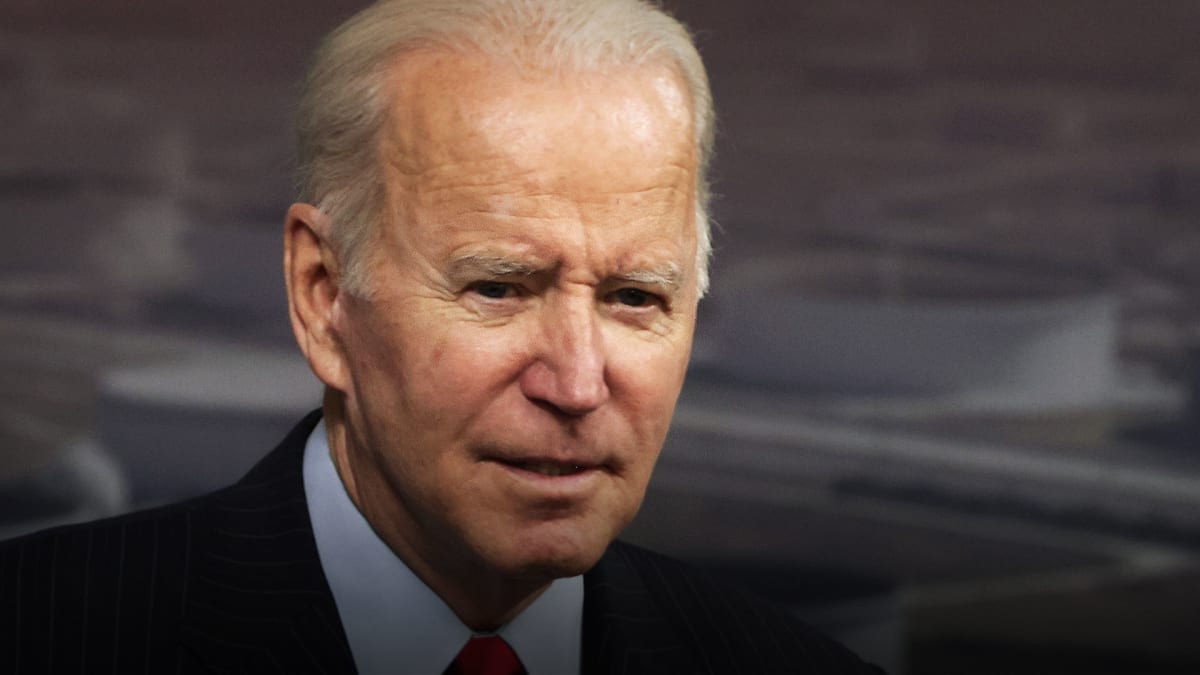

President Joe Biden on Monday sent a message to critics of U.S. regulators' emergency plan to avoid contagion from the collapse of Silicon Valley Bank.

Biden appeared to say he heard the anger of critics who see the plan as another bank bailout after the 2008 financial crisis.

All depositors of SVB and Signature Bank New York are going to receive all their money, even as the two banks were closed for liquidity problems following bad bets on bonds.

The president said the management of the two banks would be fired, that shareholders and investors would receive nothing, and that the government would tighten the loose banking regulations put in place under the administration of President Donald Trump.

Biden said in televised remarks, "Americans can have confidence that the banking system is safe."

Biden: Managers to Be Fired, Rules Tightened

He also promised that the federal government would shed light on what led to the SVB disaster.

"The management of these banks will be fired," Biden said during a short appearance on Monday. "If the bank is taken over by FDIC, the people running the bank should not work there anymore."

"Investors in the banks will not be protected. They knowingly took a risk, and when the risk didn't pay off, investors lose their money. That's how capitalism works."

Biden also said that "we must get the full accounting of what happened and why those responsible can be held accountable."

"No one is above the law," the president warned.

Stating that the risk of the current situation recurring must be reduced, Biden promised tougher regulations.

"During the Obama-Biden administration, we put in place tough requirements on banks, like Silicon Valley Bank and Signature Bank, including the Dodd-Frank law to make sure that the crisis we saw in 2008 would not happen again," Biden said. "Unfortunately, the last administration rollbacked some of these requirements."

"I'm going to ask Congress and the banking regulators to strengthen the rules for banks to make it less likely this kind of bank failure would happen again, and to protect American jobs and small businesses."

What Happened in the Failure of SVB?

SVB was closed on March 10 by U.S. regulators after a run on the bank. The run stemmed from the firm’s announcement that it planned to raise $2.25 billion by issuing new equity to shore up its finances, after it sold bonds in its portfolio of investments at a $1.8 billion loss.

About $42 billion of deposits were withdrawn by the end of March 9, according to a regulatory filing. By the close of business that day, SVB had a negative cash balance of $958 million.

The FDIC took control and is now the manager of $175 billion in customer deposits, including money from several startups and from some of the biggest names in the technology world.

The regulator also created a new banking entity and indicated that unsecured depositors -- SVB customers with more than $250,000 in their accounts -- will not, for the moment, have access to their money.

Companies with SVB accounts, lines of credit and credit facilities were wondering what this meant for them, when they would be able to access their funds, whether they would be able to get all their funds out, and whether they would have access to their credit lines.

The uncertainties were dispelled on March 12 when the Treasury Department, the FDIC and the Federal Reserve announced that all depositors of the failed California bank would receive their money in full on March 13.

In addition, the Fed stated that it was creating a new Bank Term Funding Program, designed to safeguard institutions affected by SVB's collapse.

This facility will provide loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasury securities, agency debt, mortgage-backed securities and other qualifying assets as collateral, the Fed said in a separate statement.

These assets will be valued at par -- at their original value -- regardless of the change in interest rates, the rise of which in recent months has reduced the value of long-term bonds purchased when rates were low.

These extraordinary measures indicate that depositor money from any U.S. bank is now guaranteed because regulators have indicated that the plan also applies to depositors of Signature Bank New York, which they closed on the same day.