Chipotle Mexican Grill (CMG) has been on fire this year, up almost 50% and touching all-time highs amid its recent rally.

At last check the shares ticked up 0.7%. That might not be much most days, but it is on Tuesday as regional-banking worries push the S&P 500 Index down 1.5%.

Don't Miss: Regional Banks Tumble to 52-Week Lows. Here's the Chart View.

Chipotle has been a stock that investors have been able to count on. While it saw a peak-to-trough decline of about 38% in the bear market — roughly in line with the Nasdaq — the stock has spiced up more than 70% from the June lows.

Further, the company recently reported strong results in late April, beating earnings and revenue expectations.

Starbucks (SBUX) reports earnings on Tuesday night, and that may have a slight impact on Chipotle. But so far the stock has held up pretty well. Let’s look at a potential buy-the-dip setup.

When to Buy the Dip in Chipotle Stock

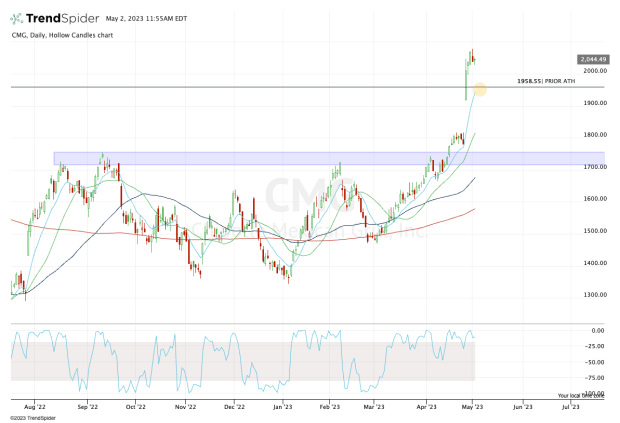

Chart courtesy of TrendSpider.com

After gapping up on the earnings report and opening near $1,918 on April 26, Chipotle stock quickly burst through the prior all-time high at $1,958.55 and passed $2,000.

Now, as the rally slows, it’s got investors wondering about a potential pullback.

If we see a dip in Chipotle stock, keep a very close eye on the $1,950 to $1,960 area. The bulls are looking for a retest of the prior all-time high, and ideally this level will hold as support.

This setup becomes much more attractive if the rising 10-day moving average is in this zone, if and when Chipotle stock pulls back to it.

Don't Miss: Zoom Video Stock Has Slumped; Is It Time to Buy?

A combination of the 10-day moving average and the $1,950 to $1,960 area would be a strong setup for active buyers.

If this area is support, a bounce back up toward $2,000 (or higher) seems a good target.

But if that area fails as support, it could open the door down to the 21-day moving average and the $1,815 area.

Let’s go one step at a time. For now, see whether Chipotle shares pull back to the $1,950 to $1,960 zone.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.