Tesla (TSLA) has become one of the most followed and controversial stocks in the entire market.

From CEO Elon Musk four years ago hinting at taking the company private, to his actually putting in an offer to buy Twitter (TWTR), there's a reason this stock attracts some controversy.

The company is also the most successful electric-vehicle producer in the world and continues to tighten its grip on the market.

And yet, despite its record production result earlier this month, investors booed the automaker’s report. Production missed expectations, and the stock sank 8.6% in a single session and 15.9% that week.

Will Tesla stock react that way again when Tesla reports earnings on Wednesday after the close? Here's a preview of what to look for in the fundamentals.

Trading Tesla Stock on Earnings

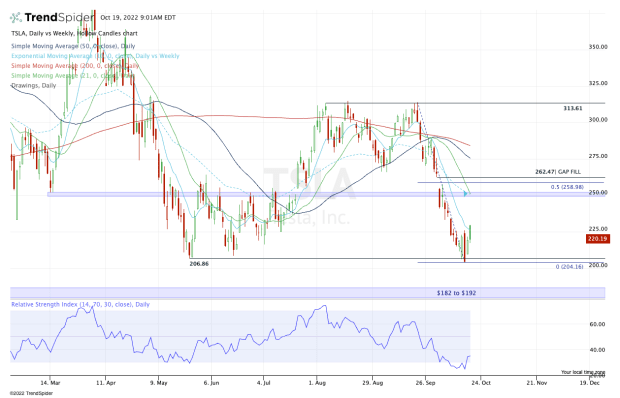

Chart courtesy of TrendSpider.com

Tesla stock lately has not had an easy run. The shares have fallen in four straight weeks and have suffered a 35.9% peak-to-trough decline in that stretch.

The stock rallied almost 5% on Tuesday but was rejected by the 10-day moving average.

The chart above is actually somewhat discouraging for the bulls.

Various support levels have failed and active resistance remains in play. But the stock faces a binary event with the earnings on tap, so the chart could become more constructive if the reaction to the earnings is favorable.

If the reaction is bullish, there is a small gap-fill near $235, but my eyes drift mainly up to the $250-ish area. There we find a key resistance zone from the summer that I had hoped would act as support amid the current pullback.

Further, the stock also faces its 21-day and 10-week moving averages in this area, while the 50% retracement of the current decline is up near $259.

That’s followed by the much larger gap-fill near $262.50.

As for the downside, Tesla stock had a very nice undercut of the prior 2022 low and a subsequent bounce. If it sees a bearish reaction to earnings, the low $200s will again be in play.

If the stock breaks $200, it puts the $182 to $192 zone on tap, and as one can see from the weekly chart, this would be a critical zone for the bulls to hold should it come to that.

The bottom line: $250 to $260 is critical on the upside and the low-$200s are key on the downside.