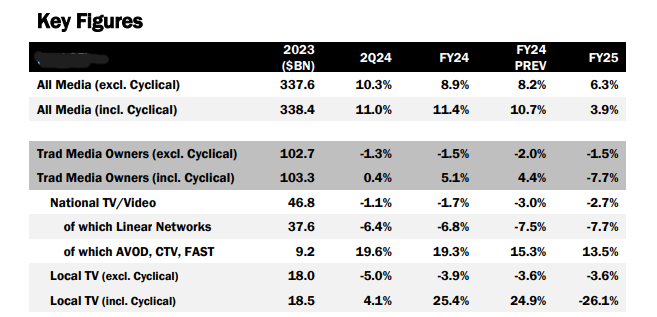

A stronger-than-expected U.S. advertising market and special events meant smaller declines in national TV ad revenues in the second quarter, according to media agency Magna, which boosted its full-year ad spending forecast for 2024.

National television/video revenues fell 1.1% in Q2. That included a 6.4% drop for linear networks and a 19.6% increase for ad-supported video-on-demand, connected TV and free ad-supported streaming television (FAST).

For 2024, Magna forecasts that national TV will finish down 1.7%, an improvement from Magna’s earlier forecast of a 3% decline. Linear networks will be down 6.8% while AVOD, CTV and FAST will be up 19.3%.

Local TV is expected to be up 25.4% in 2024 including cyclical events, and down 3.9% excluding cyclical events.

For all media, Magna sees ad revenues including cyclical events as rising by 11.4% (the previous forecast was 10.7%) and up 8.9% excluding cyclical events (the earlier forecast was 8.2%). That would mark the strongest growth rate in 20 years.

Those cyclical events will bring in $10 billion in incremental ad sales in 2024. The election will add a record $9 billion to media owners. Magna estimates NBCUniversal’s ad sales during the Paris Olympic Games at $1.5 billion, including $1.1 billion for linear and $400 million for digital and streaming.

On the digital side, ad revenue rose 16% in the first half of 2024. Magna noted that Meta and Google credited AI tools with driving incremental spending.

For the full year, digital pure-play ad revenue is expected to be up 14.2% in 2024.

Magna also forecasts that the ad market will remain strong in 2025.

Overall, noncyclical ad spending will grow 6.3% to $291 billion in 2025, Magna said, while sales including cyclical events, like the Olympics and elections, will rise only 3.9%.

National television sales will drop 2.7% while local television sales will underperform and decline 3.6% (excluding election spending) in 2025.

Digital pure players will again drive the market, growing 9.3% to $289 billion, while traditional media owners will erode by 1.5% to $102 billion.

Digital revenues are expected to be up 8.7% in 2025.

In 2026, the ad market should top $400 billion, the agency said.