Global investors remain bullish on U.S. stocks heading into the summer months, according to two benchmark surveys published on May 14, even as inflation readings suggest a longer-than-expected period of elevated Federal Reserve interest rates.

The Commerce Department's April reading of producer-price inflation showed faster-than-expected gains in the report's final demand index. The benchmark rose 3.1% on the year, raising concern that consumer-price pressures continued to accelerate at the same time.

However, downward revisions of prior PPI estimates, as well as the fact that the key components that feed into the Federal Reserve's preferred inflation gauge, the PCE Price Index, showed only marginal increases. These factors could set the stage for a muted April Consumer Price Index reading.

A hotter reading, however, might not fully blunt the market's current rally, which has lifted the S&P 500 some 3.7% this month and carried the tech-focused Nasdaq to a near 5% gain.

The S&P 500, in fact is just 0.7% from the all-time high it reached in mid-March, while the Dow is flirting with the 40,000-point mark for the first time.

"We believe that the stock market will move higher throughout the year on strong corporate profits and consumer spending, but volatility is likely to spike in the meantime because the inflation data is going to keep the Fed on edge," said Chris Zaccarelli, chief investment officer for the Independent Advisor Alliance in Charlotte.

Fed Chairman Jerome Powell reflected a portion of that concern in remarks to a banking event in Amsterdam on May 14, where he said was wasn't as confident as he was earlier this year that inflation is moving toward the central bank's 2% target.

"I expect that inflation will move back down ... on a monthly basis to levels that were more like the lower readings that we were having last year," Powell said, adding "we did not expect this to be a smooth road."

Rate cuts might not matter

He also repeated his view that the Fed was unlikely to increase rates in the face of faster inflation data, suggesting instead that "it's more likely we hold the policy rate where it is."

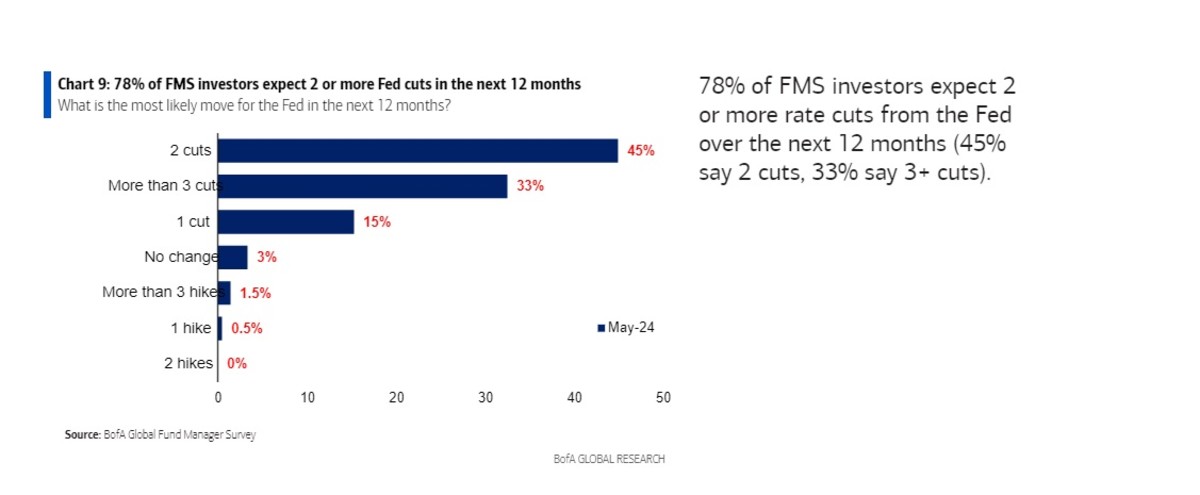

But that view seems not to be damping investors' appetite. Bank of America's monthly survey of global fund managers, a closely tracked report on Wall Street, suggests investors are the most bullish they've been since November 2021.

Related: S&P 500 aims for biggest gain in Fed interest rate pause history

The optimism, the report adds, is now tied more to bets on a series of Fed rate cuts, with the first of two likely coming in the second half, than to forecasts of increasing earnings gains.

In fact, 8 of every 10 respondents say they expect two rate cuts between now and year's end, with no recession in sight.

CME Group's FedWatch tool shows little chance of a rate move at either of the Fed's next two policy meetings, in June and July, but pegs the odds of a September cut at around 66%.

S&P Global's Investment Manager Index, meanwhile, shows equity-risk appetite surged to a two-and-a-half-year high this month, but conversely cites earnings potential over rate-cut optimism.

Earnings optimism is driving stocks

“Sentiment has been buoyed by better-than-anticipated earnings performance, which has propelled shareholder returns and equity fundamentals to the fore in terms of perceived market drivers," said one of the report's co-authors, Chris Williamson, executive director at S&P Global.

"The U.S. economy and fiscal policy are also seen as supportive to equities, contrasting with drags from central bank policy and the broader global economy, and in particular from concerns over valuations and geopolitics,” he added.

The Atlanta Fed's GDPNow forecasting tool, a real-time tracker of the U.S. economy, suggests a current-quarter GDP growth rate of 4.2%, more than twice the 1.6% pace the Commerce Department published for its recent first-quarter estimate.

A year's worth of gains in five months

LSEG data, meanwhile, estimate collective first-quarter profits for the S&P 500 rose 7.4% from a year earlier to $467.9 billion, a $5 billion improvement since the start of the reporting season.

Looking into the three months ending in June, LSEG sees that year-on-year growth rate improving to 10.6%, with profits rising to a share-weighted $495 billion.

Clark Bellin, president and chief investment officer at Bellwether Wealth in Lincoln, Neb., is slightly more cautious, noting the S&P 500's five-month gain of 9.5% is the equivalent to the average year's overall return.

"The stock market has just about recovered from its April correction, and we think the market can continue to inch higher throughout the rest of the year, although we have likely already seen the bulk of 2024's stock market gains as of now," he said.

Related: Will the S&P 500 defy 'Sell in May' this year?

"As earnings season winds down, we expect investors to pay even more attention to bond yields, Bellin added. "Higher yields could cause some downside market volatility and vice versa."

More Economic Analysis:

- Watch out for 8% mortgage rates

- Hot inflation report batters stocks; here's what happens next

- Inflation report will disappoint markets (and the Fed)

Bond yields jumped and then quickly retreated following the April PPI report, and more price and yield swings are expected when the CPI report hits tomorrow at 8:30 a.m. U.S. Eastern Time.

Economists are looking for a headline inflation rate of 3.4%, a modest decline from the 3.5% pace recorded in March, with the monthly reading unchanged at 0.4%.

The Commerce Department will also publish its regular estimate of April retail sales. That report is likely to show a marked slowdown from March’s 0.7% headline figure and from that month’s 1.1% control-group pace, the figure used to calculate U.S. gross domestic product.

Related: Single Best Trade: Wall Street veteran picks Palantir stock