Economic uncertainty is set to reduce the eurozone economy, worth €14.6 trillion, by a cumulative 0.4% of GDP over 2025 to 2026, according to S&P Global’s latest report.

In its latest economic forecast, penned before the 25% tariffs on US car imports were announced, S&P Global also lowered its previous expectations for the eurozone from 1.2% to 0.9% for 2025 due to this uncertainty.

Chief EMEA Economist Sylvain Broyer told Euronews Business that “uncertainty itself is likely to pose a greater risk to the European economy than the tariffs alone”.

On the other hand, there are green shoots of hope in Europe. Due to fiscal stimulus in Germany and the EU, GDP could grow by 1.4% in 2026.

To what extent could US tariffs harm European recovery?

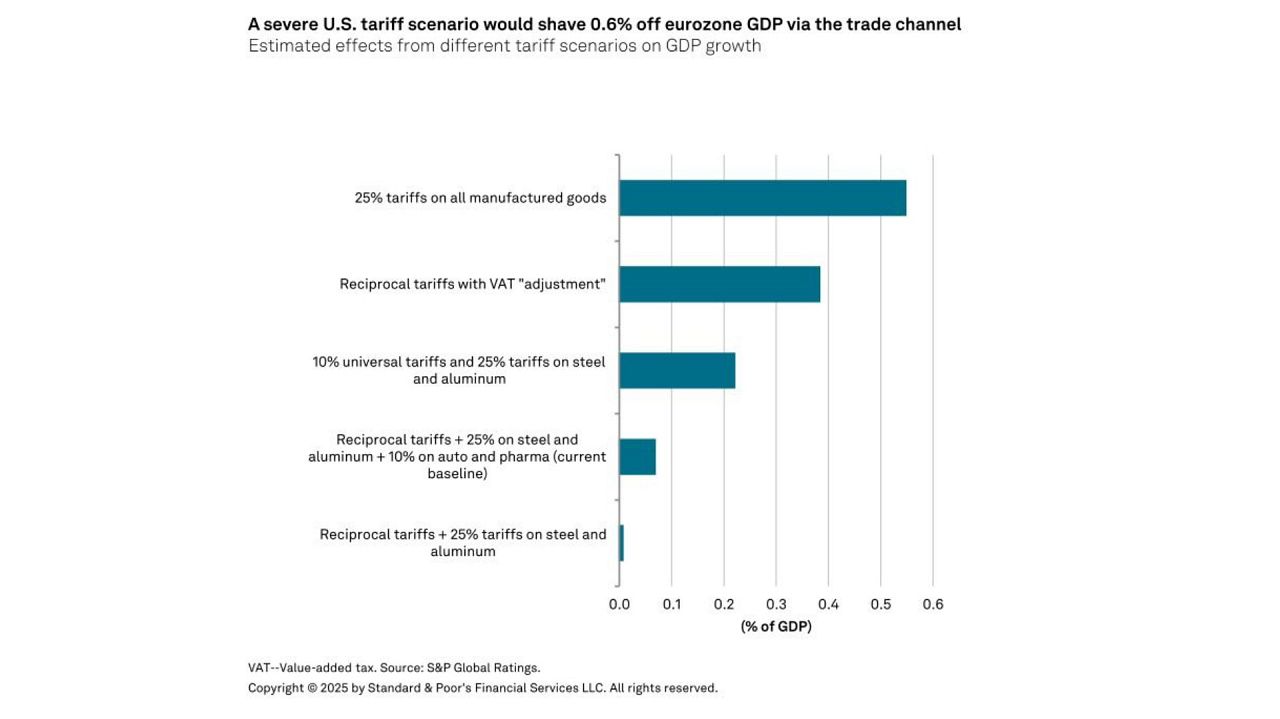

Broyer, emphasising that his forecast could change due to unpredictable policy moves ahead, sketched up various scenarios to see the effect of potential tariffs on the bloc’s economy.

In the worst case scenario, an increase in US tariffs on all EU imports to 25% would limit GDP growth in the eurozone to 0.5% in 2025 and 1.2% in 2026. In this case, he predicts that the ECB would cut interest rates more than once this year and raise them later than experts currently predict.

Commenting on the White House’s latest announcements, promising 25% tariffs on all cars and car parts, Broyer said to Euronews Business that their forecast had already taken into consideration a 10% tariff of this nature. He added that an additional 15% would have a limited effect on the current figures.

“Germany would be more significantly impacted than the broader eurozone, given its higher reliance on US car exports — approximately 1.5 times the European average,” Broyer said, adding that it would lower German output by 0.1% for 2025.

On a more positive note, confidence in Europe is climbing, supported by falling interest rates and inflation, yielding continued strength for the labour market. The expected fiscal stimulus, especially in the defence sector, is further boosting confidence.

EU member states will likely agree to an increase in defence spending by 1% of GDP from 2026, which could boost eurozone GDP by 0.1% in 2026, 0.2% in 2027, and 0.3% in 2028.

A likely rate hike from the ECB is on the horizon

As potential EU retaliatory tariffs did not seem to substantially boost inflation in the bloc at the time of finalising the report, S&P Global forecast that the ECB would cut rates one more time this year—to 2.25% in April or June.

S&P Global expects that the ECB will start raising its key interest rate in the second half of 2026, with two hikes expected, until the deposit facility rate reaches 2.75% by the end of next year. It expects a strong recovery in credit demand and suggested that fiscal stimulus will push the economy to an unsustainable rate of growth.

Broyer wrote that the risks to the current forecast include trade uncertainty, potential failure to execute fiscal plans, and spillovers from the US economy if growth across the Atlantic is hit by higher import prices.

On the flip side, fiscal stimulus programs could have a greater-than-expected impact and improve confidence rapidly.

UK growth prospects nearly halved

In another economic forecast focused on the UK, which arrived before the car tariff announcement, S&P Global slashed its expectations about the growth of the British economy to 0.8% from 1.5%. The almost halving of the forecast can be explained by high inflation, weak export volumes, and tight monetary policy. The UK's GDP expanded by 1.1% in 2024, according to the statistics office.

If the UK cannot wiggle its way out of the newly announced 25% tariffs on car exports to the US, this could result in a 0.2% hit to GDP, according to Marion Amiot, Chief UK Economist at S&P Global Ratings.

“Car exports to the US are the largest source of bilateral goods trade surplus for the UK,” she said.

Uncertainty around trade, weak demand in Europe and China, and the strong value of the pound are limiting the country’s exports, which provided 31% of the nation’s GDP in 2024. Weak export growth is also due to elevated labour and energy costs for companies.

“The energy prices are still twice as high today as they were before the energy crisis, so there are a lot of things they have to absorb,” Amiot told Euronews Business.

One segment that can expect accelerating demand at the moment is defence. As the UK is the fourth largest defence exporter in Europe, it could potentially benefit from increased EU military spending in the coming years.

“It's not quite clear what the partnership will look like in the future, but there seems to be willingness to cooperate on defence, even though we saw that some of the EU spending is likely to exclude UK firms,” Amiot said.

What is the Bank of England’s next move?

As the UK government has left itself very little fiscal room to manoeuvre, there is uncertainty as to whether the state will raise taxes—particularly as the cost of servicing debt has risen.

“Firms and households are likely to expect more tax increases or some further cuts to the welfare bill. So this doesn't put businesses and households in a good position to confidently invest or spend,” Amiot said.

Meanwhile, sustained wage growth close to 6% in December is fuelling inflation, putting the central bank in a difficult position as growth remains weak.

Inflationary pressures are tying the policymakers' hands as they remain cautious about cutting, while investors are hungry for lower rates.

The Bank of England kept its benchmark interest rate stable at 4.5% at its latest monetary policy meeting. The latest inflation figure, 2.8% for February, fuelled hopes of a cut, but the majority of the analysts agreed that prices would rise sharply in the coming months.

In its forecast, S&P Global expects the Bank of England to cut rates to 4% by the end of the third quarter in 2025. They nonetheless expect one less rate cut than in their previous forecast, expecting more stubborn inflation.

In 2026, growth is expected to accelerate, with the report predicting a 1.6% increase in economic output.

“Things are looking up for 2026, with regional growth picking up, rates cut by another 50bp, and inflation edging back to 2.5%,” read the report.