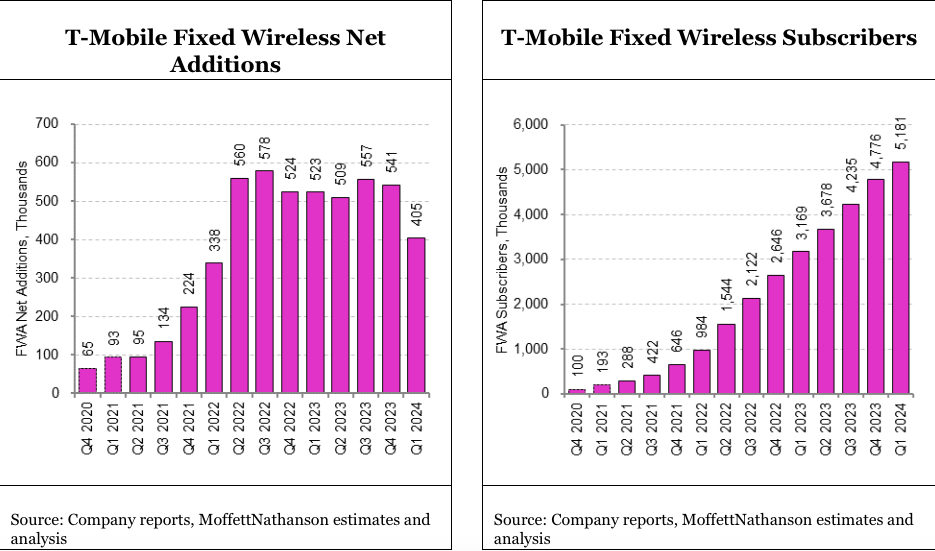

The long-expected deceleration of fixed wireless access (FWA) customer expansion appears to be at hand, with T-Mobile reporting first-quarter customer growth of just 405,000 souls for its 5G Home Internet service, down 22.5% from January - March of 2023.

T-Mobile ended the quarter with 5.181 million FWA subscribers.

Earlier this week, Verizon reported its FWA business had slowed customer growth by 10% in Q1 to 354,000 customers. AT&T doubled its FWA ranks by adding 110,000 customers to its Internet Air service, but AT&T is just getting started in what it still describes as a very niche platform aimed mainly at business customers.

For a business originally built around excess 5G wireless network capacity, FWA was always intended to have limits. T-Mobile has said it would stop growing its fixed wireless ranks once the business accounts for around 5% of its total revenue. T-Mobile said it's goal is to have around 7-8 million FWA customers by 2025, and it remains on pace to achieve that objective.

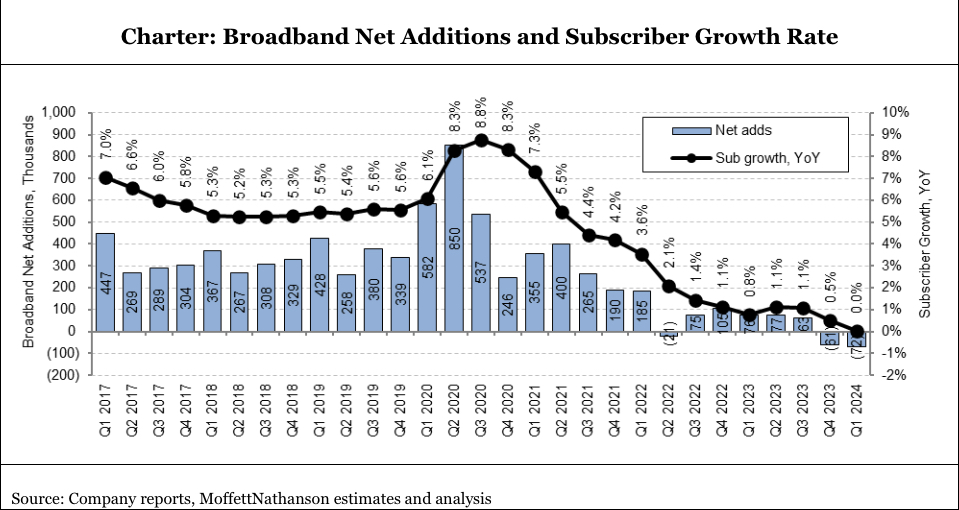

T-Mobile and Verizon's entry into the home internet market with cheap cellular-based platforms three years ago is a major reason why both Comcast and Charter Communications keep losing wireline broadband customers every quarter -- the two cable giants were down another 65,000 and 72,000 high-speed internet customers respectively in Q1.

In his note to investors Friday following Charter's Q1 earnings report, equity analyst Craig Moffett remarked, "With FWA now clearly on the downslope, we believe the headwinds to cable broadband very likely peaked in Q4 of last year."

Moffett also noted that AT&T's fiber-to-the-home business also saw diminished customer growth in the first quarter, down to 252,000 customers from 272,000 a year prior.

But cable investors shouldn't expect a major growth rebound just yet, he said.

"Under other circumstances, these welcome portents might well have already sparked a significant rally in cable stocks, where broadband competition is virtually all that matters," Moffett added. "But the house on fire for the moment isn’t the competitive threat posed by FTTH or FWA, but instead is the [expiration] of the government's Affordable Connectivity Program subsidy program. Charter leaned into ACP like no other peer, building their ACP sub count to five million. No other operator is close to being as exposed."