Electric vehicle stocks fell across the board in the week ended September 2 amid macroeconomic concerns that rocked the market. The August jobs report, the U.S. government’s move to restrict chip exports to China, and the shutting down of the Nord Stream 1 offshore pipeline that supplies oil from Russia to Europe all served to intensify risk aversion in the market.

Now, here are the key events that happened in the EV space during the week:

Tesla’s Gigafactories Up And Running: Tesla, Inc. (NASDAQ:TSLA) is reportedly looking for recruiters in Quebec, Canada for handling a major round of recruitment. The Tech Crunch report has sent tongues wagging about Canada being the location of the company’s next Gigafactory. The rumor comes on top of the lobbying documents the company filed with Canada and the stray giveaways from Canadian politicians regarding Tesla Canada plans.

The Gigafactory in Berlin is also reportedly brisk with its recruitment, as German media outlet rbb24 said, citing Tesla, that 120 apprentices have started with the company. This intake follows the factory ramping up production. Incidentally, CEO Elon Musk tweeted this week that he spent a day walking the entire Giga Berlin production line and appreciated that the team there did an excellent job.

Meanwhile, Tesla China overcame a lean patch in July amid a factory revamp. Giga Shanghai rolled out 77,000 cars in August, according to preliminary data released by the China Passenger Car Association. This bodes well for the company as it looks to bump up the volume after the first-half slackness due to factory shutdowns in China.

China EV Sales Mixed: This week saw the release of August sales results by Chinese EV makers, including Nio, Inc. (NYSE:NIO), XPeng, Inc. (NYSE:XPEV), Li Auto, Inc. (NASDAQ:LI) and Warren Buffett-backed BYD Company Limited (PNK: BYDDF). BYD clocked in another record month of sales, and Nio reported sequential growth in deliveries. XPeng and Li Auto saw month-over-month sales declines.

Ford EV Sales Catalyze Strong August: Ford Motor Company's (NYSE:F) sales climbed 27% year-over-year in August, helped by an easier comparison with the year-ago period, which was marred by production disruptions and component shortages. The strength was partly attributable to Dearborn’s strong sales of its EV lineups, including the Ford F-150 Lightning EV truck, E-transit, and Mustang Mach-E.

The F-150 Lightning pickup is the fastest turning vehicle in Ford’s lineup at just eight days, the company said in the release.

See also: Why Ford Stock Looks Set To Bounce Despite Massive Vehicle Recall

Rivian Software Update For Camp Mode: Rivian Automotive, Inc. (NASDAQ:RIVN) announced in a blog post this week its latest software update provides a range of features to make camping in its R1T pickup truck and R1S SUV even more comfortable and convenient. These features included the ability to level the vehicle when it’s parked on uneven or sloped terrain. It also lets users optimize the vehicles’ energy when parked, set timers for charging parts and outlets, turn off interior displays, turn on a special Camp courtesy mode, and light up the composite with floodlights in the side mirrors.

Lucid, Nikola To Raise Equity Financing: Lucid Group, Inc. (NASDAQ:LCID) and Nikola Corporation (NASDAQ:NKLA) separately filed with the SEC for raising equity financing. Nikola plans to raise up to $400 million in an “at-the-market” offering for financing its proposed acquisition of battery manufacturer Romeo Power, Inc. (NYSE:RMO) and the production of its Tre semi-truck. Lucid, meanwhile, has filed a shelf registration for raising up to $8 billion through equity offerings over the next three years.

Honda, LG To Build Battery Plant In U.S. Honda Motor Co., Ltd. (NYSE:HMC) and LG Energy Solutions have formed a joint venture to set up a $4.4 billion EV battery manufacturing plant in the U.S., likely to be located in Ohio. Construction is expected to start in early 2023 and mass production will likely to begin by the end of 2025.

Canoo Continues To Lose Top Talent: Canoo Inc. (NASDAQ:GOEV), which recently announced plans to outsource manufacturing to fulfil its contract with Walmart, Inc. (NYSE:WMT), is reportedly seeing a key executive departure. Bloomberg reported that its manufacturing head John Mocny is leaving the company less than a year of his joining. The report noted that the company has recently lost several executives, including its former chief human resources officer and other employees in the talent acquisition department.

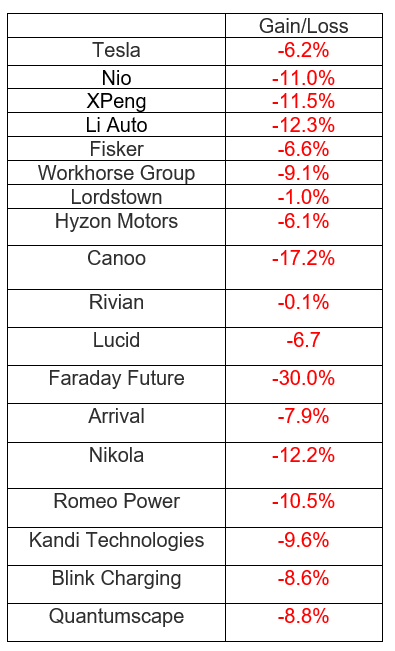

EV Stock Performances for The Week: