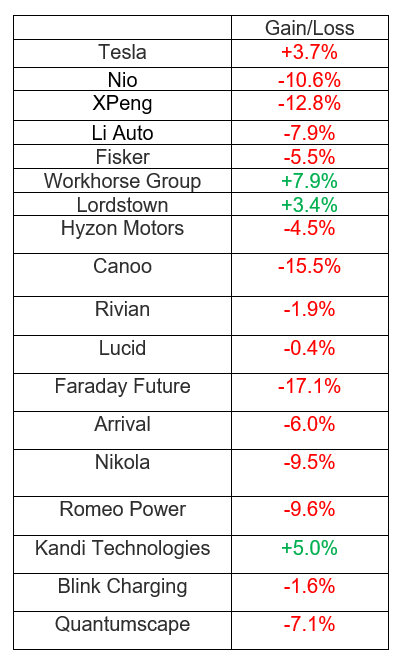

Electric vehicle stocks moved to the downside once again in the week that ended Sept. 30 as economic worries continue to roil the broader market. Lordstown Motors Corp. (NASDAQ:RIDE) and Workhorse Group, Inc. (NASDAQ:WKHS) were among the stocks that bucked the downtrend.

Now, here are the key events that happened in the EV space during the week:

Tesla AI Day Updates And More: Tesla, Inc. (NASDAQ:TSLA) held its AI Day 2022 at an odd time, as Musk and his AI team took to the stage very late in the evening on Friday to announce all the “cool updates” Musk has been hinting at.

As expected, the Tesla bot, named Optimus, took center stage in the presentations. A prototype of the bot was presented, and it walked on stage, and waved to the seated audience. A video was shown of the robot watering plants, carrying a box and working at Tesla’s factory. Musk sees the bot being made in volume, driving down prices to as low as $20,000.

The company also announced incremental updates on its full self-driving software and the Dojo supercomputer.

A Reuters report suggested that Tesla is planning to see a spike in the global production of its Model Y and Model 3 EVs to 495,000 in the fourth quarter, with momentum accelerating in 2023. The rumored plan would mean the company’s projected growth would outpace the global auto growth estimates by about 10 times.

Tesla China is planning to extend the insurance subsidy it offered in September to the end of the year, CnEVPost reported, citing the China unit’s Weibo account. The announcement comes in the wake of the Oct. 1-7 National Day holiday in China.

Li Auto Rebounds Strongly: Chinese EV trio Nio, Inc. (NYSE:NIO), XPeng, Inc. (NYSE:XPEV) and Li Auto, Inc. (NASDAQ:LI) announced a September delivery update on Saturday. Li Auto’s deliveries jumped over 100% month-over-month, with the bulk of the vehicles sold being its new L9 electric SUV. Nio managed to have a small increase in deliveries from a month ago, while XPeng’s fell.

Nio began deliveries of its ET5 smart sedans this week, expanding the products on offer to six.

Fisker Says Production Ahead Of Schedule: Fisker, Inc. (NYSE:FSR) announced this week, to date it has produced 95 prototypes of the Fisker Ocean SUV along with its production partner Magna Steyr. The company said it is on track to start production on Nov. 17 and ahead of that, it hopes to bring the vehicle to the Paris Motor Show, scheduled for Oct. 17-30, and the Oslo Motor Show being held from Oct. 28-30.

Lucid Initiated At Overnight By Cantor: Lucid Group, Inc. (NASDAQ:LCID) shares were initiated at Overweight by Cantor Fitzgerald analyst Andres Sheppard. The analyst has a $23 price target for the shares. The analyst based his optimism on Lucid’s premium vehicles providing greater efficiency, longer range, faster charging, and more space relative to its peers.

Lordstown Gets Started On EV Truck: Thursday, Lordstown Motors Corp. (NASDAQ:RIDE) said it has begun production of its Endurance EV pickup truck at the Ohio plant, which it sold to Taiwanese contract manufacturer Hon Hai Precision Industry Company Limited (OTC:HNHPF). Two commercially salable vehicles have rolled off the production line and a third is in the pipeline, with these being part of the first batch of 500 vehicles the company plans to build.

Faraday Future Raises Financing: Struggling EV startup Faraday Future Intelligent Electric Inc. (NASDAQ:FFIE) said it has secured up to $100 million in funding that would help it to launch its long-delayed first model, the FF 91. The company also announced an agreement with FF Top Holding, its largest shareholder, to settle a lawsuit against the board, with the terms of the deal including making changes to the board membership and size.

EV Stock Performances for The Week: