Key takeaways

- Tax deductions reduce the amount of income that's subject to tax, which ultimately reduces your tax bill.

- The standard deduction amounts for 2023 were increased approximately 7% from 2022.

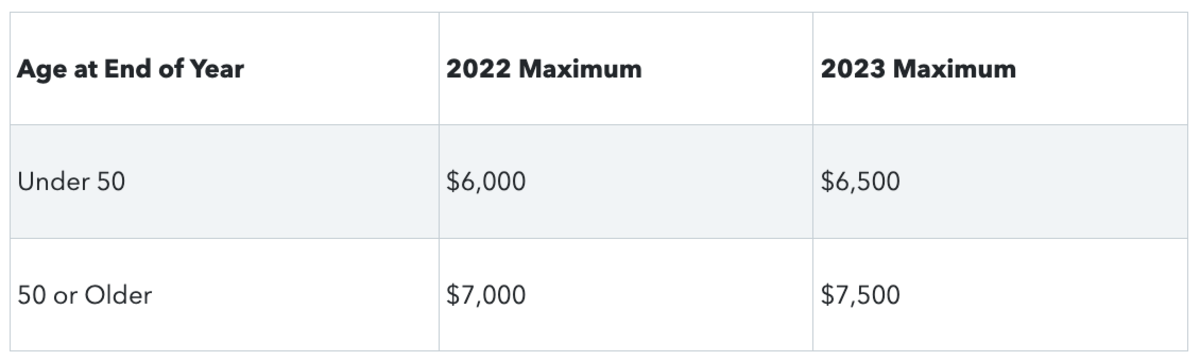

- The maximum deduction for 2023 tax year contributions to a traditional IRA is $6,500 for most people, but it’s $7,500 for people who are at least 50 years old.

- The 2023 student loan interest deduction is gradually reduced if your modified adjusted gross income exceeds $75,000 ($155,000 for joint filers).

Changes to the law and adjustments for inflation can affect the tax deductions you can claim from one year to the next.

In many cases, that’s good news. For example, a tax deduction might be larger after an inflation adjustment. You might also be able to claim a deduction you didn’t qualify for on a previous tax return.

That’s why it’s important to understand what’s new and changed for the 2023 tax deductions that might be available to you.

What are tax deductions and how do they work?

Tax deductions cut your tax bill by reducing the amount of income that’s subject to tax.

After adding up your total income on your tax return (with certain exceptions for tax-exempt income), you subtract any deductions from that amount to calculate your taxable income. For most people, the tax owed on your taxable income is then determined by using either the tax tables or tax rate schedules (you can subtract tax credits and tax payments already made from your tax liability later).

So, the more deductions you can claim, the lower your taxable income will be. And by lowering your taxable income, you’ll end up with a smaller tax payment or a larger tax refund.

What kind of tax deductions are available

There are different types of tax deductions. For instance, there’s the standard deduction, which is a single deduction based on your filing status. There are also several itemized deductions, including write-offs for:

- Medical and dental expenses

- State and local taxes

- Home mortgage interest payments

- Charitable donations

- Losses from natural disasters or theft

Unfortunately, you have to pick between the standard deduction and itemized deductions – you can’t claim both. But you can pick whichever one is higher and saves you the most money.

There are also “above-the-line” deductions, which you can claim regardless of whether you take the standard deduction or itemize. They get their name because you report them on your tax return right above the line showing your adjusted gross income (AGI).

Above-the-line deductions also have the added benefit of reducing your AGI. Since the eligibility for or amount of several other tax breaks are based on your AGI, above-the-line deductions can have a ripple effect and trigger more tax savings elsewhere on your tax return.

Some of the more popular above-the-line deductions are for:

- Individual retirement account (IRA) contributions

- Health savings account (HSA) contributions

- Student loan interest payment

- Educator expenses

- Self-employed health insurance premiums

Finally, sole proprietors can claim the qualified business income deduction and other business deductions on Schedule C. While this article is focused on non-business deductions, it’s important to point out that sole proprietors can claim business deductions on their individual income tax return.

Tax deductions vs. tax credits

Both tax deductions and tax credits help lower your income tax bill, but they do so in different ways. And while tax deductions are nice, tax credits are generally better.

As explained above, tax deductions lower your taxable income, which ultimately reduces the tax you owe for the year. But, at best, your actual savings are only a fraction of the deduction amount and depend on your tax bracket. For instance, if you’re in the 22% tax bracket and claim a $1,000 IRA deduction, your tax liability is only reduced by $220 ($1,000 x .22 = $220).

On the other hand, you can subtract income tax credits from the tax you owe on a dollar-for-dollar basis after applying the marginal tax rates to your taxable income. So, if you have a $1,000 tax credit, you can reduce your tax bill by up to $1,000.

There are also two general types of credits: refundable and nonrefundable tax credits. If the credit is “refundable,” you will get a tax refund if the credit amount is greater than the tax you owe before applying the credit. For example, if your pre-credit tax liability is $2,000 and you qualify for a $2,500 refundable tax credit, you’ll get a $500 refund.

If the credit is “nonrefundable,” the credit will only reduce the tax you owe to $0. For instance, if your pre-credit tax liability is $2,000 and you qualify for a $2,500 nonrefundable tax credit, you won’t owe any tax but you won’t get a refund, either ($500 of the credit is essentially lost).

Tax deductions vs. exclusions

An exclusion is like a tax deduction, since they both reduce the amount of income that’s taxed. But while you subtract a tax deduction from income that’s reported on your tax return, you don’t even need to report income that’s granted an exclusion.

Since income that’s excluded generally isn’t reported on your return, it reduces both your AGI and taxable income.

Are there any new tax deductions for 2023?

No. There are no new tax deductions for the 2023 tax year. But no deductions were repealed for 2023, either. As a result, the list of available tax deductions for 2023 is the same as it was for 2022.

Which 2023 tax deductions changed?

While there are no new tax deductions for 2023, there’s still a handful of changes to 2023 tax deductions stemming from the IRS’s annual adjustments to account for inflation. These adjustments are good for taxpayers, because they increase the value of several tax breaks and/or make them available to more people. And since inflation has been high lately, the increases for the 2023 tax year are larger than normal.

Let’s take a look at the inflation adjustments impacting tax deductions on your tax return for the 2023 tax year.

Standard deduction

The standard deduction amounts increased by about 7% from 2022 to 2023. For the 2023 tax year, the standard deduction is $13,850 for single people and married taxpayers who file separate returns (up from $12,950 for 2022), while married couples filing jointly and qualifying surviving spouses can deduct an amount twice that size at $27,700 (up from $25,900 for 2022). Head-of-household filers can claim a 2023 standard deduction of $20,800 (up from $19,400 for 2022).

The additional standard deduction for age or blindness also increased for the 2023 tax year. It’s equal to $1,500 for joint filers, married taxpayers filing separately, and surviving spouses (up from $1,400 for 2022); and $1,850 for single taxpayers and head-of-household filers (up from $1,750 for 2022).

There are also limits on the standard deduction if you can be claimed as a dependent on someone else’s tax return. For 2023, it can’t exceed the greater of $1,250 (up from $1,150 for 2022), or $400 plus your earned income.

IRA deduction

The maximum deduction for contributions to a traditional IRA is larger for 2023 because the annual IRA contribution limit is higher. For the 2023 tax year, the deduction is worth up to $6,500 for people who didn’t reach their 50th birthday by Dec. 31, 2023 ($6,000 for 2022). If you were at least 50 years old by the end of 2023, the 2023 deduction tops out at $7,500 ($7,000 for 2022).

The IRA deduction is also gradually phased out (potentially to $0) if you or your spouse are covered by an employer-sponsored retirement plan. The phase-out ranges are based on your filing status and adjusted for inflation each year.

If you’re covered by a retirement plan at work, the 2023 deduction is phased out as follows:

- For single and head-of-household filers, the deduction is reduced if your modified AGI is more than $73,000 (more than $68,000 for 2022) and is completely eliminated if your modified AGI is $83,000 or more ($78,000 or more for 2022)

- For joint filers and surviving spouses, the deduction is reduced if your modified AGI is more than $116,000 (more than $109,000 for 2022) and is completely eliminated if your modified AGI is $136,000 or more ($129,000 or more for 2022)

- For married taxpayers filing a separate return, the deduction is reduced if your modified AGI is less than $10,000 and is completely eliminated if your modified AGI is $10,000 or more (the $10,000 threshold was the same for 2022)

If you’re not covered by a workplace retirement plan but your spouse is, and you’re filing a joint return, the 2023 IRA deduction is reduced if your modified AGI is more than $218,000 (more than $204,000 for 2022) and is completely eliminated if your modified AGI is $228,000 or more ($214,000 or more for 2022).

You can’t deduct contributions to a Roth IRA.

HSA deduction

The contribution limits for health savings accounts also rose from 2022 to 2023, which means the maximum deduction for HSA contributions is higher for the 2023 tax year, too. But don’t forget that you must be covered under a qualifying high-deductible health plan to contribute to an HSA.

For 2023, the HSA deduction generally can’t exceed $3,850 if you have self-only coverage or $7,750 if you have family coverage (up from $3,650 and $7,300, respectively, for 2022). But if you were at least 55 years old at the end of 2023, you can deduct an additional $1,000.

Self-employed SEP, SIMPLE, and qualified plans deduction

Self-employed people can deduct contributions made to their own retirement plans. But like contributions to IRAs and HSAs, the deduction can’t exceed the annual contribution limit for the particular type of retirement account used – which were increased from 2022 to 2023.

For Simplified Employee Pension (SEP) IRAs, the maximum deductible amount for 2023 contributions is $66,000 ($61,000 for 2022) or 25% of your first $330,000 of compensation ($305,000 for 2022), whichever is lower.

You can put all your net earnings from self-employment in the plan: up to $15,500 in 2023 ($14,000 in 2022), plus an additional $3,500 in 2023 if you’re 50 or older ($3,000 in 2022), plus either a 2% fixed contribution or a 3% matching contribution.

The basic 2023 deduction limit for contributions by a self-employed person to his or her own Savings Incentive Match Plan for Employees (SIMPLE) IRA is $15,500 ($14,000 for 2022). However, you can deduct an additional $3,500 if you were at least 50 years old at the end of 2023 ($3,000 for 2022). Plus, you can deduct either 2% of the first $330,000 of your self-employment compensation ($305,000 for 2022) or an “employer match” of up to 3% of your compensation.

A self-employed person with a 401(k) plan (including a solo 401(k)) can deduct up to $22,500 in contributions to their own 401(k) account for the 2023 tax year if they’re under 50 years of age ($20,500 for 2022). That amount jumps to $30,000 if you were at least 50 years old at the end of the tax year ($27,000 for 2022). They can also deduct contributions of up to 25% of their net earnings from self-employment. However, their deduction for all contributions for the 2023 tax year can’t exceed $66,000 ($61,000 for 2022).

Student loan interest deduction

The student loan interest deduction is worth up to $2,500 per year. But your deduction will be phased-out if your modified AGI exceeds a certain amount that’s based on your filing status.

The phase-out ranges are adjusted upward each year to account for inflation. For the 2023 tax year, the deduction is phased out as follows:

- For single filers, head-of-household filers, and surviving spouses, the deduction is reduced if your modified AGI is more than $75,000 (more than $70,000 for 2022) and is completely eliminated if your modified AGI is $90,000 or more ($85,000 or more for 2022)

- For joint filers, the deduction is reduced if your modified AGI is more than $155,000 (more than $145,000 for 2022) and is completely eliminated if your modified AGI is $185,000 or more ($175,000 or more for 2022)

Married taxpayers filing separate returns can’t claim the student loan interest deduction.

TurboTax Tip: If your parents or someone else pays your student loans for you, you can still claim the student loan interest deduction if you’re the one who’s legally obligated to pay off the loan. The IRS will treat the interest payment as if you paid it yourself.

Medical expense deduction

Premiums paid for long-term care insurance are generally deductible as a medical expense (although your total medical expenses are only deductible to the extent they exceed 7.5% of your AGI). However, the deduction for long-term care insurance is capped at an inflation-adjusted amount that’s based on your age at the end of the tax year.

For the 2023 tax year, the deduction is limited as follows (based on your age on Dec. 31, 2023):

- $480 if you’re 40 or younger ($450 for 2022)

- $890 if you’re 41 to 50 ($850 for 2022)

- $1,790 if you’re 51 to 60 ($1,690 for 2022)

- $4,770 if you’re 61 to 70 ($4,510 for 2022)

- $5,960 if your 71 or older ($5,640 for 2022)

If you drive your own car or truck to a medical appointment, you can also deduct related costs as a medical expense (again, subject to the 7.5% of AGI limitation). You can either deduct your actual expenses for gas, parking, tolls, and the like, or use the standard mileage rate to calculate the deductible amount.

The standard mileage rate for medical travel costs is 22 cents per mile for the entire year. For 2022, the rate was 18 cents per mile for the first half of the year and 22 cents per mile for the second half.

Self-employed health insurance deduction

A self-employed person can generally deduct premiums paid for health insurance for his or her family. The deduction also can be taken for the cost of long-term care insurance, but the same age-based caps listed above for the medical expense deduction for long-term care insurance apply to this deduction, too. As noted, those limits increased from 2022 to 2023.

Moving expense deduction for members of the military

As with the deduction for medical transportation costs, the 2023 standard mileage rate for the military moving expense deduction is 22 cents per mile for the entire year. The mileage rate for this deduction was also split for the 2022 tax year (18 cents per mile for the first half and 22 cents per mile for the second half).

Deduction for business expenses of reservists, performing artists, and fee-basis government officials

Certain business expenses of reservists, performing artists, and fee-basis government officials are deductible, including unreimbursed expenses related to the business use of a personal car or truck.

Eligible taxpayers using the standard mileage rate to calculate travel expenses (as opposed to the actual expense method) for the 2023 tax year can deduct 65.5 cents per mile. For the 2022 tax year, the rate for business use of a vehicle was 58.5 cents per mile for the first half of the year and 62.5 cents per mile for the second half.

Tax deductions that didn’t change for 2023

Tax deductions for the following expenses and payments didn’t change from 2022 to 2023:

- Alimony

- Amortizable bond premiums

- Archer Medical Savings Account (MSA) contributions

- Attorney fees and court costs for lawsuits involving certain discrimination claims or IRS whistleblower awards

- Chaplain contributions to a 403(b) retirement plan

- Charitable contributions

- Estate “excess deductions” reported to a beneficiary on Schedule K-1 (Form 1041)

- Estate tax (federal) on income connected to a person who died

- Foreign housing deduction

- Gambling losses (only to the extent of gambling winnings)

- Impairment-related work expenses of a disabled person

- Interest on borrowed money that’s allocable to property held for investment

- Jury duty pay given to your employer

- Losses from a contingent payment or inflation-indexed debt instrument

- Losses from natural disasters or theft

- Mortgage interest and points

- Olympic and Paralympic medals or prize money

- Penalties on the early withdrawal of certain savings

- Pension contributions under Section 501(c)(18) of the tax code (i.e., to a pension created before June 25, 1959, funded only by employee contributions)

- Reforestation amortization and expenses

- Renting personal property if you’re not in the business of renting the property

- Repayment of amounts under a claim of right over $3,000

- Self-employment taxes

- State and local taxes

- Teacher and other educator expenses for classroom materials

- Unemployment benefit repayments

- Unrecovered investments in a pension

With TurboTax Live Full Service, a local expert matched to your unique situation will do your taxes for you start to finish. Or, get unlimited help and advice from tax experts while you do your taxes with TurboTax Live Assisted.

And if you want to file your own taxes, you can still feel confident you'll do them right with TurboTax as we guide you step by step. No matter which way you file, we guarantee 100% accuracy and your maximum refund.