During the last three months, 15 analysts shared their evaluations of Synchrony Finl (NYSE:SYF), revealing diverse outlooks from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 6 | 3 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 4 | 3 | 3 | 1 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

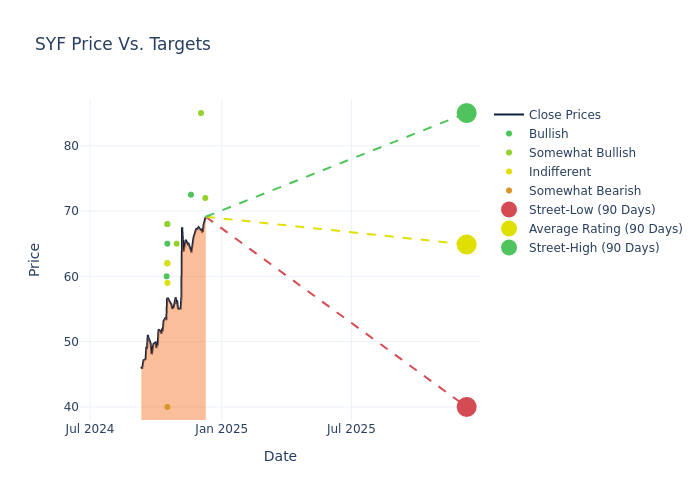

Analysts have set 12-month price targets for Synchrony Finl, revealing an average target of $63.77, a high estimate of $85.00, and a low estimate of $40.00. Witnessing a positive shift, the current average has risen by 12.81% from the previous average price target of $56.53.

Interpreting Analyst Ratings: A Closer Look

In examining recent analyst actions, we gain insights into how financial experts perceive Synchrony Finl. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Richard Shane | JP Morgan | Raises | Overweight | $72.00 | $59.00 |

| Donald Fandetti | Wells Fargo | Raises | Overweight | $85.00 | $60.00 |

| Alex Scott | Goldman Sachs | Raises | Buy | $72.50 | $64.00 |

| John Pancari | Evercore ISI Group | Raises | Outperform | $65.00 | $58.00 |

| Moshe Orenbuch | TD Cowen | Raises | Buy | $62.00 | $60.00 |

| Donald Fandetti | Wells Fargo | Raises | Equal-Weight | $60.00 | $53.00 |

| Mark Devries | Barclays | Raises | Equal-Weight | $59.00 | $49.00 |

| John Hecht | Jefferies | Raises | Buy | $65.00 | $60.00 |

| Jon Arfstrom | RBC Capital | Raises | Sector Perform | $62.00 | $55.00 |

| Betsy Graseck | Morgan Stanley | Raises | Underweight | $40.00 | $37.00 |

| David Scharf | JMP Securities | Raises | Market Outperform | $68.00 | $60.00 |

| Mark Devries | Deutsche Bank | Raises | Buy | $68.00 | $58.00 |

| David Rochester | Compass Point | Raises | Buy | $60.00 | $56.00 |

| David Scharf | JMP Securities | Maintains | Market Outperform | $60.00 | $60.00 |

| John Pancari | Evercore ISI Group | Lowers | Outperform | $58.00 | $59.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Synchrony Finl. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Synchrony Finl compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Synchrony Finl's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Synchrony Finl's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Synchrony Finl analyst ratings.

All You Need to Know About Synchrony Finl

Synchrony Financial, originally a spinoff of GE Capital's retail financing business, is the largest provider of private-label credit cards in the United States by both outstanding receivables and purchasing volume. Synchrony partners with other firms to market its credit products in their physical stores as well as on their websites and mobile applications. Synchrony operates through three segments: retail card (private-label and co-branded general-purpose credit cards), payment solutions (promotional financing for large ticket purchases), and CareCredit (financing for elective healthcare procedures).

Breaking Down Synchrony Finl's Financial Performance

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Over the 3 months period, Synchrony Finl showcased positive performance, achieving a revenue growth rate of 9.76% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Synchrony Finl's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 20.14%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Synchrony Finl's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.28% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.64%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.06.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.