Super Micro Computer (SMCI) has been surging in 2023 as hopes for its success in artificial intelligence drive it higher.

Many semiconductor and technology stocks have enjoyed an AI-related surge this year, but Super Micro Computer has nearly been in a league of its own.

Its shares are up by more than a factor of five over the past 12 months.

At one point in 2023 they'd more than tripled from year's end.

Currently, Super Micro Computer stock is up about 175% on the year, after the stock fell in two straight weeks. Amid the dip, the shares have suffered a peak-to-trough decline of almost 18%.

Super Micro Computer still garners a market cap of almost $12 billion.

Don't Miss: Microsoft Keeping Monthly Streak Alive? Check the Chart

The stock is holding up better than some other high-flying stocks, like C3.ai (AI), but not as well as others, like Nvidia (NVDA). Now the stock is trying to rebound off this week’s low.

Let’s take a look at one of the less-discussed stocks in the AI space.

Trading Super Micro Computer Stock

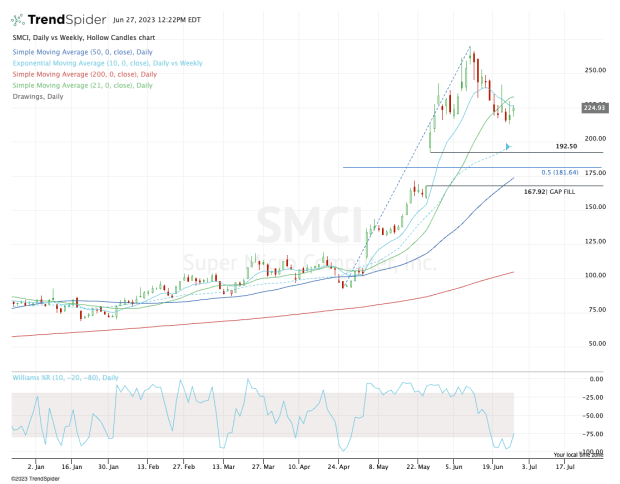

Chart courtesy of TrendSpider.com

Given the size of SMCI's rally — up 175% year to date and roughly 190% from the late-April low to the recent high — the volatility is relatively mild.

Buyers continue to materialize in the $215 to $220 area, but the stock is below the 10-day and 21-day moving averages.

That doesn’t doom Super Micro Computer, but it does suggest the short-term uptrend has run its course and the stock is set for some consolidation.

Don't Miss: Alphabet Has Helped Drive the Nasdaq; Here's Where to Buy the Dip

If that consolidation manifests in the form of sideways chop, the bulls should focus on Super Micro Computer eventually regaining its short-term moving averages and rotating over a prior week’s high as a start.

If that consolidation comes in the form of a correction, two major areas on the downside should be watched.

The first comes into play around the $192.50 area, which is the low following the stock’s big gap-up on May 25 when Nvidia reported earnings. That’s also about where the 10-week moving average comes into play.

The second area is around $175. This area isn’t as clean as some setups because just above it is the 50% retracement near $181 and just below it is the gap-fill level near $168. In between that range is the 50-day moving average.

In other words, this area is legitimate, but the range is a bit wider (from roughly $168 to $181).

The bottom line: Bulls looking for a correction could see support materialize in two different zones. To get there, though, we’ll need to see Super Micro Computer shares break below $215.

Sign up for Real Money Pro to learn the ins and outs of the trading floor from Doug Kass’s Daily Diary.