The Trump administration recently imposed new tariffs on goods from Canada, Mexico, and China, causing serious concerns among gamers and gaming industry representatives. Due to supply issues, these measures may lead to higher prices for devices, peripherals, and software. The already declining demand for physical CDs may create new hurdles for this vulnerable market.

One of the most discussed measures was the introduction of a 25% import tax on CDs from Mexico. Mexico is a key producer of gaming discs, including those for PlayStation, Xbox, and Nintendo Switch. The new tax may lead to a significant reduction in the physical release of games, becoming a niche product, and new duties may accelerate their disappearance from the market.

This, in turn, may strengthen the positions of digital platforms, including Steam, PlayStation Store, and Xbox Live, where games are sold as digital downloads.

Manufacturers that continue to produce CDs will likely shift some or even all of the tax burden to their consumers. This will increase retail prices for both physical and digital versions of games.

However, if the cost of disc manufacturing increases significantly, publishers may try to compensate for their losses by lifting the prices for digital copies. Thus, fees may affect the buying power of all gamer types, regardless of their format preferences.

Another major challenge for the gaming industry is the 20% tariffs on Chinese console imports. Approximately 75% of all game units sold in the United States are made in China, so prices for new shipments may rise in the coming months. Console manufacturers, which had previously blamed the Brazilian and Indian governments for high import duties, contributed to price increases.

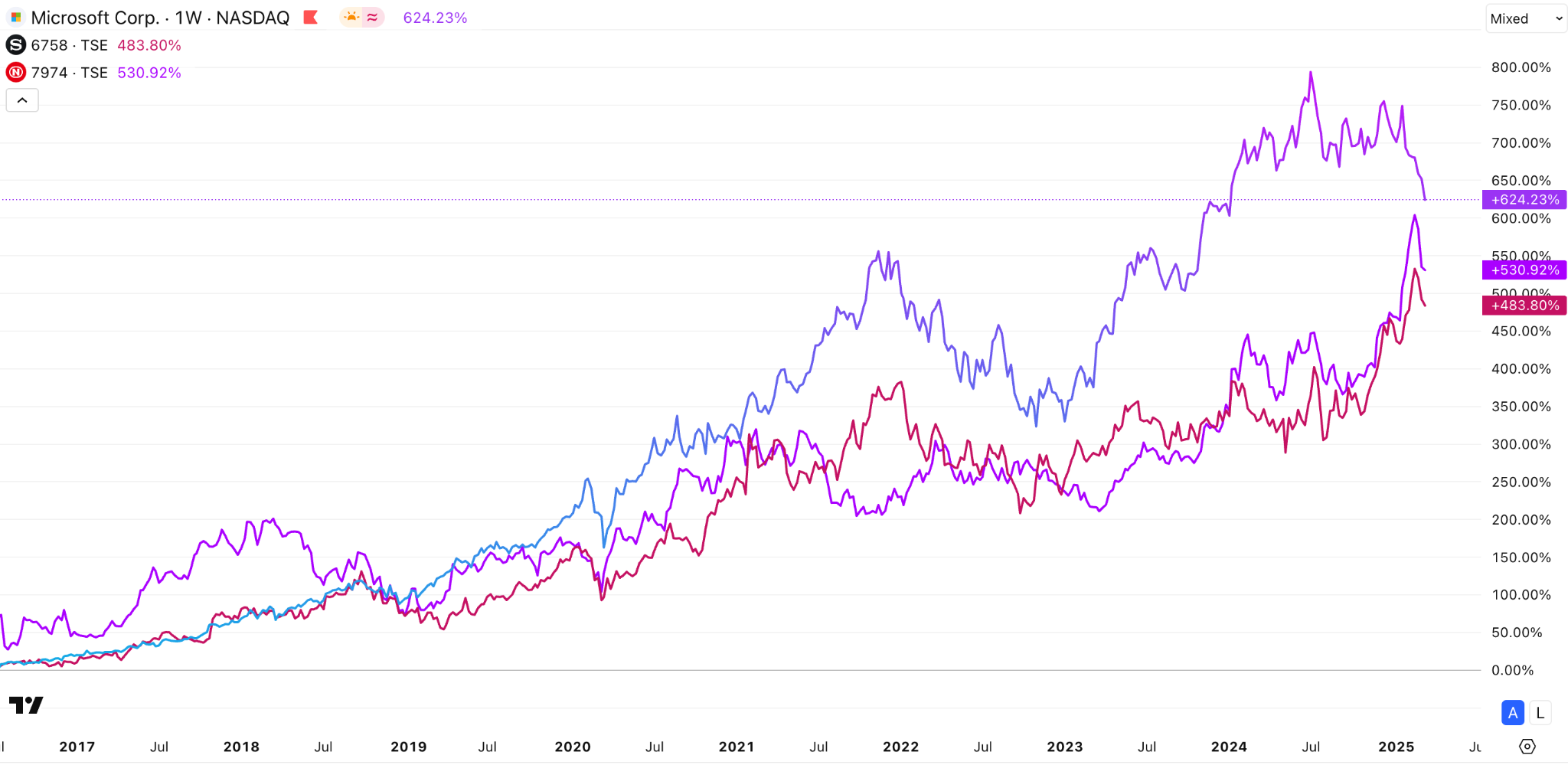

Such stringent measures may trigger a sale of major manufacturers' shares, including Microsoft stock, which, despite being a US-based company, heavily relies on their Chinese counterparts. Following the COVID-19 pandemic in 2020, the Xbox developer began moving its production outside China. This decision may help Microsoft mitigate some of the tariffs’ effects.

In 2019, even before Microsoft, Nintendo began shifting its production to Vietnam and Thailand, alleviating the risks of a potential trade war escalation. Such a foresighted move might reduce Japanese company's tax burden on the United States imports. For other countries, Nintendo continues to assemble consoles in Mainland China.

Unlike its competitors, Sony is still heavily dependent on China, with only 30% of PlayStation units produced outside of it. This makes the company particularly vulnerable to new tariffs.

The economic uncertainty surrounding these trade policies has also affected investor sentiment. As fears of higher manufacturing costs and declining sales grow, gaming-related stocks have faced increased volatility. The Dow Jones Index, which includes major technology and entertainment companies, has seen fluctuations as investors assess the long-term impact of tariffs on the gaming sector. A decline in consumer purchasing power, coupled with rising production costs, could put additional pressure on the market.

The new duties could pose a serious challenge to the US gaming industry. Rising prices for hardware and games, supply issues, and the withdrawal from the physical media market could all change the industry's familiar landscape. Manufacturers will need to adapt to the new conditions by rescheduling production, reviewing prices, and increasing their focus on digital platforms.

This could mean higher spending on games and consoles and an accelerated transition to digital content. In the long run, this may lead to the eventual disappearance of games on discs, as automated trading replaces manual trading, which would be another step in the evolution of the gaming industry. However, there is still hope that companies will be able to find ways to minimize the damage to consumers and keep games accessible to everyone.