As great of a company as DocuSign (DOCU) is, a stranger off the street could have probably told investors it would be down on Friday after reporting earnings.

Shares are hitting new 52-week lows after falling more than 20% on the day.

That’s as the company reported in-line earnings results and beat on revenue expectations. However, the company crushed analysts’ expectations when it came to the outlook.

Management expects first-quarter revenue of $579 million to $583 million vs. estimates of $561.6 million. For the full year, management estimates $2.47 billion to $2.482 billion in revenue, easily besting consensus estimates of $2.09 billion.

After a 70% slide from the highs and ahead of earnings, do I think the stock deserves a 20% haircut on a report like this? No, not with an outlook as strong as DocuSign provided.

But it doesn’t really matter what I think the stock deserved to do after earnings. The simple fact of the matter is that the overall market is in a downtrend, tech is underperforming the broader market as a whole and growth stocks are the worst of the bunch.

Twilio (TWLO) probably didn’t deserve to fade after its strong results and yet it did.

Nvidia (NVDA) probably doesn't deserve to be down 40% from the high, but at this week’s low it was.

What’s “deserved” doesn’t matter. What does matter is price.

Trading DocuSign Stock

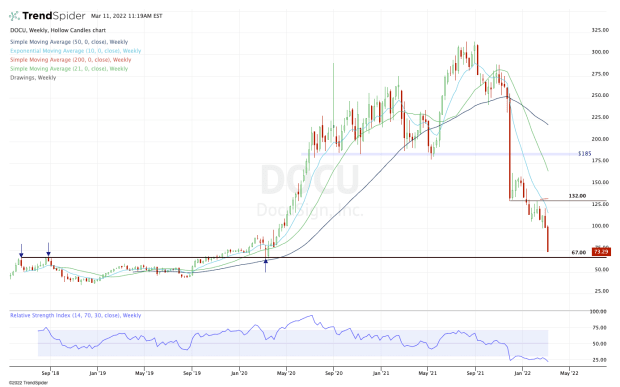

Chart courtesy of TrendSpider.com

Like many others, DocuSign exploded higher during the 2020 Covid outbreak. When it initially pulled back, it tested into the $67 breakout area, which held as support and went on to climb above $300.

When shares pulled back hard, the $185 support zone failed without a fight, highlighting to bulls just how much the trend had changed.

DocuSign stock bounced off the $132 level for a moment, but that mark later turned to resistance once it failed in January.

Now adding to the tumultuous decline, DocuSign stock is again approaching its 2020 Covid lows and the major breakout spot from several years ago near $67.

I want to say, “I would be surprised if these lows don’t hold,” but the truth is, I wouldn’t be.

It seems ridiculous that DocuSign could be a profitable and growing enterprise that saw its revenue explode after the pandemic, then potentially trade below its pandemic low — which is $64.88 by the way — despite its business operating at a significantly higher level than it was two years ago.

For comparison, in its full-year 2019 operations — in other words, completely pre-pandemic — DocuSign did about $700 million in revenue. In 2020, it did just under $975 million.

As you saw from management’s outlook, the company expects to do almost $2.5 billion in revenue this year.

I don’t know what fair value is for this stock. Trading back to pre-pandemic levels seems short-sighted to me, but I don’t think a retest of $67 is out of the question. If it gets there, that seems like a reasonable risk/reward area if support shows up.