U.S. stocks are on pace for one of their best six-month runs in more than a decade, powered in part by surging megacap tech stocks and an alignment of investors' interest rate cut forecasts with the Federal Reserve's prognosis.

And while Wall Street sees further gains over the coming months, fueled by solid corporate earnings and a better-than-expected economy, some analysts suggest the current rally could run out of steam, or even produce a notable correction, into the second half of the year.

The S&P 500, the market's broadest measure of U.S. blue-chip shares, is holding on to gains of just over 10% for the first three months of the year. That puts the index on pace for the best run of back-to-back quarterly gains since 2011, following a fourth-quarter advance of 11.1%.

The benchmark's streak of five consecutive monthly gains also sets up a solid backdrop for near-term returns, with data from Carson Investment Research suggesting it should outpace historic advances for at least the next 12 months.

Improving market breadth

A broadening of the market's top performers also adds to the bullish consensus. Around 80% of stocks in the index are trading north of their 200-day moving averages, a key performance metric, and around 25% of constituents have recorded one-year highs over the past week.

S&P 500 is up 10% in the first 60 trading days of 2024, the 14th best start to a year going back to 1928. $SPX pic.twitter.com/It3BIAYmz0

— Charlie Bilello (@charliebilello) March 27, 2024

Adam Turnquist, chief technical strategist for LPL Financial, says that kind of breadth usually means stocks will do well, with forward three-month returns for the S&P 500 averaging 1.8%, with a near 75% rate of positive gains over the past 25 years.

"The market and Fed are finally aligned on the outlook for rate cuts this year," he said. "This should help alleviate some fixed-income-market volatility, a welcome sign for both bond and equity investors."

April is also traditionally one of the best months of the year for the S&P 500, recording an average gain of around 2% over the past two decades, according to Trading.biz analyst Cory Mitchell.

Earnings will be a key factor in market moves

Rob Swanke, senior equity strategist for Commonwealth Financial Network in Waltham, Mass., agrees that market breadth and market/Fed alignment are important, but he also notes that valuations could be tested in a higher interest rate environment.

"Valuations overall are still reason for caution as rates are much higher than they were in 2022, and the market will certainly be looking for earnings growth to support those expectations in the next reporting cycle," he said.

Related: Fed hints at bank stock risk from repo market meltdown redux

Markets won't need to wait too long for that first test either, as JPMorgan (JPM) will lead off the first big-bank earnings on April 12. The bulk of the reporting season then shifts into high gear over the following weeks.

LSEG data suggest investors are looking for collective S&P 500 earnings to rise around 5% from last year to a share-weighted $458.6 billion. Around a third of that growth is expected from the information technology and communication services sectors.

Looking into the rest of the calendar year, forecasts suggest 2024 earnings growth of around 9.8%, nearly double last year's advance, pegging S&P 500 earnings at around $243 a share.

Stock gains could be harder to get

RBC Capital analysts, however, are forecasting S&P 500 earnings at around $237 a share. And while they lifted their end-year forecast for the benchmark by 250 points, to 5,300, they suggest further gains are going to be harder to achieve over the second half.

“We consider our price target to be a signaling mechanism for our overall message on the potential direction of the U.S. equity market from here. It’s a compass, not a GPS,” RBC said.

“The story we see in the data today is that the strong move observed in the S&P 500 so far this year has been deserved, and a rational case can be made for additional upside from here” even if markets might need a breather.

That pullback certainly hasn't materialized so far, and some investors are worried.

Related: Meme stocks are back as Trump Media surges, GameStop crashes, Reddit soars

So far this year the S&P 500's biggest daily decline has been 1.7%, the smallest since 1995, while the market's key volatility gauge, the VIX index, has averaged just $13.7, the lowest since 2017.

Goldman Sachs's chief equity strategist, David Kostin, sees a "flattish" market between now and year-end, with an S&P 500 price target of 5,200 points and an earnings forecast of around $241 per share.

"The equity market is pricing stocks as if the economy is growing at 4%, and it's not," he told CNBC earlier this week. He also noted "net selling" from pension funds and mutual funds, in contrast to still-solid inflows from households and corporate share buybacks.

More Economic Analysis:

- Bond markets tell Fed rate story that stocks still ignore

- February inflation surprises with modest uptick, but core pressures ease

- Vanguard unveils bold interest rate forecast ahead of Fed meeting

Dubravko Lakos-Bujas, JP Morgan's chief global equity strategist, thinks that both the market's reliance on AI-powered tech stocks such as Nvidia, which is up nearly 88% for the year, and Fed rate-cut projections put it at risk of a near-term correction.

“It just might come one day out of the blue. This has happened in the past; we’ve had flash crashes,” Lakos-Bujas said in an investment presentation reported by Bloomberg.

“One big fund starts de-levering some positions, a second fund hears that and tries to reposition, the third fund basically gets caught off guard, and the next thing you know, we start having a bigger and bigger momentum unwind," he warned.

Waiting for Godot

However, that bearish scenario isn't playing out yet, and Bank of America's Fund Manager Survey for March notes that big investors are the most exposed to stocks in two years. The survey also sees faster inflation as the market's biggest so-called tail risk, topping geopolitical and U.S. election concerns.

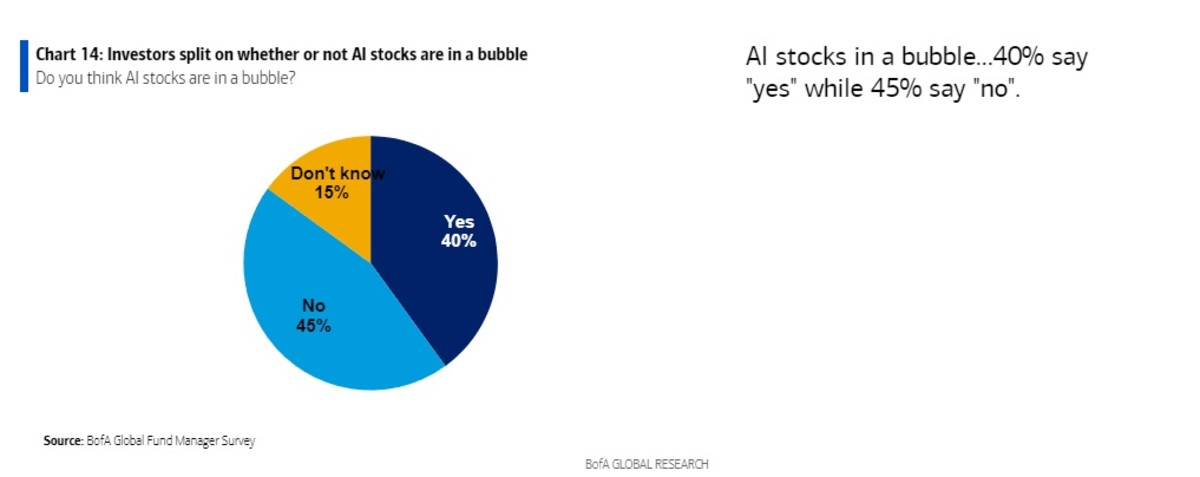

The survey noted that holding the so-called Magnificent 7 tech stocks remains the market's "most crowded" trade, and respondents are largely split as to whether AI stocks are in a bubble.

Still, with fourth-quarter GDP pegged at 3.4% by the Commerce Department, and growing at the current 2.1% according to the Atlanta Fed, investors looking for a recession catalyst to trigger a broader market correction should find a comfortable chair, according to Chris Zaccarelli, chief investment officer for Independent Advisor Alliance in Charlotte.

"As always, pullbacks will happen along the way, and of course, this bull market will end eventually, so we’re not forecasting boom times forever," he said.

"But we are reminded of legendary investor Peter Lynch, who said 'more money has been lost preparing for or trying to anticipate recessions than has ever been lost during recessions.'"

Related: Veteran fund manager picks favorite stocks for 2024