Australia's top-selling electric car brand has teamed with a local insurance provider to accelerate the adoption of low-emission vehicles.

Tesla announced its partnership with Zurich Australia on Monday along with plans to make insurance coverage available inside its app as it has done in some US states since 2019.

The launch follows widespread criticism of the high price of some electric vehicle insurance policies in Australia, although industry experts said the trend was likely to turn around this year as more battery-powered cars hit Australian roads.

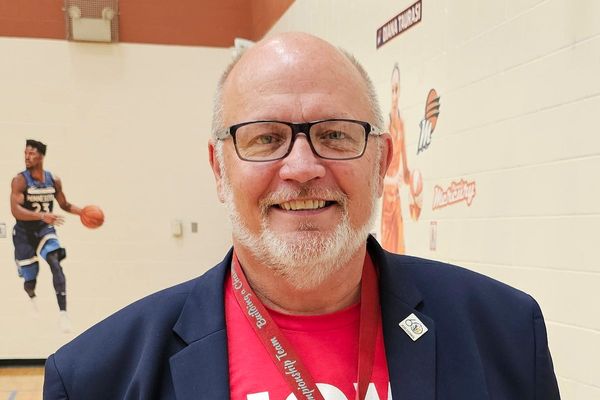

Tesla country director Thom Drew said the company's deal with Zurich had been designed to give "more Australians the confidence to switch to electric vehicles".

InsureMyTesla packages offered in the Tesla app would cover vehicle repairs such as battery, glass and charging equipment issues.

A spokesperson for the insurer said the average comprehensive insurance deal for a middle-aged Model 3 driver would be about $1400.

Zurich Australia chief executive Justin Delaney said the deal could help make EV policies more accessible for potential buyers.

"EV uptake in Australia is rapidly growing as consumers continue to recognise the importance of lowering their environmental impact," he said.

"Ensuring these customers receive quality insurance protection is critical for supporting the national transition journey."

A recent study by Compare The Market analysed the costs of running a BYD Atto 3 electric vehicle compared to a Toyota Corolla Cross petrol SUV.

It found the electric vehicle was significantly cheaper to run overall and in almost every category except insurance, which cost almost $600 more per year.

Australian Electric Vehicle Association national president Chris Jones said the cost of insuring electric cars had often been higher because insurance providers were risk-averse and some did not have enough EV data.

"If they don't know what the supply of parts and the supply of skilled workers is going to be like, they play it safe, charge a bit more, and they're more prone to write cars off than repair them," he said.

"They don't know what the damage profile will be over time - they're still building that picture."

Dr Jones said buyers should shop around for better deals and predicted the higher premiums would not persist.

"Whatever shenanigans we see going on at the moment with insurance will fade away in a year's time once there's more vehicles, more partners, more workers to repair them and insurance companies start to understand how likely a crash and repair job might be," he said.

Australians bought more than 50,000 new electric vehicles in the first six months of the year, according to the Federal Chamber of Automotive Industries, representing almost eight per cent of all new car sales.

Tesla vehicles made up almost half of Australia's electric car sales, however the brand faces growing competition from BYD, Hyundai and MG.