Stocks finished higher Wednesday after the Federal Reserve made no changes to either its benchmark borrowing rate nor its forecast for around three rate cuts between now and the end of the year.

The Dow Jones Industrial Average rose 1.03% to 39,512.13, while the S&P 500 gained 0.89% to 5,224.62, and the tech heavy Nasdaq advanced 1.25% to 16,369.41.

The Federal Open Market Committee kept the federal funds rate unchanged at 5.25%-5.50% for the fifth straight meeting, stating that “it will not be appropriate to reduce the federal funds target range until inflation moves sustainably toward 2%.”

Analysts at Wells Fargo Investment Institute said in a note that they still believe "the Fed has reached its terminal policy rate for this cycle and that the Fed will proceed cautiously and attempt to move away from being overly restrictive."

"Attention will remain on the timing and the extent of rate cuts during 2024.," Wells Fargo said, "The latest median federal funds target range projections from the FOMC imply that at least nine policymakers still expect three rate cuts this year, finishing 2024 at 4.6% and three additional cuts in 2025."

Updated at 2:53 PM EDT

Getting there

Federal Reserve Chairman Jerome Powell, however, told reporters in Washington the the central bank wasn't swayed by the faster-than-expected inflation readings over the first two months of the year, and said that price pressures will return to the Fed's 2% target along what he called a 'bumpy' path.

“We’re looking for data that confirm the kind of low readings that we had last year, and give us a higher degree of confidence that what we saw was really inflation moving sustainably down toward 2%,” Powell said.

Stocks extended gains immediately following Powell's question-and-answer session with the media, with the S&P 500 marked 33 points higher, or 0.64%, on the session

The Dow Jones Industrial Average was marked 273 points higher while the Nasdaq gained 147 points, or 0.91%.

Powell: "Feb was also high, but not terribly."

— Wall St Engine (@wallstengine) March 20, 2024

"January inflation numbers were quite high but reason to think there were seasonal affects there."

"Those Jan and Feb inflation numbers did not add to our confidence."

"We are not going to overreact to these two months of data;…

Updated at 12:23 PM EDT

Fed faith

The Fed held rates steady for an eighth consecutive month following its two-day policy meeting in Washington, but also published fresh growth and inflation forecasts that suggest at least three rate cuts between now and the end of the year.

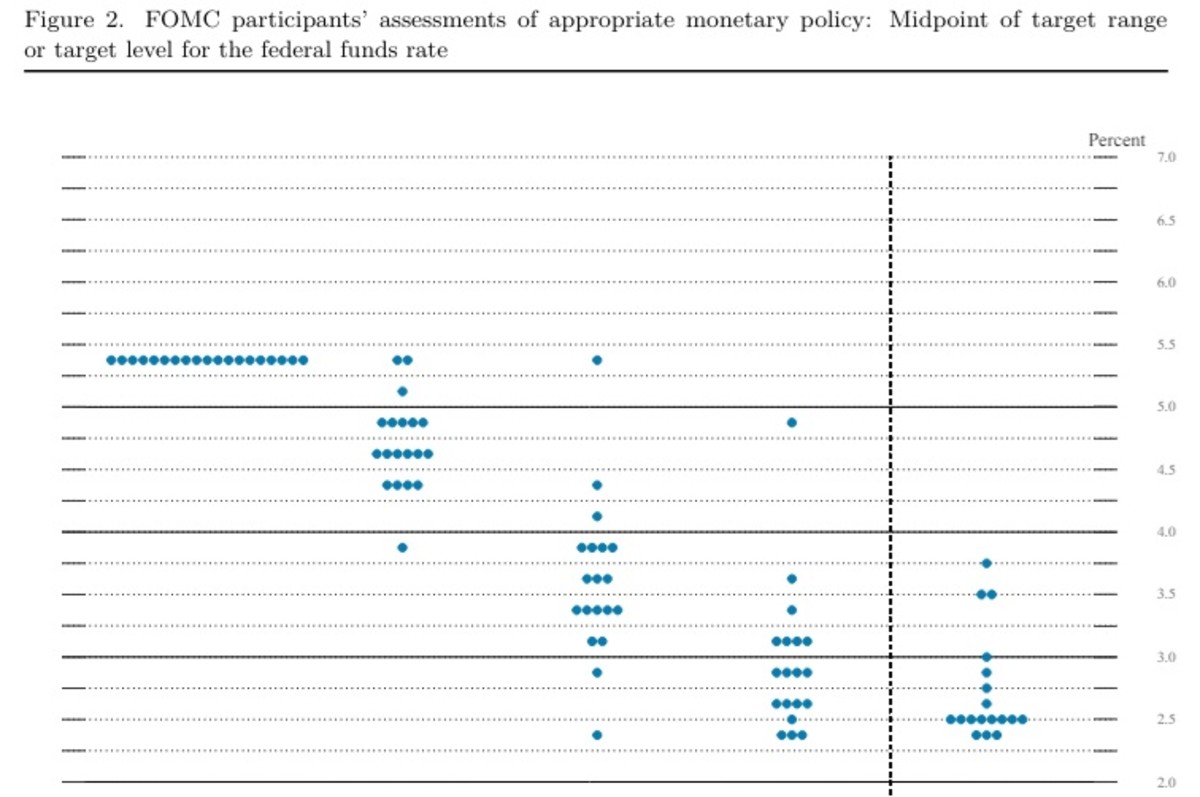

Markets breathed a sigh of relief following the so-called 'dot plot' release, with the S&P 500 rising 7 points, or 0.14% , and the Nasdaq gaining 47 points, or 0.3%.

Benchmark Treasury note yields were little-changed, with 10-year paper trading at 4.299% and 2-year notes trading at 4.645%, as investors parsed through details of the Fed statement and awaited Chairman Powell's press conference at 2:30 pm Eastern time.

#FOMC The latest Fed dot plot indicates a thin median for 3-rate cuts are expected in 2024. pic.twitter.com/IcaHnm3Fxu

— Wall St Engine (@wallstengine) March 20, 2024

Updated at 12:23 PM EDT

Oil slick

Crude oil prices, which hit multi-month highs earlier this week, are on the back foot Wednesday even after the Energy Department posted a second consecutive weekly decline in domestic stockpiles.

WTI futures for May delivery, which are tightly-linked to U.S. gasoline prices, were last marked $1.77 lower at $80.95 per barrel while Brent contacts for the same month, the global pricing benchmark, fell $1.73 to $85.66 per barrel.

US #crudeoil stocks fell for a second week by 1.9m bbl as exports jumped 1.7m b/d to 4.9m b/d. #Gasoline -3.3m to a Dec low with implied demand (4-wk avg) rising to 8.8m b/d, while distillates rose for a second week. Refinery utilisation rose by more than expected #oott pic.twitter.com/TGoQYmovpP

— Ole S Hansen (@Ole_S_Hansen) March 20, 2024

Updated at 10:00 AM EDT

Tesla price hike (kind of)

Tesla shares are getting a modest boost this morning, rising 0.7% to around $172.60, following confirmation of a second quarter price hike on its Model Y sedan in China and late quarter discounts in the U.S.

I just got the email from $TSLA thats been circulating about the small Model Y, S, X end of quarter discount in the US and Model Y $1k price increase on April 1st.

— Gene Munster (@munster_gene) March 20, 2024

Over the past year there have been so many price adjustments it’s hard to read between the lines what a $1k end of… pic.twitter.com/V7qteTg9ym

Updated at 9:36 AM EDT

Mixed open

Investors aren't looking to take on any new risk ahead of today's Fed decision, and stocks are reflecting that, with the S&P 500 marked 2 points lower, or 0.04%, in the opening minutes of trading.

The Dow, meanwhile, was hovering around the 39,000 point mark while the Nasdaq added 28 points, or 0.17%.

Ahead of #FOMC the market has priced in one 25 bps cut by July and three for the year pic.twitter.com/grDmCkx2P6

— Ole S Hansen (@Ole_S_Hansen) March 20, 2024

Updated at 9:10 AM EDT

Little Dot

The Fed's 'dot plot' projections are likely to be the key focus of today's policy decision as investors whittle-down their 2024 rate cut forecasts.

December's dot plots, shown below, indicate the Fed's narrow bias for three quarter point rate cuts this year. But note that only two dots will need to change to bring that consensus down to two.

Check back for updates throughout the trading day

Stocks returned to their winning ways again Tuesday, with the S&P 500 rising nearly 30 points on the session and the Nasdaq recording modest gains, as the market's larger tech stocks paced the overall advance following AI-chip maker Nvidia's (NVDA) flagship developers' conference.

Investors' focus in today's session, however, is likely to fall firmly on both the Fed rate decision, expected at 2:30 pm Eastern Time, as well as Chairman Jerome Powell's remarks to the media 30 minutes later.

With no change expected to the central bank's benchmark lending rate, which currently sits between 5.25% and 5.5%, the highlight of today's release is likely to be the publication of the Fed's new Summary of Economic Projections, better-known as the dot plots.

Related: The Fed rate decision won't surprise markets. What happens next might

The dot plots will lay out, in visual terms, where Fed officials see the median federal-funds rate over the coming three years, which by proxy provides a guide to how many rate cuts it may need to deliver.

December's dots pointed to three rate cuts in 2024, but markets are now starting to bet that officials may trim that figure to two amid the surprise uptick in inflation over the first two months of the year and the continued resilience in the labor market.

Powell "will try to sound tough on inflation," while members of the policy-making Federal Open Market Committee "will focus on when cuts might occur," said Bryce Doty, senior portfolio manager with Sit Investment Associates.

"With inflation hovering just above the Fed’s 2% target, some investors are fearing the worst on rate cuts," he added. "But as long as the door is open to cuts this year, bonds (and likely stocks) will rally (and) Fed members will be left scratching their heads wondering why their tough talk on inflation led to lower yields!"

Benchmark 10-year-note yields were marked 2 basis points lower from last night's levels at 4.279% heading into the start of the trading day. Two-year notes were pegged at 4.675%.

The U.S. dollar index, which tracks the greenback against a basket of its global currency peers, was marked 0.5% higher at 104.110. Much of the upward move was tied to weakness in the Japanese yen, which slumped to 151.69 in a holiday-thinned market in Tokyo.

On Wall Street, futures tied to the S&P 500 indicate an opening-bell decline of around 3 points, with the Dow Jones Industrial Average called 25 points lower

The tech-focused Nasdaq, meanwhile, is looking at a 45 point gain thanks in part to premarket advances for Intel (INTC) , which was awarded $20 billion in loans and grants by the U.S. government to build a domestic chipmaking facility, and Tesla (TSLA) .

In overseas markets, stocks in Europe were little changed heading into the early hours of Frankfurt trading, with the regionwide Stoxx 600 slipping 0.14% as investors eyed today's Fed rate decision.

Overnight in Asia, markets in Tokyo were closed for Japan's annual celebration of the Vernal Equinox, while the regionwide MSCI ex-Japan benchmark slipped 0.56% into the close of trading.

Related: Veteran fund manager picks favorite stocks for 2024