PORTSMOUTH, N.H.—As streaming companies continue to ramp up prices, a new study from Hub Entertainment Research addresses an increasingly central issue: How much are consumers willing to pay for video services and what kinds of content might convince cost-conscious consumers to spend a little more money? With so many platforms and abundance of content from which to choose, what’s worth paying for?

One key takeaway of Hub's annual Monetization of Video study is that consumers are already running up against the limits of what they are willing to spend and that they are already feeling the bite of inflation. Even so, the survey found that some features and content may drive additional spend from consumers.

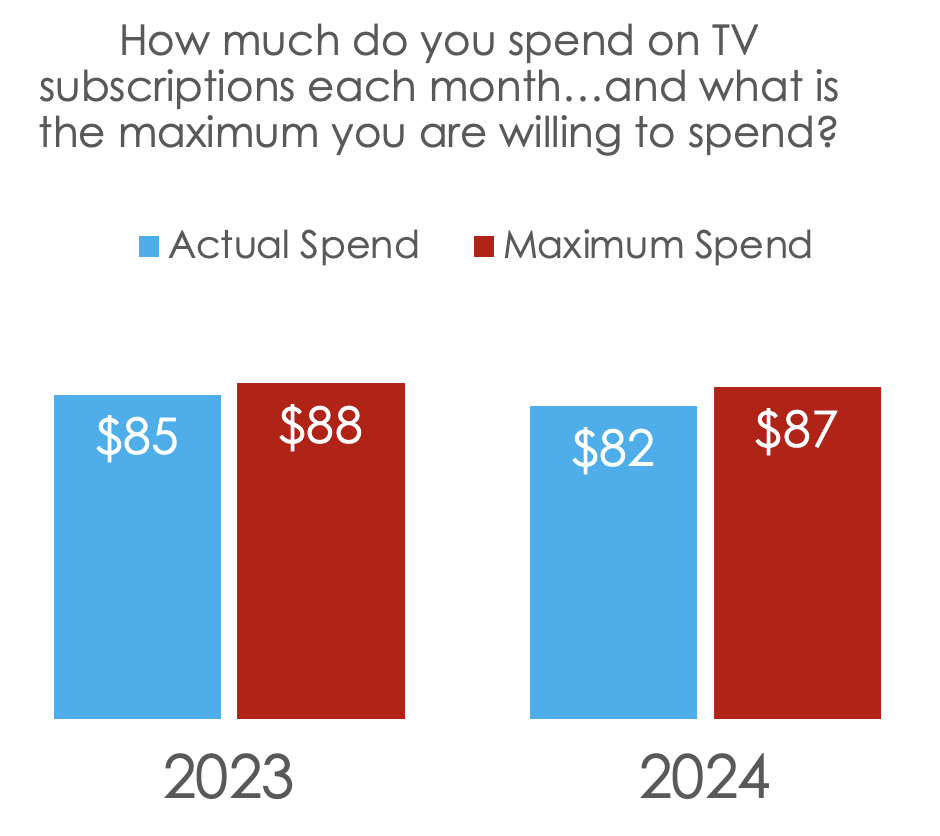

The study found that consumers feel maxed out on the cost of TV. The average respondent estimates they are spending $82 a month on TV content, very close to what they say is the maximum they’d be willing to pay ($87).

That indicates that consumers have already cut back from their 2023 monthly spending of $85 a month.

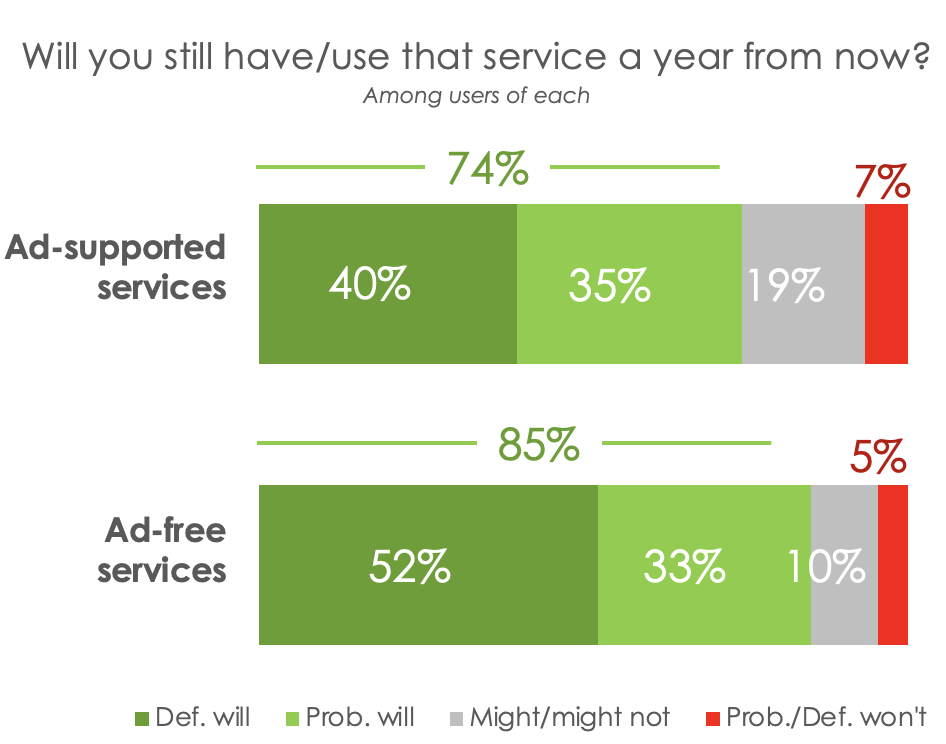

But the survey also found that the more expensive ad-free services are stickier than cheaper (or free) ad-supported ones.

Despite the plateau in overall spend, people paying extra for ad-free services consider them more valuable and are more loyal. Cheaper ad-supported and FAST services like Pluto and Tubi have helped to fill the gaps for people tapped out on spending, but loyalties to those services may not be as strong. In comparison, subscribers to ad-free services are significantly more likely to say they’ll still be using that service a year from now.

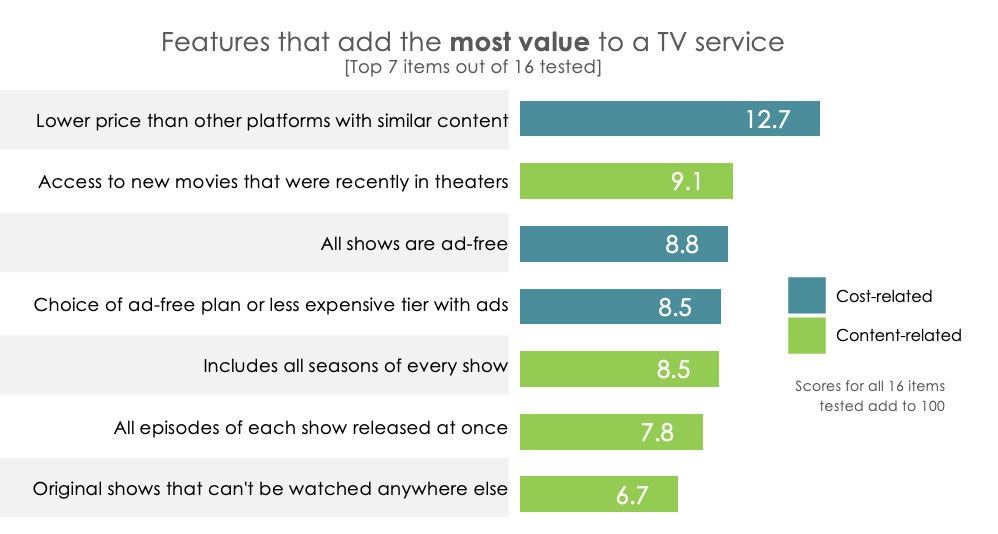

In addition, the survey found that while price matters, consumers are willing to pay for the right features and content.

Respondents prioritized 16 features based on how much value each adds to a streaming or TV service. Not surprisingly, features related to price were among the highest scoring. The survey found that a lower price than other services with similar content added the most value. A choice between ad-free or a less expensive ad-supported tier also scored highly.

But most of the other top items had to do with content: access to recent theatrical movies, original shows, and access to all seasons and episodes of each show all make a platform more valuable. And in aggregate, those content attributes matter more than just a low price.

“These results are encouraging for streamers under pressure to maximize profits,” said Jon Giegengack, principal at Hub. “Consumers are feeling the pinch of inflation. But even so, key content like theatrical movies and exclusive originals are as important as cost – great news for platforms that need to raise prices, not lower them.”

Hub’s annual “Monetization of Video” report, based on a survey conducted among 1,600 US TV consumers with broadband, age 16-74. Interviews were completed in early June 2024. A free excerpt of the findings is available on Hub’s website. This report is part of the “Hub Reports” syndicated report series.

Since 2013, Hub Entertainment Research has measured and tracked how technology changes the ways consumers discover, choose and consume entertainment content. We work with the largest networks, pay TV operators, streaming providers, and studios. For more information, visit their website and subscribe to their newsletter at hubintel.substack.com.