Five things you need to know before the market opens on Tuesday April 4:

1. -- Stock Futures Edge Higher As Recession Worries Clip Treasury Yields

U.S. equity futures edged higher Tuesday, while the dollar slumped lower against its global peers and oil prices steadied, as investors looked to the impact of OPEC production cuts, and weakening manufacturing activity, on world growth prospects.

Stocks were able to build solid gains Monday amid a pullback in Treasury bond yields that belied the mounting inflation concerns linked to OPEC's surprise decision to add another 1.16 million barrels in production cuts to the near 2 million barrels it has been taking from the market each day.

The move sent crude prices up the most in more than a year and spiked inflation expectation readings even as a key survey of manufacturing activity in the world's biggest economy showed the weakest growth profile in nearly three years.

The ISM Survey was pegged at 46.3 points, well below the 50 point mark that separates growth from contraction, with softer-than-expected readings for both new orders and hiring, suggesting that tighter conditions from the U.S. banking crisis will have an impact on growth prospects.

That lead to a pullback in Treasury bond yields as traders moved to risk-free assets to counter possible recession risks, with 2-year Treasury note yields falling to around 3.971% before steadying at 3.998% in overnight trading.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.11% lower at $101.977 while WTI crude futures for May delivery added another 30 cents to trade at $80.72 per barrel - the highest since late January.

The CME Group's FedWatch, meanwhile, continues to price in the chance of another Fed rate hike next month in Washington, suggesting a 56.4% chance of a 25 basis point increase that would take the Fed Funds rate to a range of between 5% and 5.25%.

Heading into the start of the trading day on Wall Street, futures contacts tied to the S&P 500 are priced for a modest 13 point opening bell gain and those linked to Dow Jones Industrial Average are looking at a 45 point bump. Contacts tied to the tech-focused Nasdaq are indicating an 85 point gain.

In Europe, the region-wide Stoxx 600 managed was marked 0.36% in early Frankfurt trading while Britain's FTSE 100 added 0.06%.

Overnight in Asia, the MSCI ex-Japan index was marked 0.32% lower into the close of trading, while Japan's Nikkei 225 gained 0.35% in Tokyo.

2. -- Walmart Planning 2,000 e-Commerce Job Cuts As Demand Wanes

Walmart (WMT) shares edged lower in pre-market trading following reports that suggested the world's biggest retailer is planning to cut more than 2,000 jobs.

Bloomberg News reported that Walmart is preparing layoffs at e-commerce warehouses in Texas, Pennsylvania, Florida, California and New Jersey following a regulatory filing last month by the group that warned of potential job cuts.

Walmart posted better-than-expected fourth-quarter earnings in February but issued a muted full-year profit forecast as it cautioned that consumers will continue to spend conservatively in a slowing economy.

Walmart shares were marked 0.08% lower in pre-market trading to indicate an opening bell price of $148.57 each.

3. -- Credit Suisse Chairman 'Truly Sorry' For Bank Collapse As Shareholders Vent Ire

Credit Suisse chairman Axel Lehmann issued a rare public apology for the collapse of the Swiss bank, and its forced sale to crosstown rival UBS Group last month, at the lender's annual shareholders' meeting in Zurich.

Lehmann said he was "truly sorry" that he was unable to save the venerable institution from failure, but insisted the bank's only options were either the $3.3 billion takeover by UBS -- orchestrated by Swiss authorities without the approval of shareholders -- or bankruptcy.

"Until the end, we fought hard to find a solution. But ultimately, there were only two options: deal or bankruptcy," Lehmann said. The merger had to go through."

The UBS takeover, which came with more than $100 billion in liquidity assistance for both firms from the Swiss National Bank, will "secure financial stability and protect the Swiss economy in this exceptional situation" according to Switzerland's Finance Minister Karin Keller-Sutter.

Neither Lehmann nor most of the senior management at Credit Suisse are expected to survive votes of no-confidence at today's shareholder meeting in Zurich, and are unlikely to play any role in the bank's future when the deal with UBS is completed.

4. -- Virgin Orbit Files For Bankruptcy After January Launch Failure

Virgin Orbit, the space company founded by billionaire investor Richard Branson, filed for Chapter 11 bankruptcy protection in Delaware Tuesday after failing to secure long-term funding.

Virgin Orbit, which went public through a so-called SPAC deal in 2021 with a value of around $3 billion, after being spun-out of Branson's larger Virgin Galactic business in 2017, listed assets of around $243 million with debts of around $153.5 million in its bankruptcy petition.

The group focused on launching smaller telecommunications-focused rockets from a modified Boeing BA 747, but suffered a major set-back in January when its LauncherOne rocket failed to reach orbit and fell into the Atlantic ocean.

"We believe that the Chapter 11 process represents the best path forward to identify and finalize an efficient and value-maximizing sale," said Virgin Orbit CEO Dan Hart.

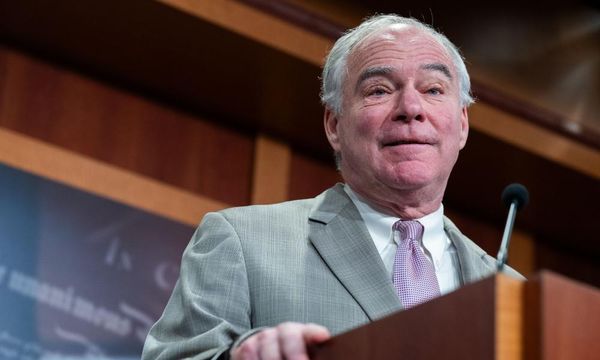

5. -- Former President Donald Trump Faces Historic Arraignment In Manhattan Court

Former President Donald Trump is slated to appear in a Manhattan court later today to face charges reportedly linked to so-called 'hush money' payments made to an adult film actress prior to his term in office.

Trump, 76, is expected to be arraigned at around 2:15 pm Eastern time before Judge Juan Merchan, who has permitted limited photography of the event but ruled against television cameras inside the courtroom itself.

The former President -- and leading contender for the Republican nomination in 2024 -- will hear the list of charges brought against him by Manhattan District Attorney Alvin Bragg, which were delivered last week in a sealed indictment, have his mug shot and finger prints taken and issues a formal plea as part of the arraignment process.

New York City Mayor Eric Adams, meanwhile, is planning a heavy police presence for the arraignment in downtown Manhattan, warning protestors to "control yourselves ... New York City is our home, not a playground for your misplaced anger."