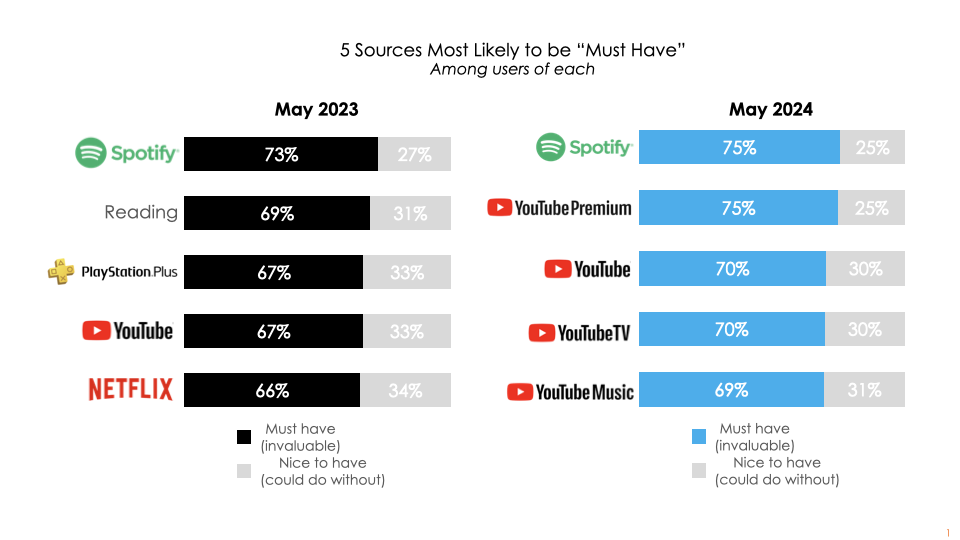

PORTSMOUTH, N.H.—It’s nearly unanimous. A YouTube brand is ranked in four of the top five spots as “must haves” by users responding to the latest Hub Entertainment Research Battle Survey.

The dominance of YouTube brands in this year’s survey marks a major swing to the upside from the May 2023 survey when two-thirds of those using the free YouTube service said that it was a must-have, essentially tied with subscribers of Netflix and PlayStation Plus, and behind readers and Spotify users.

The May 2024 findings, however, reveal a big change. The survey found YouTube Premium is ranked as a must-have source by 75% of users, a fraction of a percent behind Spotify. The rest of the top 5 spots are occupied by YouTube, YouTube TV and YouTube Music.

Among younger people (18- to 35-year-olds), three YouTube brands— YouTube, YouTube Premium and YouTube Music—were considered to be must-haves in their top five, the survey found.

“These results are a reminder that number of subscribers isn’t a proxy for engagement,” said Jon Giegengack, principal at Hub and one of the study authors. “YouTube Premium has far fewer users than Netflix, for instance. But more of those who use YouTube Premium find it to be indispensable. As the streaming entertainment market matures, keeping existing users is a higher priority than attracting new ones. And ‘must have’ sources are less likely to be canceled.”

Hub’s semi-annual Battle Royale survey captures which entertainment platforms and subscriptions each respondent uses, across categories that include premium video, gaming, music, social media, reading and podcasts. Respondents are then asked to assign each source to one of two categories: must-have or nice to have.

“The most recent findings also show the growing role that YouTube is playing in the entertainment ecosystem,” added Mike Durange, study co-author. “YouTube TV, YouTube Premium and YouTube Music don’t have the scale of the original YouTube. But those who do use them find them very valuable. Plus, there are almost unlimited opportunities to grow these secondary platforms by marketing them to the massive number of people using YouTube itself.”

Hub’s study was conducted among 3,000 U.S. consumers, age 18-74, who are entertainment decision-makers with broadband.

Moe information is available on the Hub.