Stocks ended higher Friday, but still posted a losing week, as investors reacted to the ongoing political chaos in Washington.

The Dow Jones Industrial Average rose 498.02 points, or 1.18%, to finish the session at 42,840.26, while the S&P 500 gained 1.09% to close at 5,930.85 and the tech-heavy Nasdaq climbed 1.03% to end the day at 19,572.60.

“November inflation was more benign than expected but the stickiness of some categories support the Fed’s hesitancy to materially lower rates next year,” said Jeffrey Roach, Chief Economist for LPL Financial.

“The economy continues to grow from strong consumer demand as income growth and the wealth effect from higher portfolio values give consumers capacity to spend,” he said.

For the week, the Dow lost nearly 2.3%, notching its third straight losing week, according to CNBC. The S&P 500 fell about 2% week to date, while Nasdaq was off by about 1.8%.

Updated at 3:19 PM EST

Spooky Friday

Market volatility is heaving Friday as the VIX index falls more than 22% on the session, and was last marked at $18.77, ahead of the expiration of a record $6.6 trillion in options contracts tied to the S&P 500 and its component stocks.

The S&P 500 is now up 82 points, or 1.41% on the session with the Nasdaq rising 278 points, or 1.43% and the Dow last marked 628 points higher.

492 stocks in the S&P 500 are up right now ... that is the most since October 4, 2022 pic.twitter.com/oCcV7TfE9I

— Kevin Gordon (@KevRGordon) December 20, 2024

Updated at 12:11 PM EST

Austan powers markets

Dovish comments from Chicago Federal Reserve President Austan Goolsbee are adding to the market's late-morning rebound following the softer-than-expected PCE inflation data.

Goolsbee told CNBC that while the "uncertainty about policy makes it particularly hard to make estimates of what the neutral rate is and what the inflation rate is in particular," he still expects a "judicious amount" of rate cuts next year.

The Goolsbee Rebound: @Austan_Goolsbee comments on returning to a 2% inflation target, along with some favorable PCE PI data-and robust spending data- this morning looks to have created the conditions for a strong rebound in equity valuations & a strong bid underneath treasuries… pic.twitter.com/Na3JROVgR6

— Joseph Brusuelas (@joebrusuelas) December 20, 2024

Updated at 10:42 AM EST

Turning green

Stocks are moving higher, with Treasury yields in retreat and the VIX falling back below the $20 mark, following the better-than-expected reading for November PCE inflation earlier in the session.

The S&P 500 was last marked 40 points higher, with the Nasdaq gaining 140 points and the Dow up 320 points.

“This is a relief after Wednesday’s painful shock. The Fed wants to be vigilant on inflation, but it might be less of an issue than feared," said David Russell, global head of market strategy at TradeNation. "2025 may be a year of gradual improvement, especially with potential for the key shelter component to ease.”

BREAKING: The S&P 500 has reclaimed 5900 in what appears to be a massive post-PCE inflation short squeeze.

— The Kobeissi Letter (@KobeissiLetter) December 20, 2024

As a reminder, there are options worth $6.6 TRILLION in notional value expiring today.

Volatility is back. pic.twitter.com/5H1rSJ5NOn

Updated at 9:38 AM EST

Red open

The S&P 500 was marked 21 points, or 0.37%, in the opening minutes of trading, with the Nasdaq falling 165 points, or 0.84%

The Dow was marked 60 points lower while the mid-cap Russell 2000 slipped 9 points, or 0.41%.

Benchmark 10-year Treasury note yields were pegged at 4.506% while 2-year notes eased to 4.241%.

S&P 500 Opening Bell Heatmap (Dec 20, 2024)$SPY -0.81%🟥$QQQ -0.77%🟥$DJI -0.44%🟥$IWM -0.66%🟥 pic.twitter.com/7J7wAHXFmZ

— Wall St Engine (@wallstengine) December 20, 2024

Updated at 8:45 AM EST

Steady Feddy

The Federal Reserve's preferred inflation gauge held steady last month, data indicated Friday, adding another layer of complexity to the central bank's near-term outlook on price pressures and rate cuts.

The Bureau of Economic Analysis' PCE Price Index showed core prices rose at an annual rate of 2.8% last month, matching the October reading and Wall Street's consensus forecast forecast.

Stocks pared earlier declines following the data release, with futures indicating a 33 point decline for the S&P 500 and the Nasdaq called 195 points lower.

Benchmark 10-year note yields were 2 basis points lower at 4.526% following the data release, while 2-year notes eased 2 basis points to 4.261%.

"The market woke up in a terrible mood – an unexpected government shutdown and a more-hawkish-than-expected Fed are to blame – but this morning’s inflation data came in lower-than-expected and took some of the edge off," said Chris Zaccarelli, chief investment officer for Northlight Asset Management.

Headline PCE Price Index ... at 2.8% YoY, still solidly above the Fed's 2% target. https://t.co/QMLsIFoWDw

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) December 20, 2024

Updated at 6:32 AM EST

Novo Nordisk's loss ...

... is Eli Lilly's (LLY) gain. Shares in the drugmaker surged in early trading after its Danish rival published data on its new experimental anti-obesity drug that missed its own targets.

Novo Nordisk said patients using CagriSema lost around 22.7% of their body weight using the new treatment compared with the group's forecast of around 25%. The results could challenge its effort to launch a replacement for its market-leading Wegovy drug.

Eli Lilly shares were last marked 9.6% higher in premarket trading to indicate an opening-bell price of $830.

Novo Nordisk's U.S.-listed shares fell 17.1% to $85.77.

$NVO -20%, $LLY +7% after $NVO CagriSema test results. Not sure where the support line is for $NVO, but it lost the 200-sma at ~125. pic.twitter.com/vMU7DrNbsB

— Larry Tentarelli, Blue Chip Daily (@bluechipdaily) December 20, 2024

Stock Market Today

Stocks ended lower on Thursday, while Treasury yields jumped and the dollar tested two-year highs against its global peers as markets failed to claw back losses triggered by hawkish Federal Reserve messaging that followed its final rate cut of the year on Wednesday.

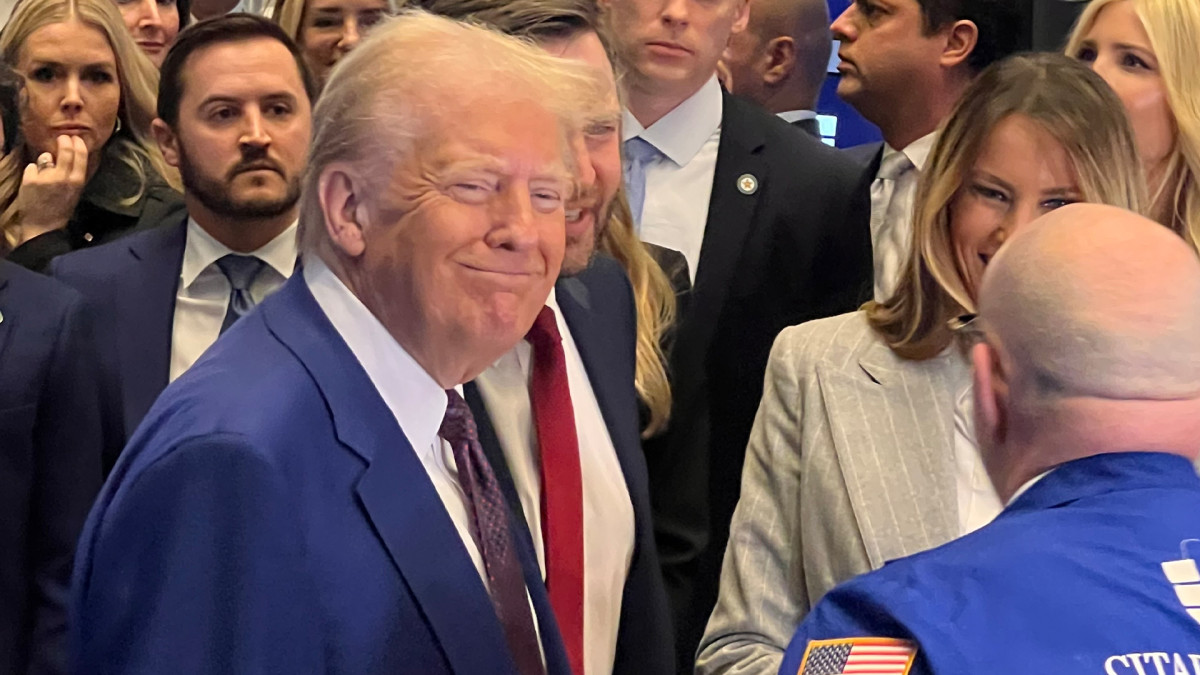

The Fed's forecast in fact suggested caution from policymakers tied to the uncertainty surrounding President-elect Donald Trump's political and economic agendas, both of which were in evidence yesterday.

Rebecca Mezistrano-TheStreet

Based on the advice of billionaire Elon Musk, the President-elect had challenged an agreed bipartisan spending bill designed to avoid a government shutdown. Trump instead backed a watered-down version that ultimately failed to find support from Republican lawmakers.

The spending bill failure, as well as Trump's attempt to insert an extended suspension of the debt ceiling into the negotiations, could raise investors' concern about the passage of Trump-era tax cuts under the new Congress.

Shutdown showdown: GOP scrambles

That's left House Speaker Mike Johnson scrambling to make a deal prior to today's midnight shutdown deadline.

Trump also waded into the tariff debate by threatening new levies on the European Union unless its member states "make up their tremendous deficit with the United States by the large scale purchase of our oil and gas."

Related: Fed Chair Powell is 'adult in the room' as Trump hammers Congress

The collective actions have stocks moving sharply lower heading into the start of Friday trading, with futures contracts tied to the S&P 500 suggesting a 52-point opening-bell decline.

Futures linked to the Dow Jones Industrial Average, which snapped a nine-day losing streak last night, are priced for a 284 point pullback while the tech-focused Nasdaq is called 300 points lower.

CBOE Group's VIX index, meanwhile, has surged to the highest levels since August and was last marked at $25.82, suggesting traders expect daily swings of around 1.6%, or 95 points, for the S&P 500 over the next month.

European stocks slide

Stocks on the move beyond the normal market pullback include FedEx (FDX) , which rose 8.6% in the premarket after the package delivery group said it would sell its freight trucking division. The move offset a disappointing quarterly earnings report.

Nike (NKE) shares, meanwhile, fell 3.6% after it topped Wall Street forecasts for its fiscal-second-quarter earnings but issued a muted near-term sales outlook amid the ongoing turnaround under new CEO Elliott Hill.

More Wall Street Analysts:

- Veteran analyst who forecast Rocket Lab's stock rally updates price target

- Analysts revamp Ciena stock price target after AI outlook

- Top analyst revisits Micron stock price target ahead of Q1 earnings

In overseas markets, Trump's latest tariff threat pulled the Stoxx 600 benchmark 1.51% lower in Frankfurt trading, with Britain's FTSE 100 falling 0.96% in London.

Overnight in Asia, the Nikkei 225 ended the week with a 0.29% pullback while the MSCI ex-Japan index fell 1.2% into the close of trading.

Related: Veteran fund manager delivers alarming S&P 500 forecast