Draft report says designers, builders and building consent authorities show favouritism to tried and tested local products, at expense of competition and consumers

The Gib factory in the industrial Auckland suburb of Penrose has been running nearly 24/7 this year, as workers play catch-up on a massive backlog of demand on residential building sites. But no doubt they paused, on the floor and in the break room, to check out the live feed of the Commerce Commission’s draft findings this morning.

Gib manufacturer Winstone Wallboards controls about 94 percent of the plasterboard market in New Zealand; the utter failure of the Fletcher-owned company to meet growing demand epitomises the problems with one or two companies’ dominance.

After a previous commission probe into Winstone Wallboards failed to find evidence of abuse of rebates, today’s report delivers a damning verdict: quantity-forcing rebates for plasterboard appear to be contributing to difficulties for competing suppliers like importer Elephant Plasterboard, in west Auckland.

The report says Gib is commonly specified by brand in building plans, making it hard for builders to substitute competing products. And building consent authorities are inconsistent on when they’ll allow builders to substitute alternative plasterboard or, indeed, other products.

Market shares by builder size (Consents per annum, Infometrics)

The problems go far beyond Gib, as commission chair Anna Rawlings disclosed when she delivered today’s draft report into competition in building supplies. She says the combined effect of the regulatory system and the decisions made by designers, builders and building consent authorities working within the system “is to favour tried and tested building products over new or competing products”.

That’s made worse by rebates paid by some established suppliers to merchants, rewarding them for selling more of their glass, or steel, or timber, or concrete. “These rebate structures reward merchants for purchasing greater volumes through a single supplier and can deter merchants from stocking competing products in their stores.”

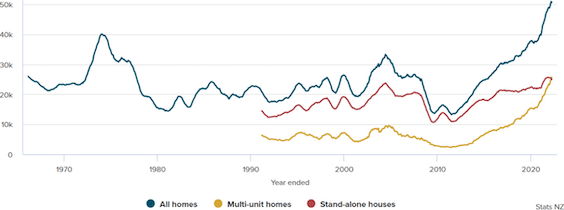

New residential homes consented, 12-month rolling totals to April 2022

Customers are being misled – and the building industry needs to think about being more “truthful” about what products really cost. “We would expect, if customers are being told the price paid for a product, that should be the price,” Rawlings says.

Mike Blackburn, from builders' co-op Combined Building Supplies, has been raising the alarm about the supply crisis – how it’s been stalling construction; how it’s been driving builders to the wall.

Now, he tells me builders, suppliers and government agencies are already forcing open the door to competing products. Bunnings, ITM and Placemakers (which it should be noted is owned by Fletcher) have worked hard to import alternative plasterboards like Thai-made ProRoc and other products in the past few months.

And MBIE has clarified rules about substituting alternative products; the Government has set up a plasterboard taskforce to crunch the problems hard and fast.

Market shares by builder size (Consents per annum, Infometrics)

The Government also kicked off a review of the building consents regime last month – and not before time. The code and associated systems are complex to navigate and competition is not an express objective of the Building Act, the commission says.

As in previous market studies in the fuel and grocery sectors, the commission has also identified that merchants are benefiting from restrictive covenants on land and entering into exclusive leases with landlords. This also has the potential to impact competition – so an economy-wide review is needed.

But amid the moves to open up the market to more products, competing on price and speed, the commission’s draft report does recognise a countervailing challenge: meeting the core objectives of the building regulatory system to deliver safe, healthy, durable homes.

Julien Leys, chief executive of the Building Industry Federation, welcomes the recommendation for a national building products register as part of improving decision-making – something the federation has been calling for. “We support the recommendation to remove impediments for product substitution as long as this does not allow products that may not perform as part of a specific design.”

// The deadline for submissions is September 1, and the final report is due on December 6.