U.S. stocks turned lower Friday, with the Nasdaq set to snap its eight-week winning streak, following weaker-than-expected economic data that revived near-term recession concern.

The resurged worry about the prospect of a recession comes even as the Federal Reserve continues to signal higher interest rates over the coming months.

S&P Global estimated that economic activity slowed to a three-month low in June, based on data from its benchmark Purchasing Managers' Index. Its reading of the manufacturing sector slumped well below the 50-point mark, which separates growth from contraction.

“Growth remains dependent on service-sector spending, however, with manufacturing slipping back into decline after three months of growth," said S&P Global's chief business economist, Chris Williamson.

"While improving supply conditions had helped boost manufacturing production in prior months, an increasingly severe downturn in new orders mean factories are running out of work."

The U.S. data followed similar PMI readings from Europe, which showed economic activity fell to the slowest pace in five months in June.

And the data come as central banks worldwide, including the Federal Reserve, continue to indicate the need for higher interest rates to combat inflation pressures that linger from the covid pandemic.

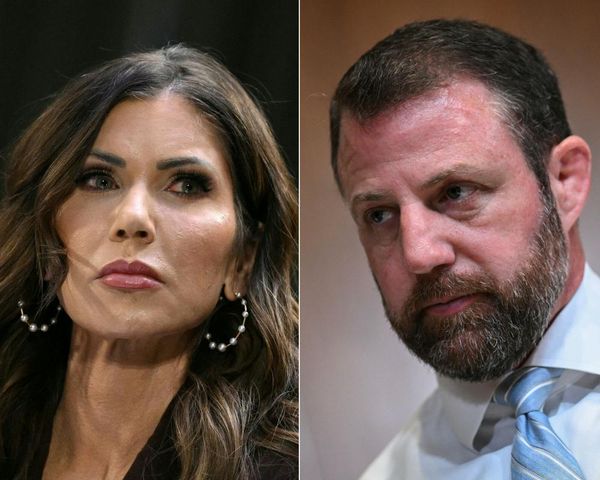

Powell: More Rate Hikes Ahead

Fed Chairman Jerome Powell told both the House Financial Services Committee and the Senate Banking Committee that there is still a "long way to go" to bring inflation back to the central bank's 2% target d.

Speaking during testimony on Capitol Hill this week, Powell noted that two more rate hikes this year would be a "pretty good guess" at policy direction.

Markets are betting on only one more hike -- in July -- from the Fed and see the economy sliding into recession over the second half of the year. The gap between 2-year and 10-year note yields has widened to around 102 basis points (1.02 percentage points), a steepening that typically amplifies investors' recession concerns.

According to a study from the San Francisco Federal Reserve, a sustained inverted yield curve has preceded all nine recessions the U.S. economy has suffered since 1955, making it an extremely accurate barometer of financial markets sentiment.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, soared 0.5% higher in New York trading to a two-week high of 102.889.

The firmer dollar, as well as fading demand prospects linked to weaker growth, pushed oil prices lower in New York dealing, with WTI futures for August delivery falling $1.43 to $68.08 per barrel. Gold prices, too, were down, trading near a three-month low of $1,917.90.

The twin conditions of rising rates and weakening growth prospects has stocks on the back foot this week, with data from S3 Partners indicating short-sellers have placed more than $1 trillion in wagers against the S&P 500, the most since April of last year.

That said, market volatility remains muted, with CBOE Group's VIX index trading at around 13.63 points in the Friday session, the lowest in around three years. That level suggests investors expect only a 37-point daily swing for the S&P 500 over the next 30 days.

Market Is 'Too Confident of a Soft Landing'

"The market is too confident that the Federal Reserve can engineer a soft landing," said Ryan Belanger, founder and managing principal at Claro Advisors in Boston.

"The S&P 500 is again trading at a rich premium to historic market multiples, buoyed by confidence that the Federal Reserve is done with rate hikes and a clearer picture of what a soft landing might look like. This confidence is misaligned."

The S&P 500, which is up around 14% for the year, was marked 27 points lower, or 0.63%, in the opening hour of trading, with the Dow Jones Industrial Average falling 175 points.

The tech-focused Nasdaq was off 142 points, or 1.05%, thanks in part to big declines For Tesla (TSLA) and this week's move higher in Treasury bond yields.

Other notable movers include 3M (MMM), which was up 2.2% in early trading at $102.63 after it reached a tentative agreement with a host of public water companies over the use of so-called forever chemicals.

3M said the agreement will see it pay around $10.3 billion over the next 10 years to settle suits linked to the use of per- and polyfluoroalkyl substances, also known as PFAs and often referred to as forever chemicals. Payments could rise to as much as $12.5 billion, 3M said, depending on the levels of PFAs found in public water systems.

CarMax (KMX) was also higher, rising 10% after the used car retailer posted stronger-than-expected first quarter earnings amid what it called a "challenging macro environment."

In overnight Asia trade, Japan's Nikkei 225 fell 1.45% to end its run of 10 consecutive weekly gains, while the regionwide MSCI ex-Japan benchmark fell 1.3% into the close of trading.

London's FTSE 100 fell 0.14% following weaker-than-expected June PMI data while the region-wide Stoxx 600 was marked 0.06% higher as the euro eased to 1.0863 against the surging greenback.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.